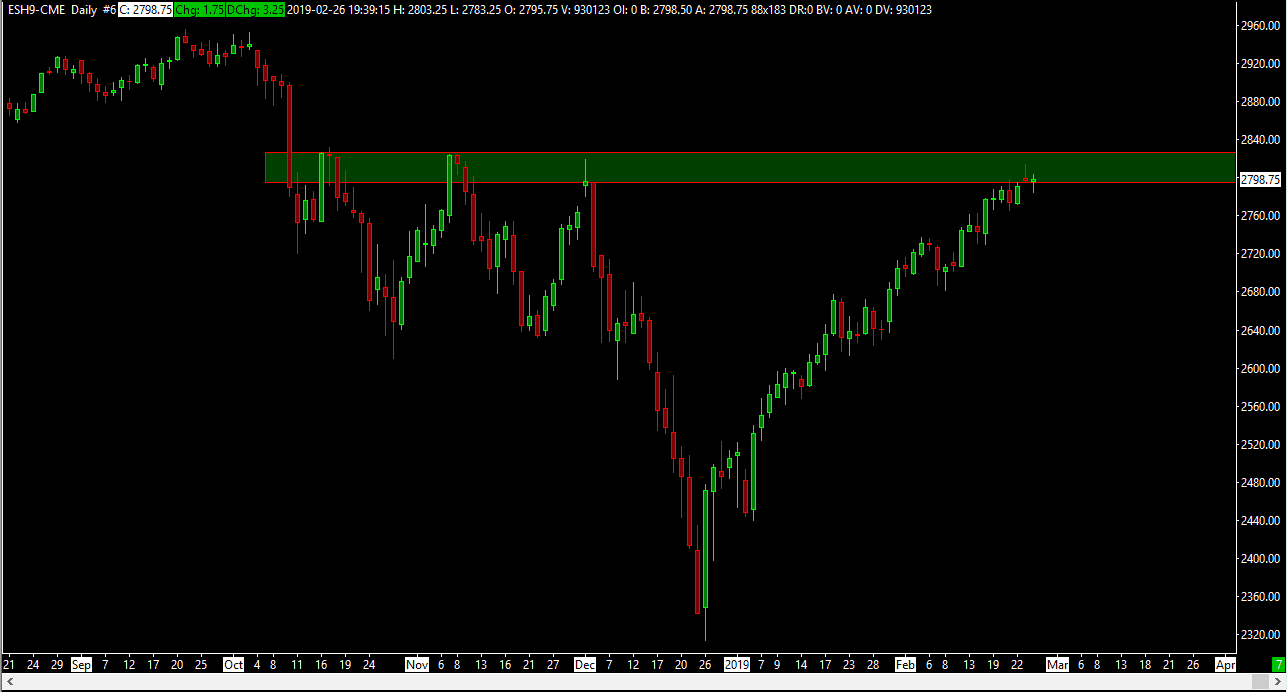

S&P 500

The S&P 500 initially fell during trading on Tuesday, as the world awaited the Humphrey Hawkins testimony out of Jerome Powell. By the time the first day of this testimony ended, the market seeing to have gotten basically what they want as we continue to hover around the vital 2800 level. That being said, this is a bit of a “medicine ball”, and therefore should not be traded. Yes, things look bullish at the moment but at the end of the day you need to see a lot of resistance taken out to the upside in order to start buying. On the alternate scenario, you need to see the market break down significantly to start shorting. While we did get a perfect shooting star during the trading session on Monday, that has all but been negated after the Tuesday session.

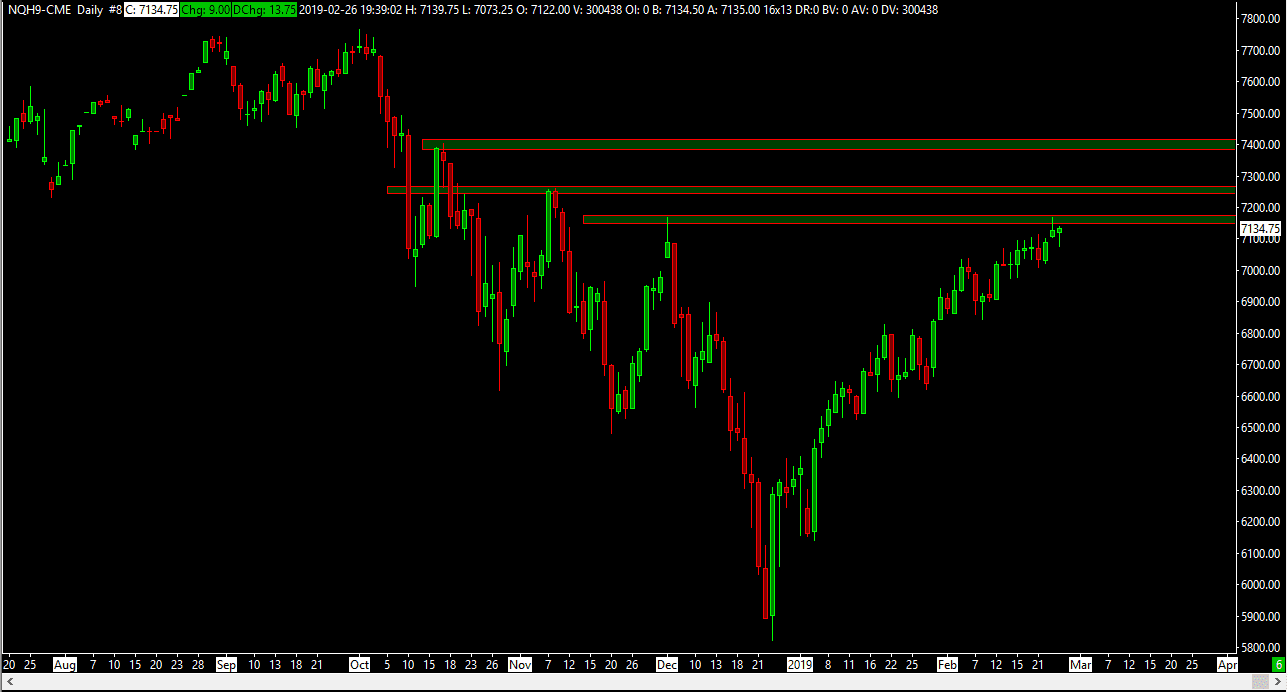

NASDAQ 100

The NASDAQ 100 initially fell as well, filled the gap and then turned around to show signs of strength again. At this point, it looks as if we are going to trying to break out to the upside, and a clearance of the highs from the trading session on Tuesday could send this market towards the 7250 level. If we can break above there, then the market probably goes to the 7400 level after that. Ultimately, this is a market that I do think has more of an upward proclivity, but we have a lot of work to do before we are clear to go much higher.

I suspect that short-term pullbacks are buying opportunities and should be looked at as such. At that point, buying the dips is the same thing as picking up value in a market that obviously is strong. However, if we turn around and break down below the 7000 handle, then the market could go much lower.