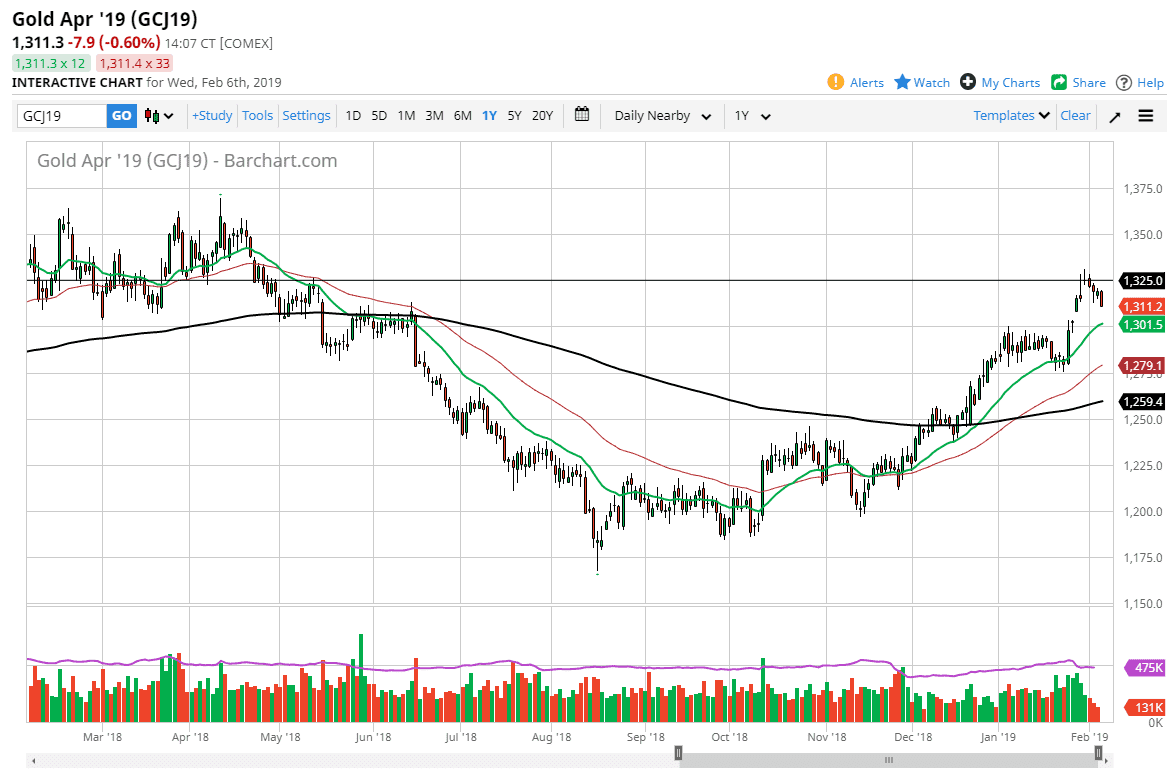

Gold markets fell significantly during the trading session on Wednesday as the US dollar strength overcame the metals markets. We have pulled back significantly from a $1325 level that has been resistance, and it now looks as if the market may have gotten a bit ahead of itself. The 20 day EMA, pictured in green on the chart, has offered support in the past, and it is just above the $1300 level. This is an area that should be supportive regardless, not only because of the moving average but also because of the large figure. Gold market should continue to see plenty of bullish pressure due to the Federal Reserve becoming a bit more dovish, and the fact that the geopolitical concerns continue to be rather strong, it makes a good case for owning precious metals.

The $1300 level looks as if it should be rather difficult to break down below, because it was so difficult to break above. Even if we do break down below there, the 50 day EMA underneath should offer support as well. The $1275 level underneath is massive support, and now that we have crossed the 20, 50, and 200 day EMA to the upside, it looks as if the longer-term money is coming back into play. If we break above the recent high, the market should then go looking towards the vital $1400 level, an area that has been important more than once, and it could be the top of a larger consolidation area for a longer-term scenario.

At this point, this is a market that continues to be choppy and noisy, but I do believe that if you are cautious enough to play this market slowly, you should continue to see opportunities to build up a larger core position.