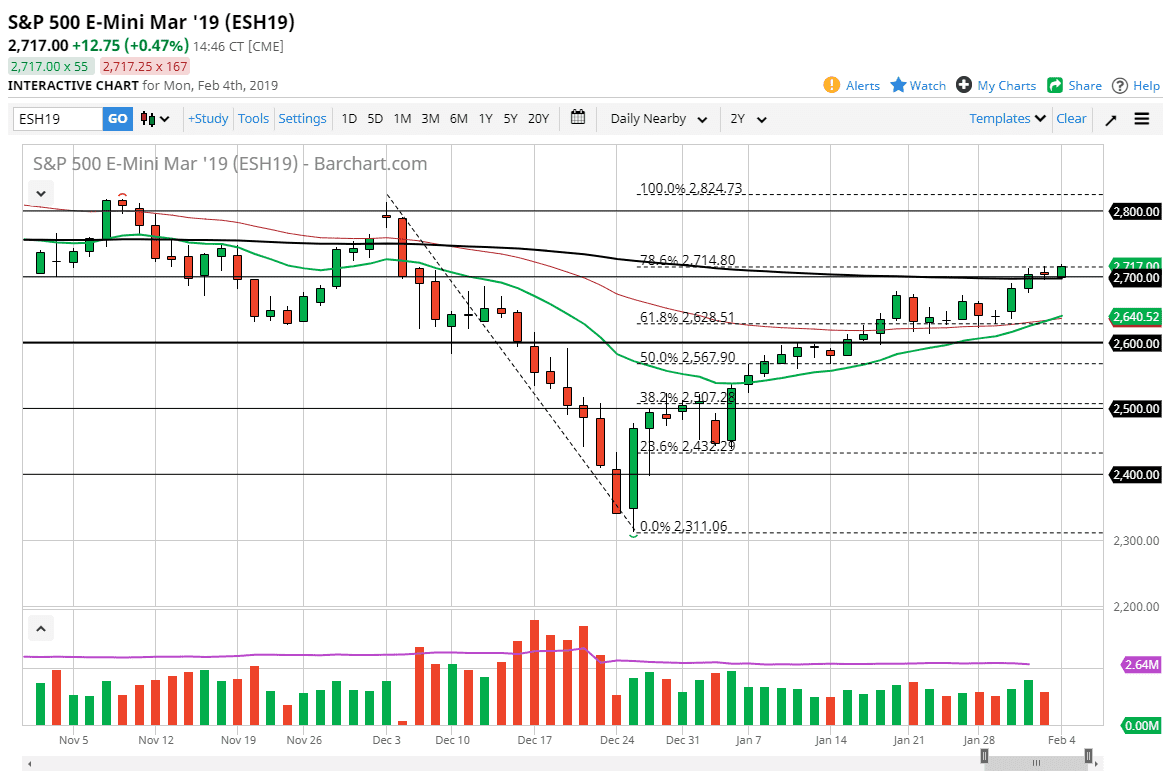

S&P 500

The S&P 500 has rallied significantly during the afternoon in America to reach towards the 2717 level. This of course is a good sign, although we haven’t quite broken out yet. It certainly looks as if the 200 day EMA is trying to offer support, just as the 2700 level Will. Because of this, I suspect that short-term pullbacks will continue to be buying opportunities as it looks likely that we are going to try to reach towards the 2800 handle. However, if we were to turn around and break down through the candle stick from the Thursday session of last week, that could be a negative sign. Keep in mind that the biggest thing that seems to be driving this market right now is the Federal Reserve stepping away from being so hawkish, which does have people looking to buy stocks.

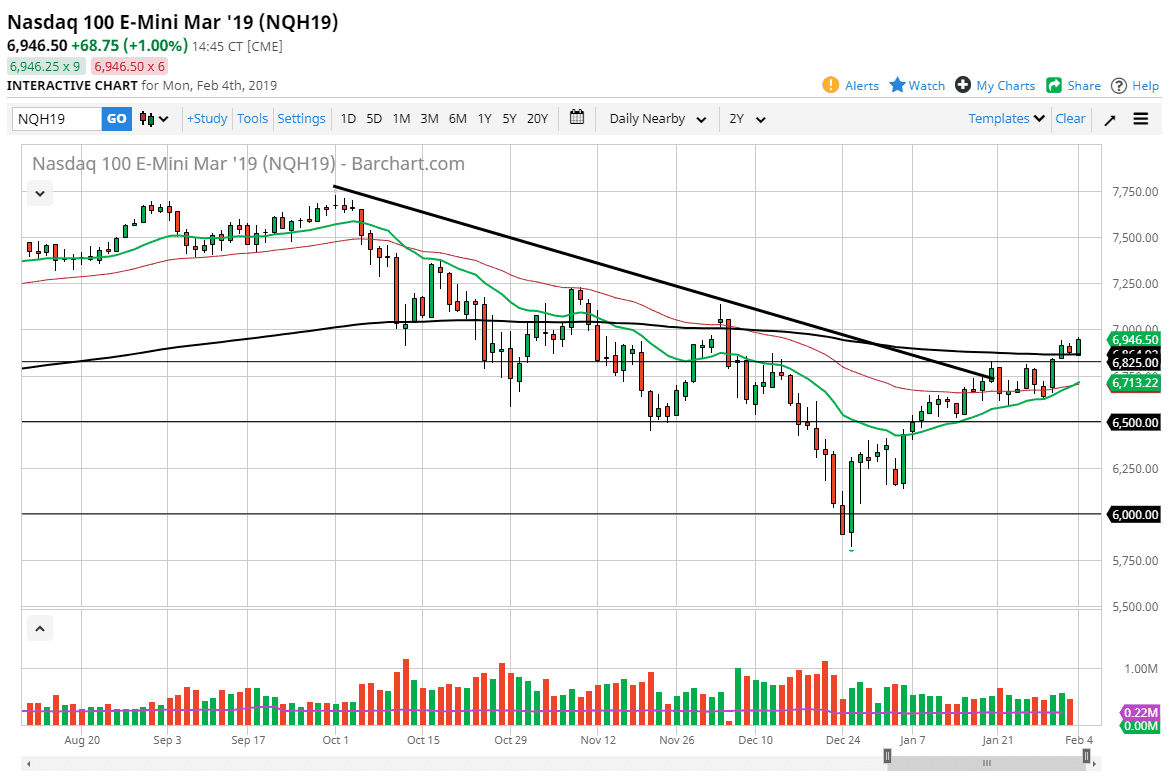

NASDAQ 100

The NASDAQ 100 rallied a bit during the trading session on Monday as well, as we reached the 6950 handle. Just above, especially at the 7000 level, there is a significant amount of resistance. I think short-term pullbacks will probably be buying opportunities, but if we can finally break above the 7000 handle then I think the market will probably go looking towards the 7200 level. Underneath, I suspect that the 6825 level should be support, based upon the massive green candle that led to this break out. Beyond that, the 20 day EMA just crossed above the 50 day EMA, which of course is a bullish sign as well from a longer-term perspective in. In general, the NASDAQ 100 will be especially sensitive to US/China trade talk headlines.