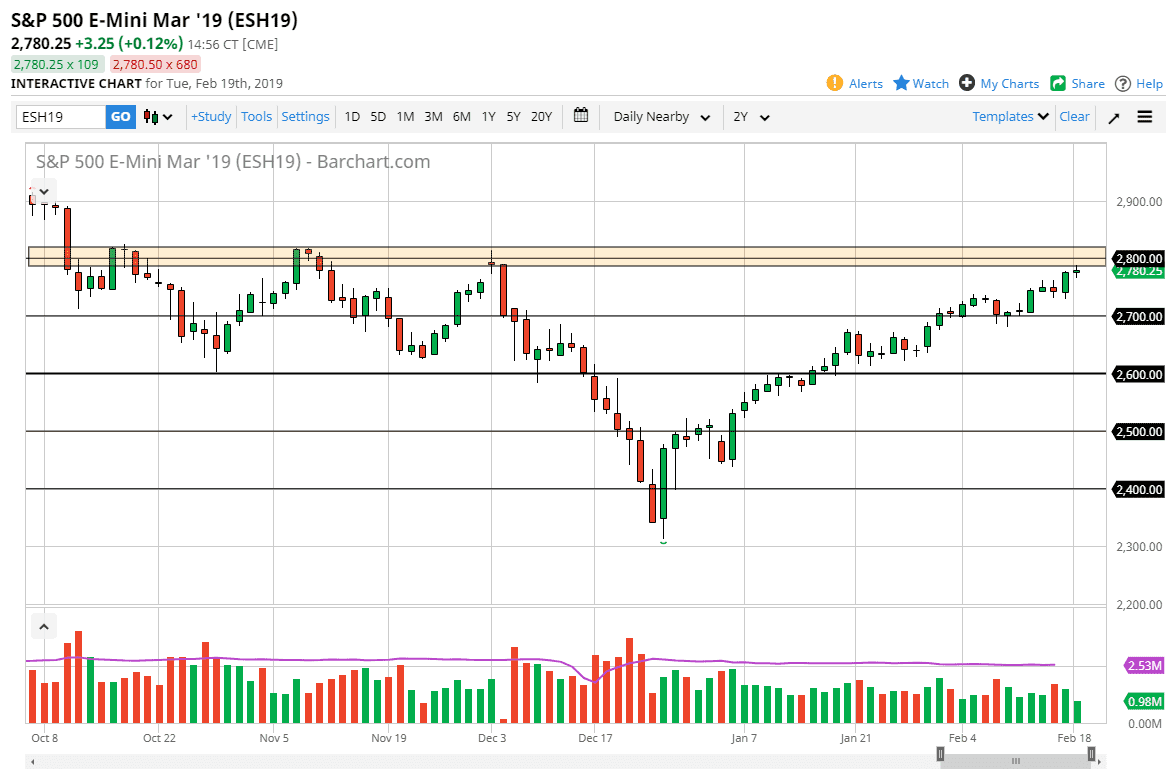

S&P 500

The S&P 500 went back and forth during the trading session on Tuesday, as we continue to see a lot of choppiness. The stock market of course is dealing with major resistance above, and of course there are a lot of moving pieces out there that can influence where we are going next. The 2800 level above is massive resistance, an area where we have seen the market hit three times and failed. We are currently awaiting the meeting minutes from the FOMC, which could give us an idea as to what the Federal Reserve might do next. If they seem very dovish, that could be good for stocks. However, we also have the US/China trade talks going on this week, so there is a lot of headline risk in this area. Ultimately, you are probably flirting with disaster if you are putting money to work right now.

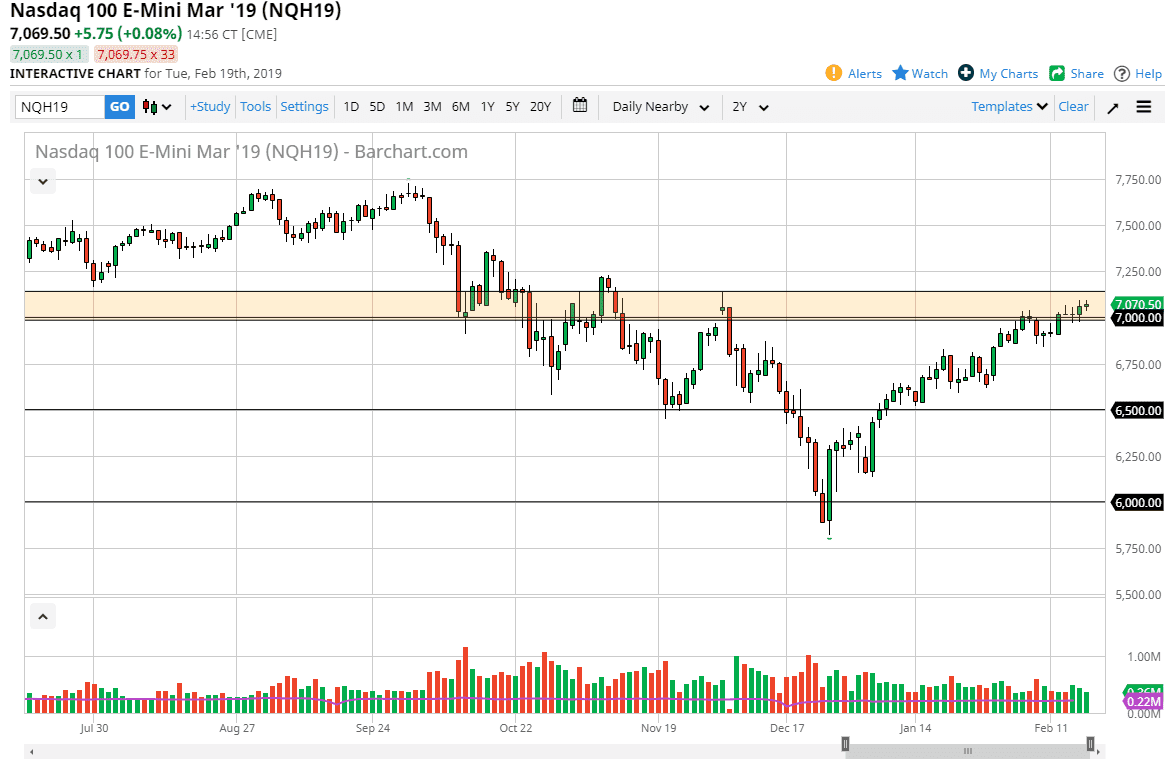

NASDAQ 100

The NASDAQ 100 is very much the same scenario, as there is a significant amount of resistance in this general vicinity. However, unlike the S&P 500, we do not have a clear-cut resistance barrier above, as we have several different impulsive moves in this general vicinity. In fact, the impulsive moves extend all the way up to the 7400 level, and as a result I believe that if we are going to see exhaustion and a roll over, it could happen in this general vicinity. I believe that if we do roll over in the stock markets overall, the NASDAQ 100 will probably be one of the first places we see it happen. With the headlines out there just waiting to happen, a fall does make sense but ultimately we will need to see what happens next before acting. This is a market that is far too dangerous to risk trading capital with right now.