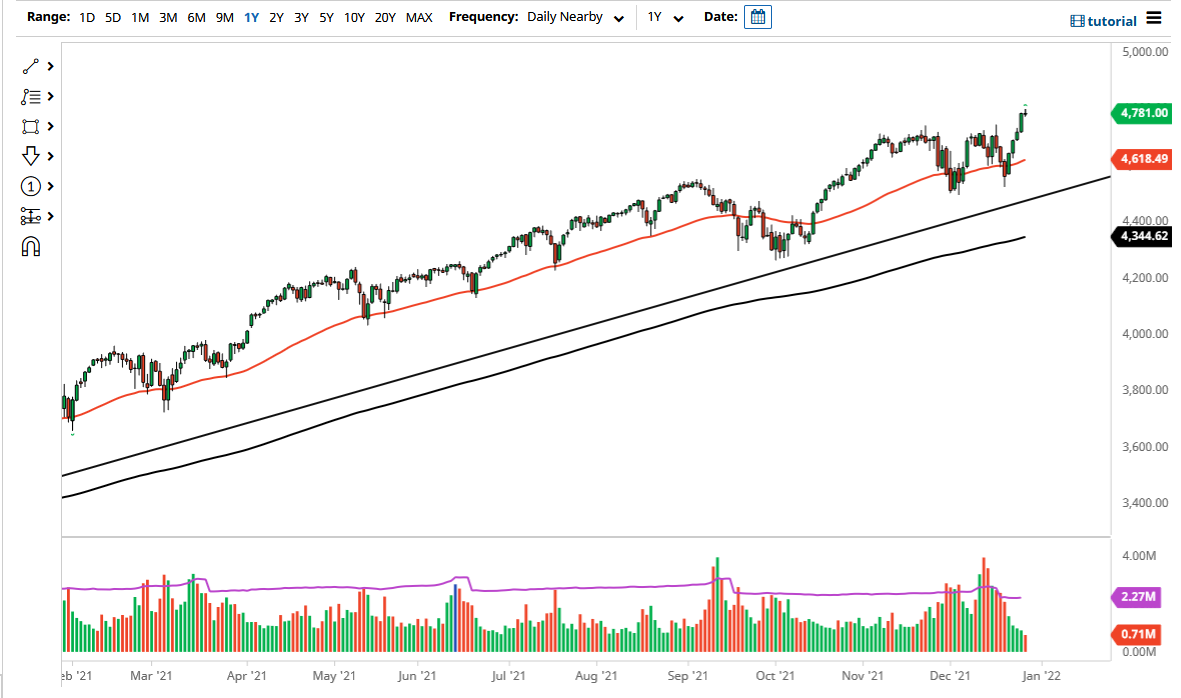

S&P 500

The S&P 500 rallied a bit during the trading session on Friday, testing the 2800 level for major resistance. We did in fact find it again, and it looks as if the market is simply a holding pattern and waiting to see what news comes out involving the US/China trade relations. At this point, it’s very likely that we will see some type of pullback, unless there is a surprise announcement of a deal being struck. That seems to be very unlikely at this point in the most likely result of the negotiations will be an extension. All things being equal, the real risk is to the downside if the talks between the two countries go sour. If they do, the market probably goes down to the 2700 level. I’m not looking to buy this market at this point until we get above the 2820 handle, which would clear the resistance barrier and have us going higher..

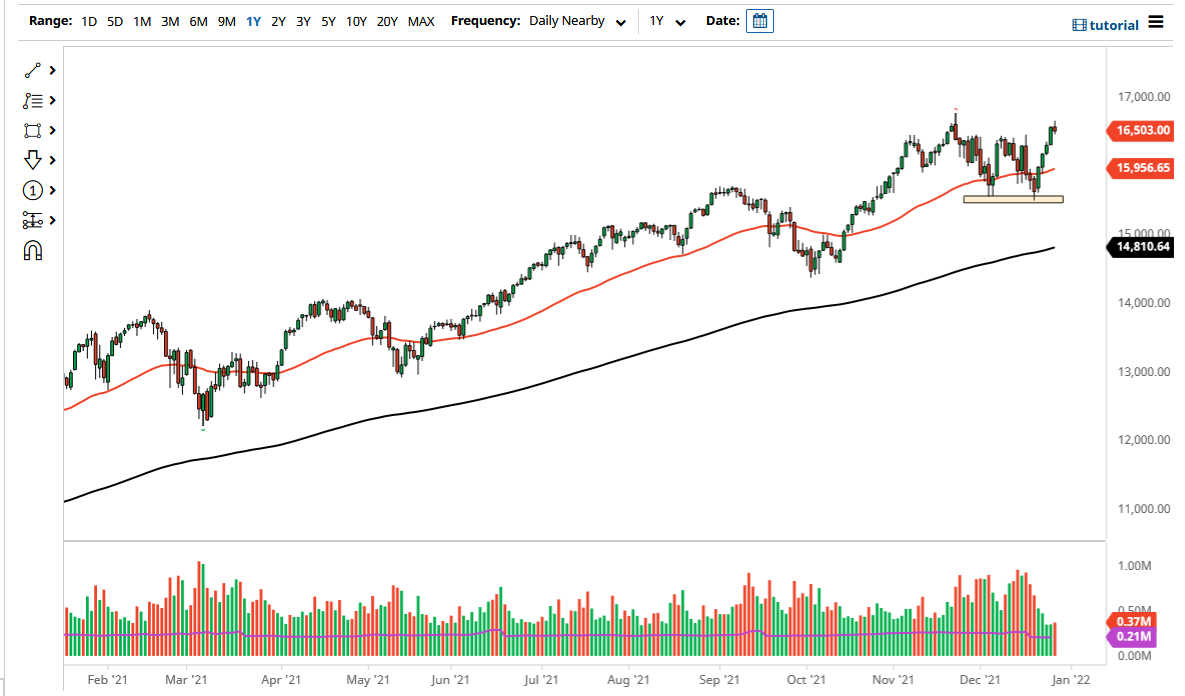

NASDAQ 100

The NASDAQ 100 rallied a bit during the trading session on Friday, as we continue to go bouncing around in this resistance region. This is an area that has been very difficult to break above, and of course I see at least a couple of different places where there is resistance, and as a result I think that the market is going to struggle. This market is very sensitive to the US/China trade talks, so it makes sense that we are simply sitting around and killing time.

If we get some type of deal, the NASDAQ 100 will probably take off to the upside. However, it makes sense that we get a little bit of a pullback, perhaps down to the 7000 handle, and then perhaps even the 200 day EMA. Overall, it’ll be interesting to see what happens over the last couple of days and I think what’s most likely is that we grind sideways overall waiting for some type of direction from world leaders.