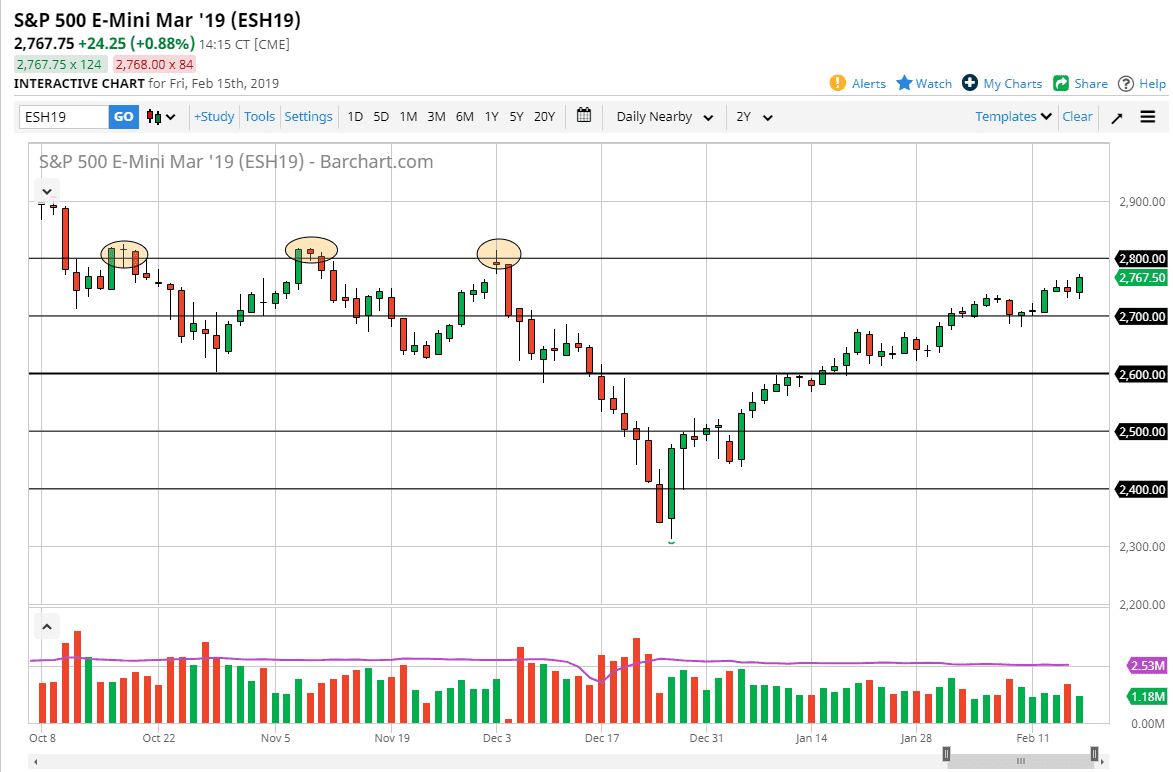

S&P 500

The S&P 500 initially pulled back during the trading session on Friday, but then shot to the upside and showed signs of strength yet again. The 2800 level above should be massive resistance, as we have seen several times before. Overall, the market has been very bullish, but I also recognize that the area above is going to be a major resistance barrier to overcome. If we can get above there, the market can go a bit higher but more than likely what we are going to see is a pullback. I think a pullback makes a lot of sense, and that should be a buying opportunity as we have seen so much strength. However, if we were to break down below the 2700 level that could change things at least for a while. A softer Federal Reserve continues to lift the stock markets.

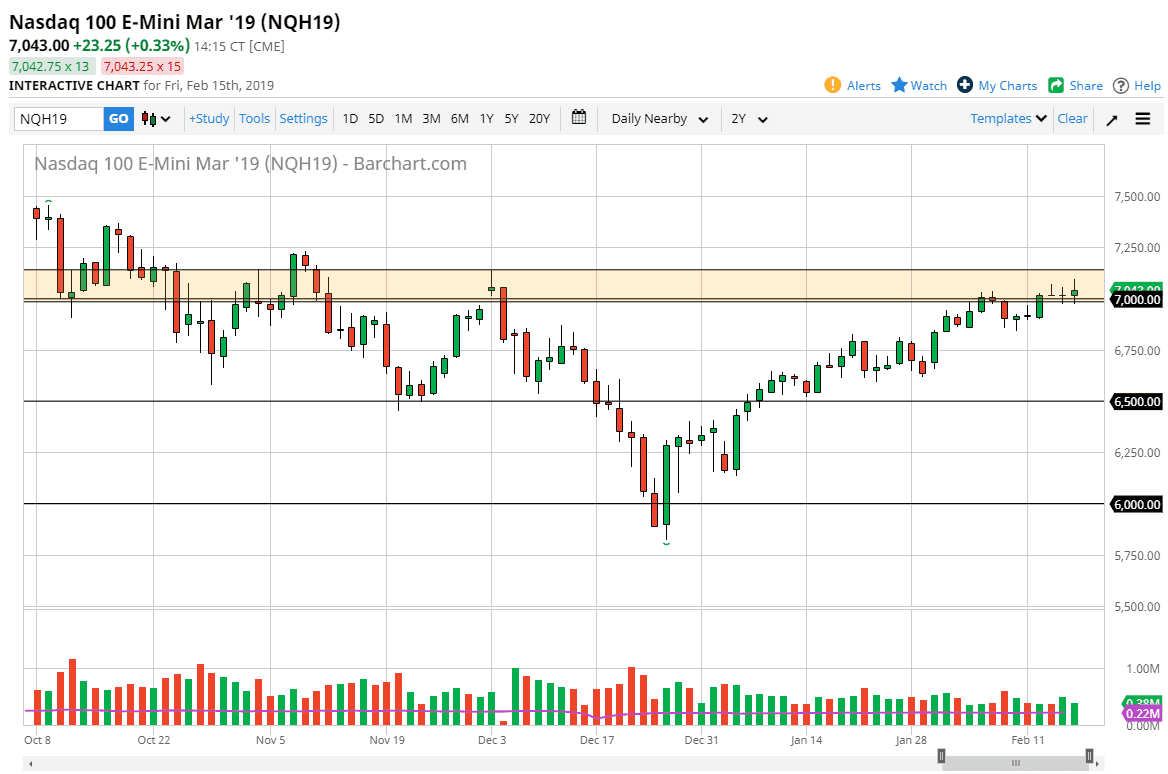

NASDAQ 100

The NASDAQ 100 went back and forth during the trading session on Friday, showing signs of volatility and an area that should be massive resistance. Ultimately, I think that the market shows signs of rolling over but I don’t essentially think this is going to be a massive break down. I suspect we need to build up momentum to finally break out, and a soft Federal Reserve may be the key. Beyond that, if we get some type of movement forward in the US/China trade negotiations, then we could get a serious move to the upside as the NASDAQ 100 is so highly levered to technology, which then of course is highly levered to Asia. However, I think we have reached a point where the sellers are about to step in and try to press the issue.