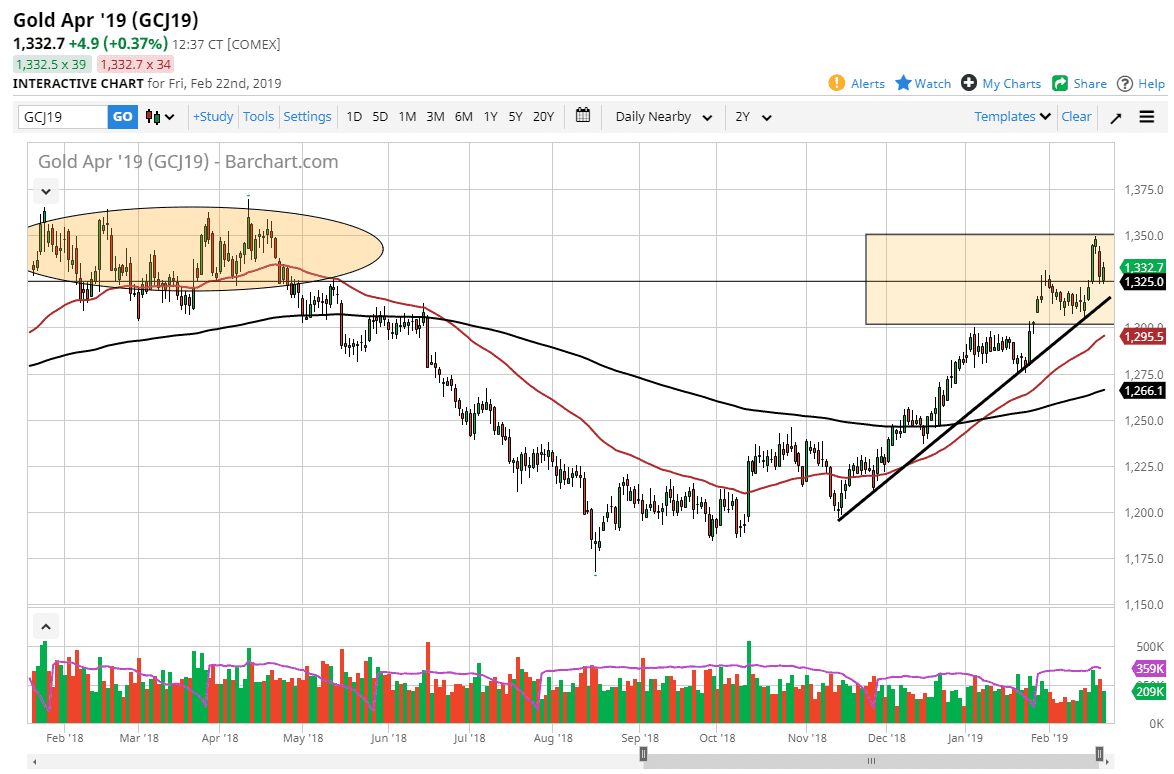

Gold markets rallied a bit during the trading session on Friday, as we bounced from the significantly important $1325 level. Ultimately, it looks as if we are starting to show signs support again at this level, and it looks that the uptrend line underneath should continue to offer support as well. Looking at the chart, it’s very obvious that we should continue to see buying on dips, as there is a lot of interest here.

When we look at the weekly chart, there is a shooting star being formed, but we have a couple of hammers ahead of this. What this tells me is that we are more than likely going to see support on these dips, as we continue to consolidate between $1300 and $1350. I think that there is enough resistance above that we need to pullback in order to build enough volume flow to go higher. However, if we were to break down below the $1300 level it then starts to change the complexity of the market a bit.

Ultimately, the trend line comes into play, so does the 50 day EMA, so pay attention to the dips and the way that the market reacts to them, because I do believe that there will be a lot of buyers underneath. This is a market that looks very likely to build up pressure to go to the upside, but a lot of this will come down to the US dollar and how it behaves. The Federal Reserve looks very soft, but at the same time the Euro looks kind of soft as well, so this doesn’t help the case for a weak dollar that should help gold. In other words, we go back and forth and therefore it does put a little bit of a cap above the gold market. Nonetheless, I think softening central banks around the world will eventually push gold higher. Look for value.