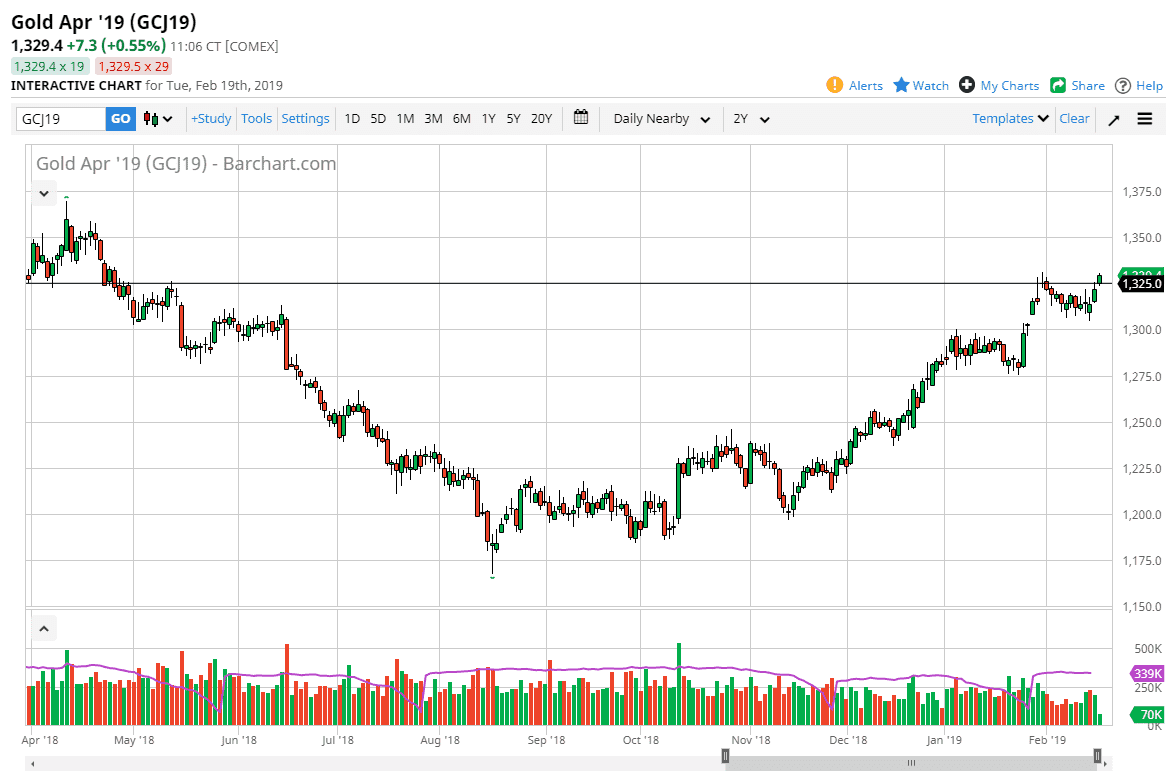

Gold markets rallied again during the trading session on Monday, gapping at the open. We cleared the $1325 level, which is the beginning of significant resistance, extending all the way to the $1350 level. At this point, it’s very likely that we will get the occasional pullback due to a lot of resistance, but I think that what we are looking at is an opportunity to pick up the Gold markets very cheap. At this point, I think that the value hunters will continue to look at gold every time we pull back, as the US dollar looks very soft going forward with the Federal Reserve keeping interest rates low, and perhaps entering a more dovish stance. At this point, I think that eventually we will go looking towards the $1350 level, and if we can get above there the market more than likely will continue to reach towards the $1400 level.

Gold will continue to yield a boost not only from the Federal Reserve, but also from the geopolitical concerns that we see around the world. After this point, the US/China trade situation could continue to be a main driver as well. Looking at the US dollar will be crucial going forward, as if it falls we could see gold rally due to the Federal Reserve. However, if the US dollar rallies due to a “fear trade”, that should also push gold higher. While I do believe that we have a major amount of resistance just above, I think that the demand will far outweigh the area of selling.

I would not jump in with both feet, as you can get hurt if you are over levered. However, the longer-term outlook for gold is very good, as the US dollar is expected to lose value going later into the 2019 handle.