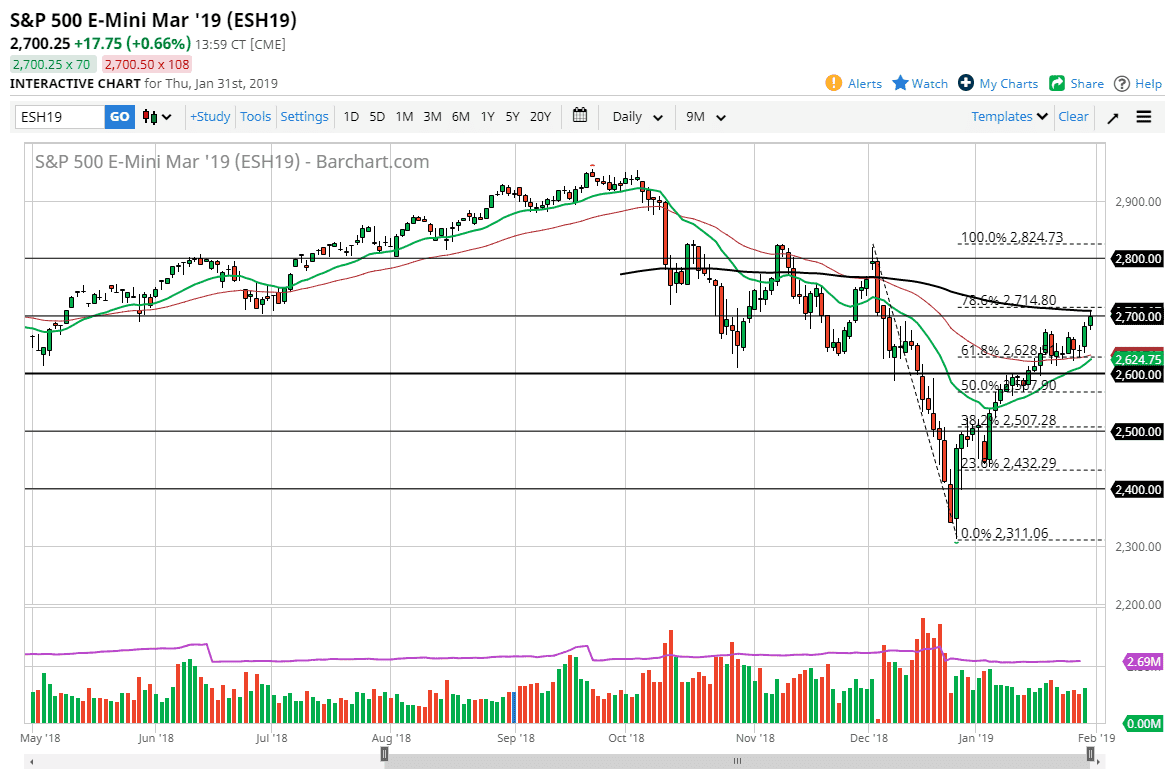

S&P 500

The S&P 500 has rallied significantly during the trading session on Thursday, breaking above the vital 2700 level. However, we have seen a bit of a pushback just above there, where the 200 day EMA is living. The fact that we are closing right at the 2700 level tells me that there is still a lot of underlying pressure in this market, but with the jobs number coming out it makes sense that a lot of people will have wanted to go home for the evening flat. With that in mind, the strategy for this is to buy the dips that occur due to the noise that will invariably be shown during the jobs figure. I believe that the 2660 area has a lot of support attached to it, but to be honest I would be a bit surprised to go that low. If we break above the top of the candle stick for the day on Thursday, then the market just simply will continue to fly towards the 2800 level. Ironically, the S&P 500 may benefit from a week jobs number as the Federal Reserve is set at neutral right now.

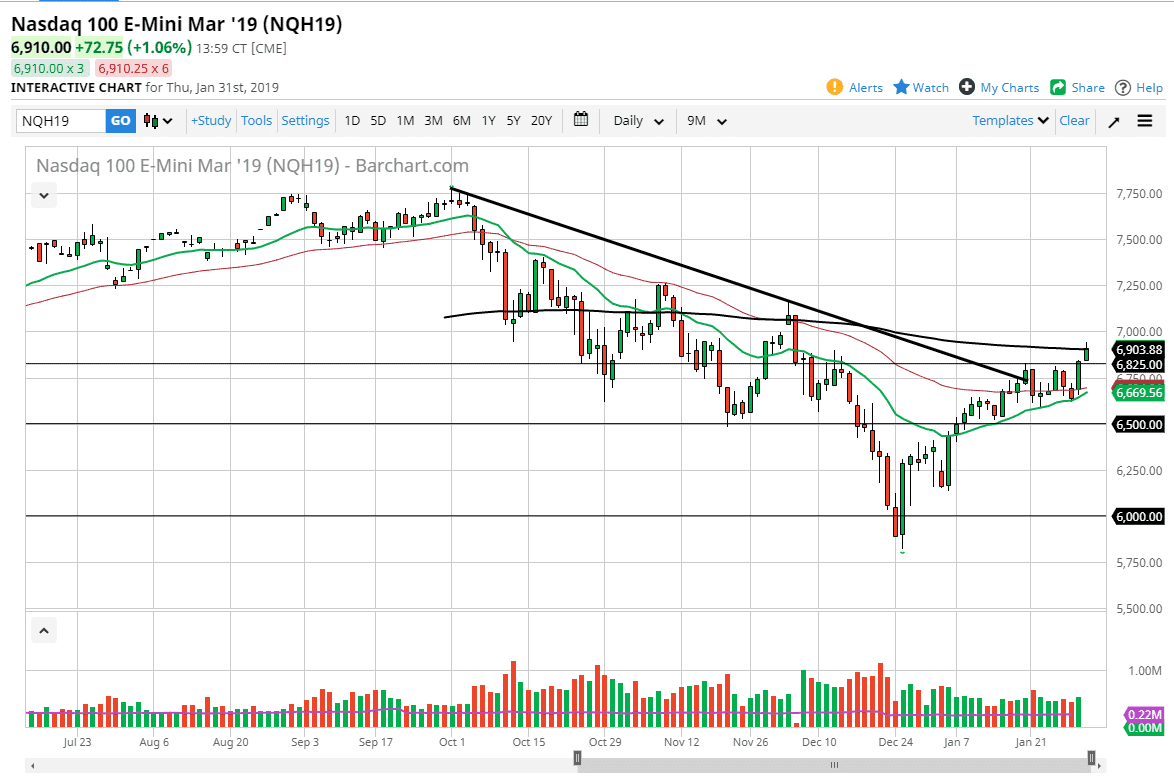

NASDAQ 100

NASDAQ 100 rallied significantly during the trading session, breaking above the vital 6825 level. That being the case, we have seen a major push higher, and I think that although we did give back some of the gains near the 200 day EMA, it’s obvious that we have seen a significant amount of bullish pressure enter the market. I think at this point, pullbacks towards the 6825 handle will probably attract a lot of attention, as we have such a bullish candle stick from the Wednesday session. At this point, I think once we get the jobs number out of the way people will come back and start buying again.