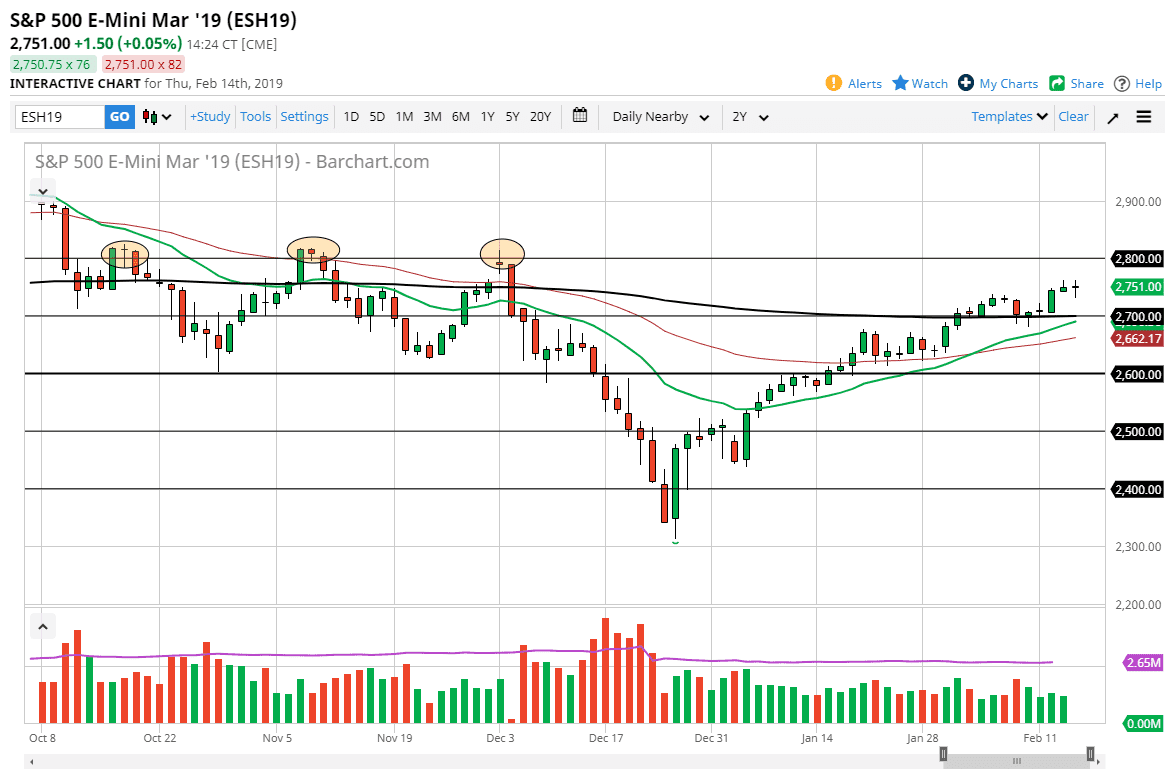

S&P 500

The S&P 500 went back and forth during the trading session on Thursday, as we initially broke down during the trading session after horrible retail sales and PPI numbers in the United States. This brought up the specter of a potential recession, because after all over 70% of the United States economy is driven by retail sales. However, people are starting to look at the numbers as being a bit skewed by a multitude of factors, and then beyond that it’s likely that it makes the Federal Reserve even more loose with its monetary policy. In other words, the market was going to go higher regardless. The premarket futures broke down significantly, but as you can see we turned right back around. The resiliency of this market continues to be a mainstay, so I’m looking at short-term pullbacks as buying opportunities. However, the 2700 level is the bottom of a larger consolidation area that extends to the 2800 level. We are essentially in the middle of it.

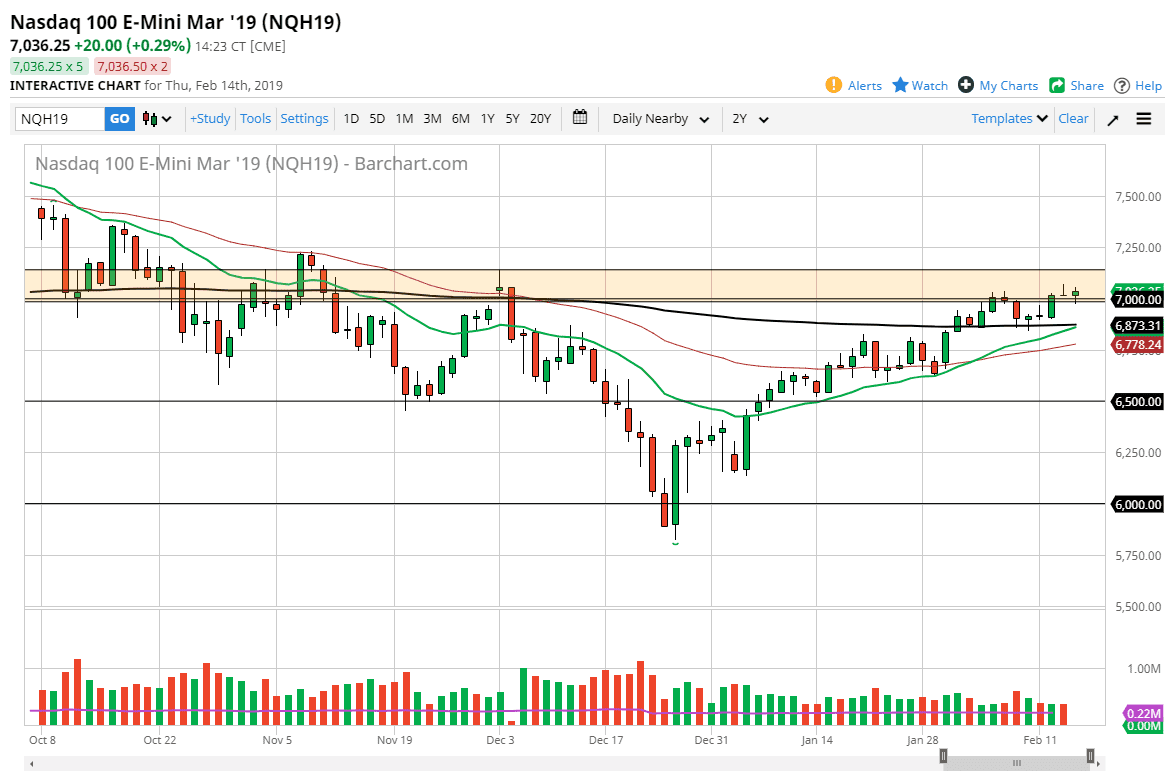

NASDAQ 100

The NASDAQ 100 initially pulled back and broke below the 7000 level, but then turned around to show signs of strength again. This is a bullish looking candle, which was preceded by a gravestone doji. In other words, there’s a lot of confusion and I think we are essentially going to chop around. However, it looks very likely that we are going to see a lot of reaction to the US/China headlines, which of course is going to be a mainstay this week. The NASDAQ 100 is full of companies that are highly sensitive to the Chinese economic figures, which of course are very sensitive to the trade war. At this point, I think we are right in the middle of massive resistance so it’s going to be difficult to go higher, but obviously there are willing participants underneath. In other words I’m looking for short-term back and forth trading.