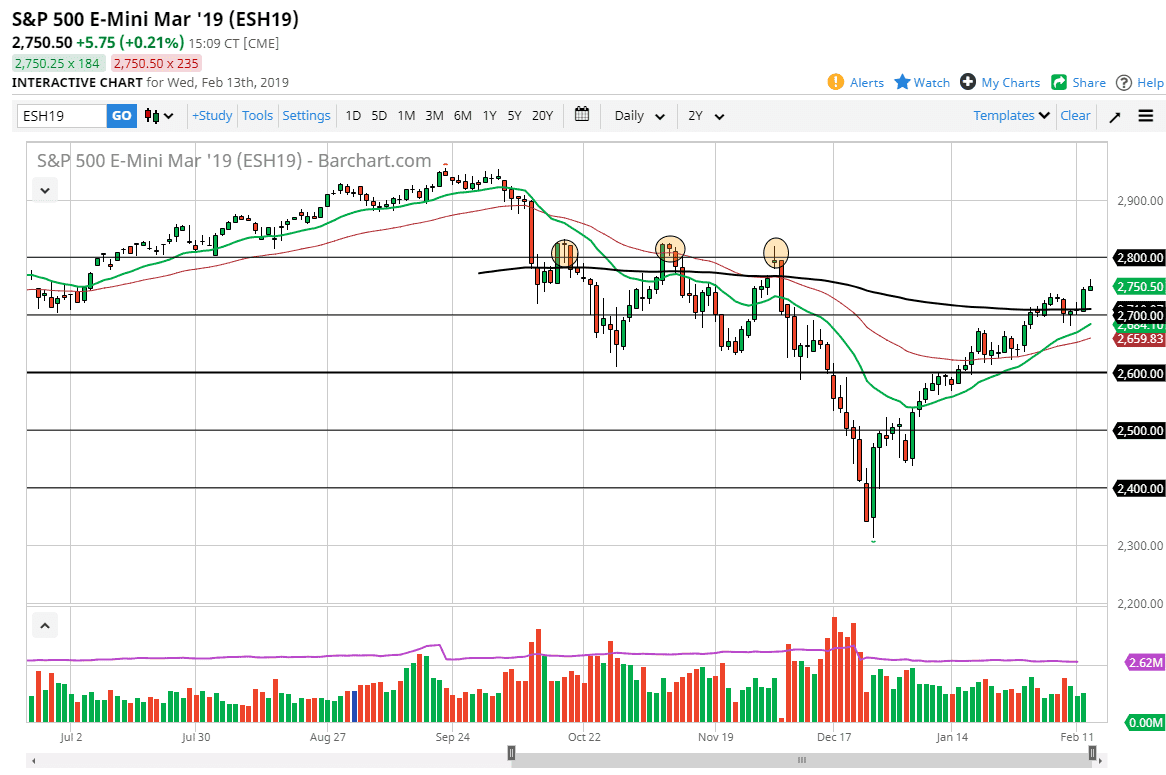

S&P 500

The S&P 500 rallied during the trading session on Wednesday but gave back quite a bit of the gains in somewhat disappointing fashion. By doing so, it’s forming a bit of a shooting star like candle, and it suggests that perhaps we need to pull back a bit. This makes sense, because we have the US and China talking right now which can of course move the markets quite drastically. I believe ultimately the market is going to run into a significant amount of resistance at the 2800 level, but we may get the occasional pullback between here and there. That might be what we are getting ready to see. With that being the case, expect the 200 day EMA underneath to offer a significant amount of support which just happens to be above the 2700 level.

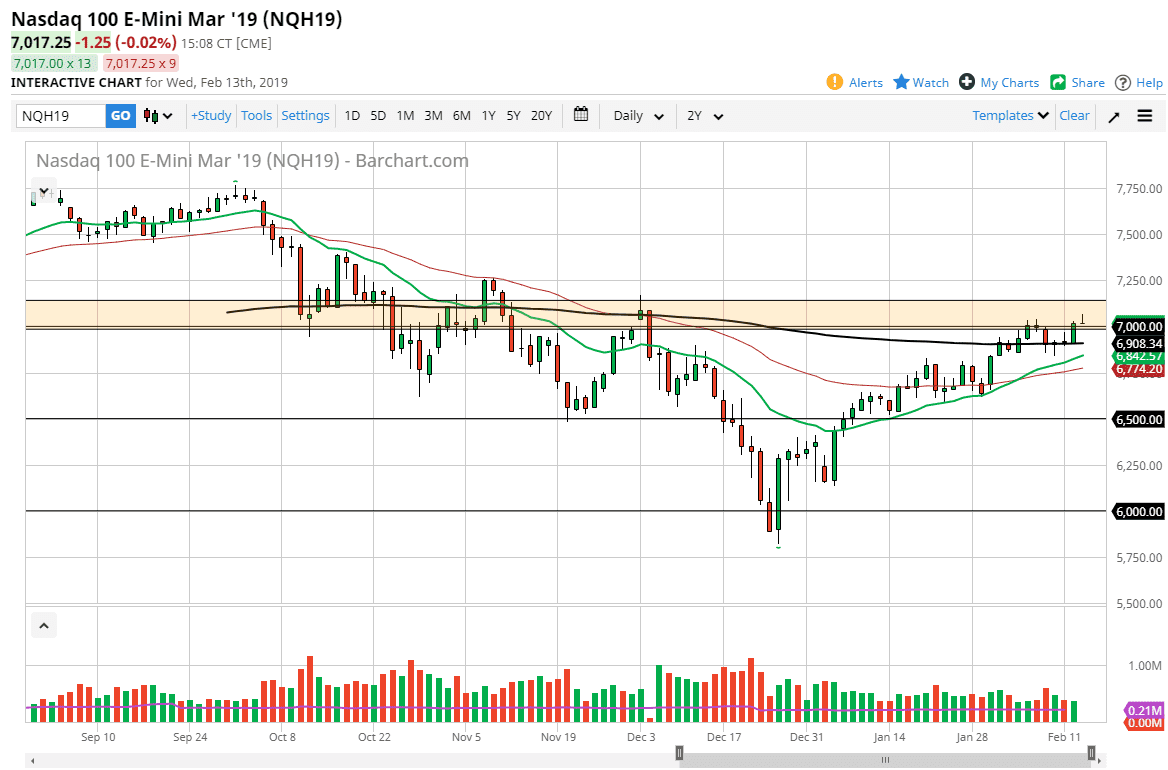

NASDAQ 100

The NASDAQ 100 was a bit more pronounced in the reaction that we got during the day as we have run into a buzz saw of resistance. The box that I made on the chart yesterday has held so far, and I think we are probably going to need to pull back a bit to build up the necessary momentum to go higher. The 200 day EMA is down near the 6900 level, so I suspect we may go back down to test that level again as we churned in order to decide whether we can continue to go higher. Remember, the NASDAQ 100 is extraordinarily sensitive to the US/China trade relations as it is full of so many technologically advanced companies. With this, I think the market may be taking a bit of a breather as we await the results of the conversations this week.