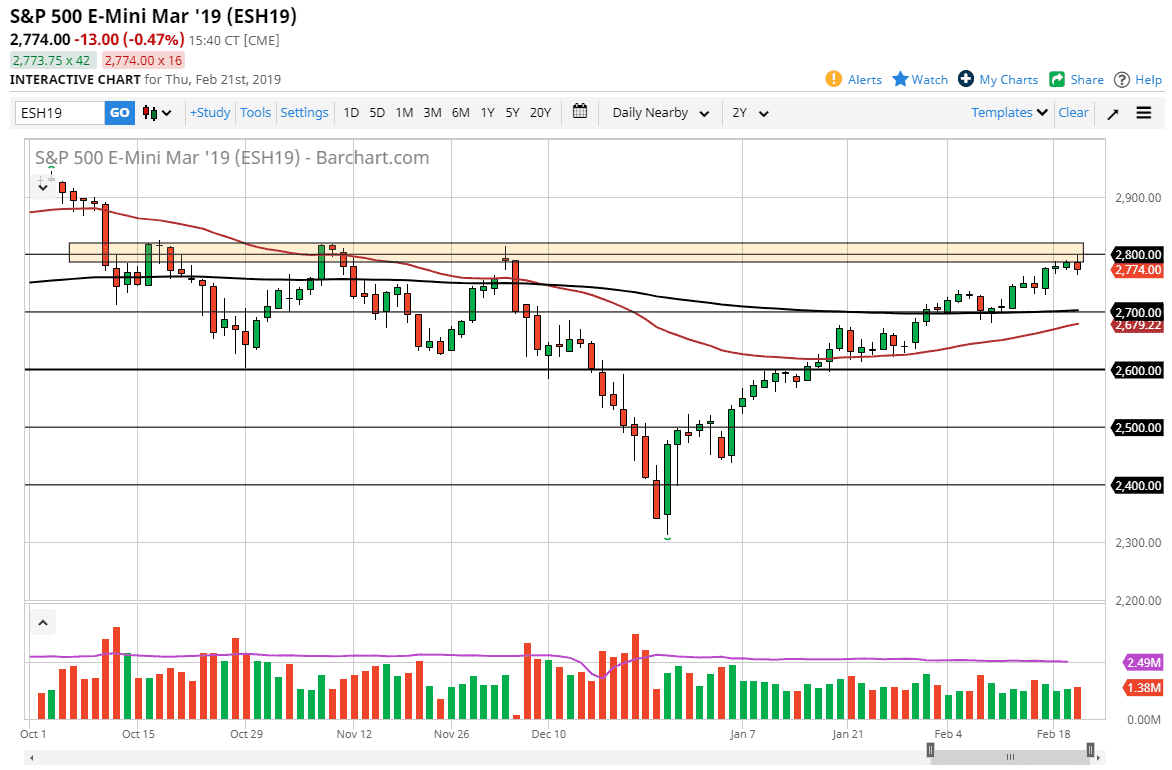

S&P 500

The S&P 500 rallied a bit during the trading session initially on Thursday but then sold off as soon as we hit the 2800 level. I think the market is getting a bit overextended and perhaps we are starting to see a bit of profit taking. This is an area that has been very difficult to overcome lately, and we have a triple top from last year that we still need to deal with. While I don’t think that were going to break down significantly here, I do think that a pullback is probably to be expected after this type of rally. Beyond that, the volume isn’t exactly exciting, so I think a little bit of sideways to slightly lower trading would make a lot of sense. However, if we can break above the 2825 handle, then we could go much higher.

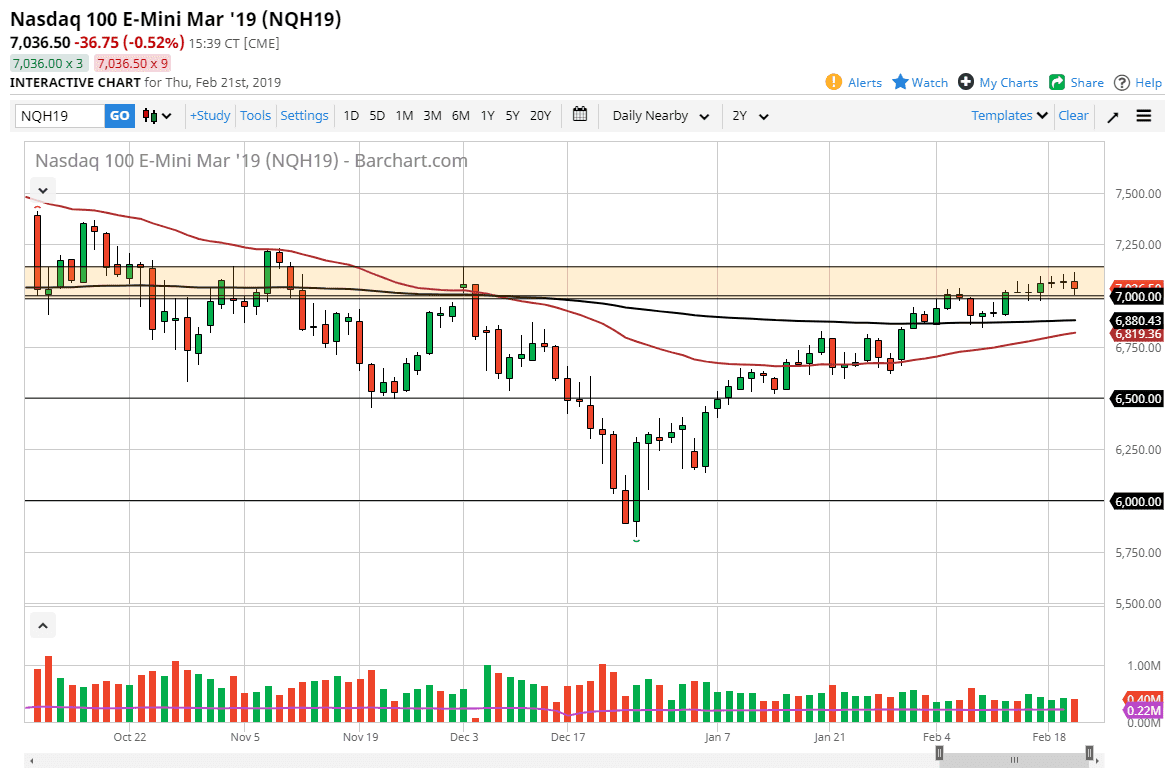

NASDAQ 100

The NASDAQ 100 initially tried to rally as well, but then fell towards the 7000 handle which found a bit of support. It looks as if the market is ready to go sideways, so therefore it’s going to be difficult to imagine a scenario where we can find it breaking out to the upside without some type of good news. I think a pullback makes sense, with the 200 day EMA at the 6880 handle offering support. Nonetheless, we have the US/Chinese trading talks going on right now and that could affect the market as well.

Looking at the market, I think that if we do break out to the upside we could go looking towards the 7250 handle, and then eventually the 7500 level next. I think short-term, stock markets in general need to take a bit of a breather as we have been in such a strong uptrend.