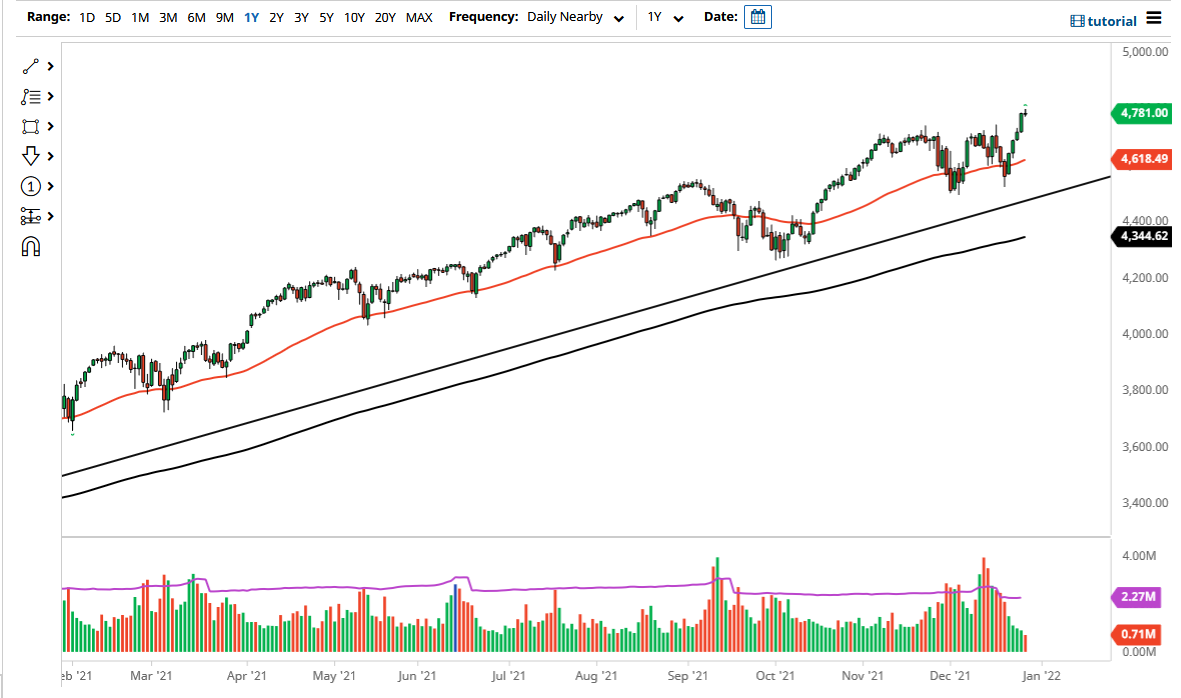

S&P 500

The S&P 500 initially tried to rally during the trading session on Monday, but then rolled over as we could not pick up any momentum as we await the results of the US/China trade negotiations. Quite frankly, we are in an area where you would expect to see a lot of bearish pressure, and of course major resistance. But frankly, I’m a bit surprised we got this far to begin with but obviously we are starting to run out of momentum. If that’s going to be the case, then I think we will roll over towards the 2600 level underneath. Rallies at this point will struggle a bit, but I believe that the 2800 level above will be the initial target, and a massive amount of resistance. At this point, it’s very difficult to put a lot of money to work until we get an impulsive candle stick.

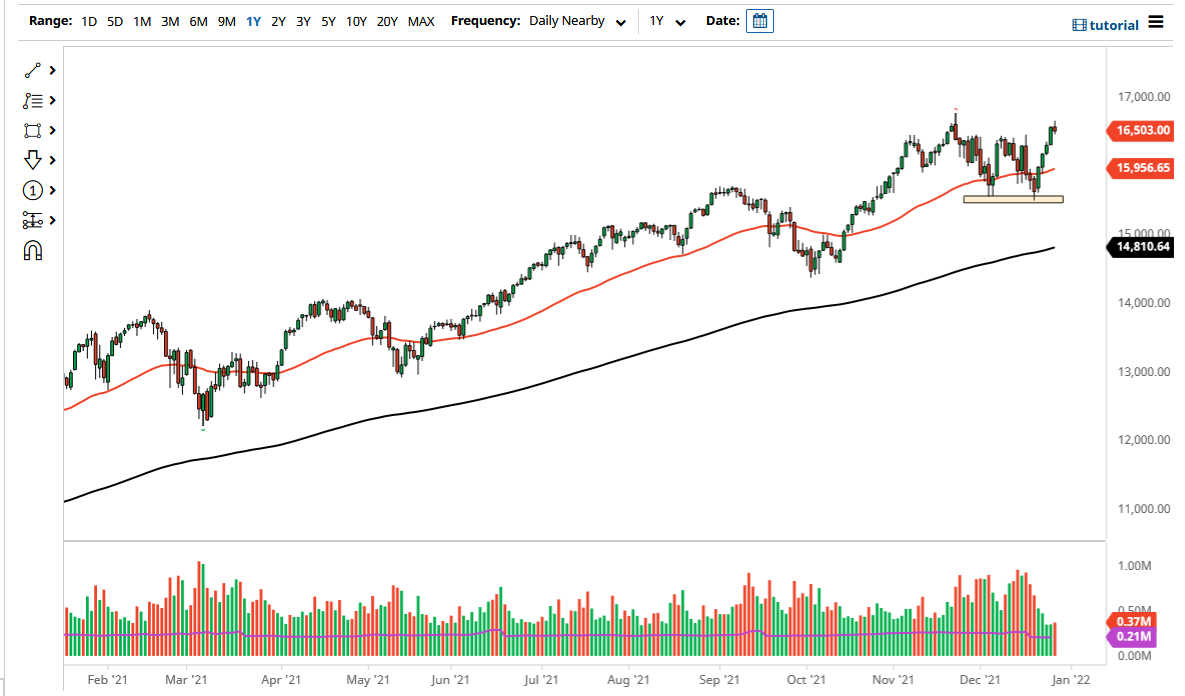

NASDAQ 100

The NASDAQ 100 tried to rally during the day but failed at the 7000 level. At this point I think we are very likely to rollover, as this area looks to be massive resistance. The 20 day EMA just below should continue to offer support, so I’m not necessarily looking to go along at this point but I also recognize that there is a lot of support underneath extending down to the 6500 level. In other words, this market just like many of the other markets that I am hired to look at these days is an absolute mess. If we can break above the 7200 level on a daily close, then we are free to go much higher. If the US/China talks don’t turn out with anything positive, the NASDAQ 100 will fall rather hard.