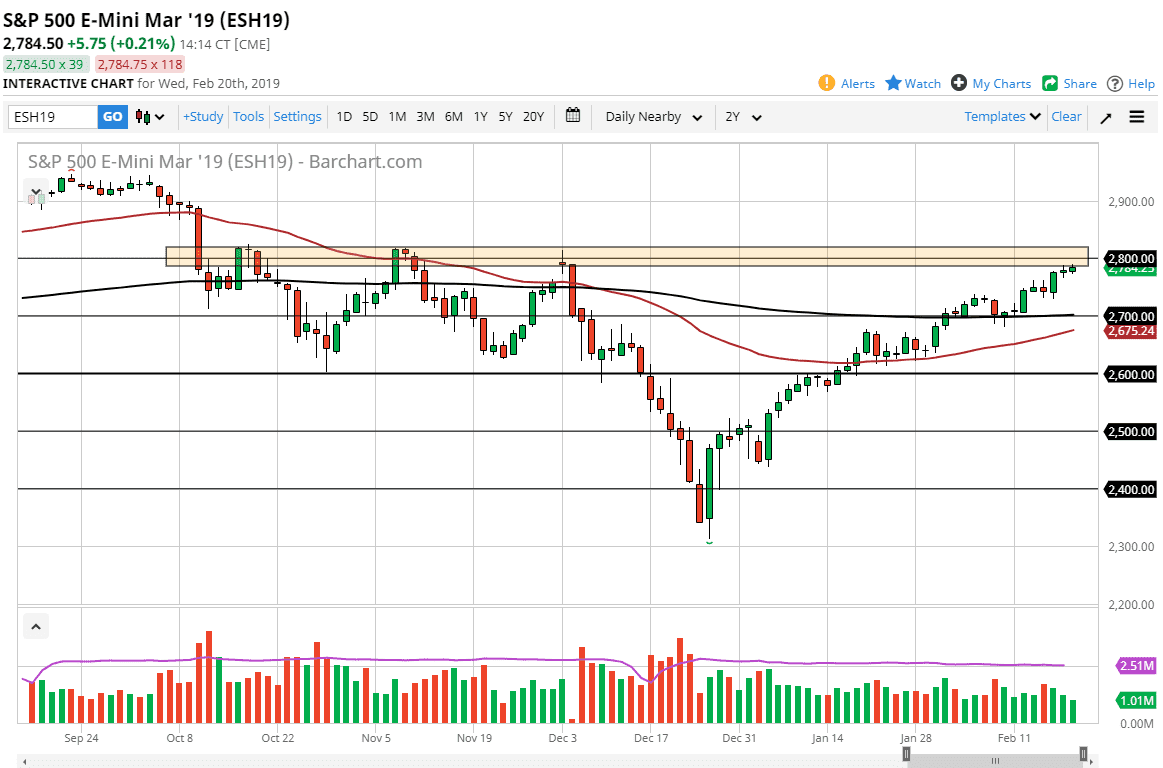

S&P 500

The S&P 500 rallied a bit during the trading session on Wednesday, as we continue to go towards the 2800 level. That’s an area that is going to be massive resistance, so I think it’s going to be difficult to break out above there, and it’s not until we clear the 2820 level that I feel we can continue to go to the upside longer-term. Although the market has been bullish during the day, I think that there is so much in the way of resistance that it’s going to be difficult to throw a lot of money into the market. We were waiting for the meeting minutes, but they did not seem to make much of a difference to the market. With that in mind, it now comes down to the US/China trade talks, which have a high probability of disappointing. I suspect there’s probably serious downward risks at the moment.

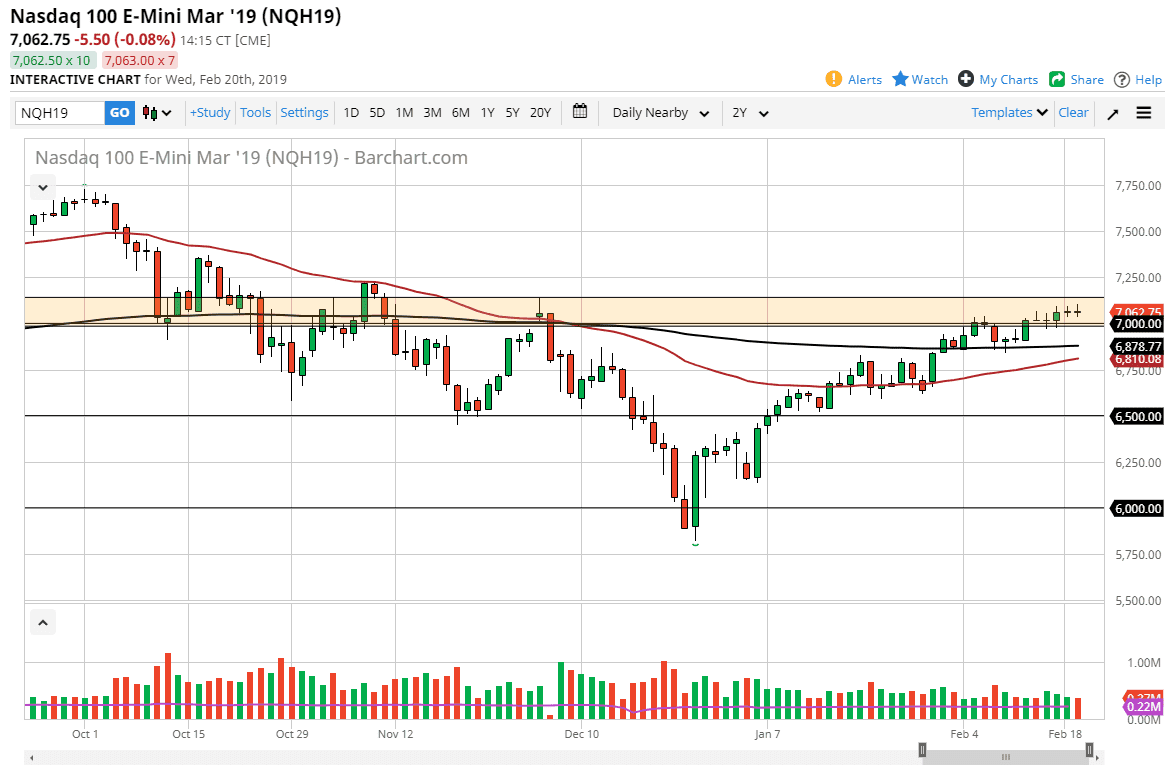

NASDAQ 100

The NASDAQ 100 has gone back and forth during the trading session on Wednesday, ultimately showing a rather indecisive candle. With that being the case, the market looks as if it is starting to struggle in a major area, and I think any disappointment in the US/China trading negotiations will more than likely send this market lower. I believe we are running out of momentum, and it’s not until we clear the 7200 level that it’s going to be advisable to perhaps put money to work. If we pull back from here and show signs of support at the 7000 handle, then it is possible we could continue to go sideways, but overall, things don’t look good and we did not close well after the meeting minutes.