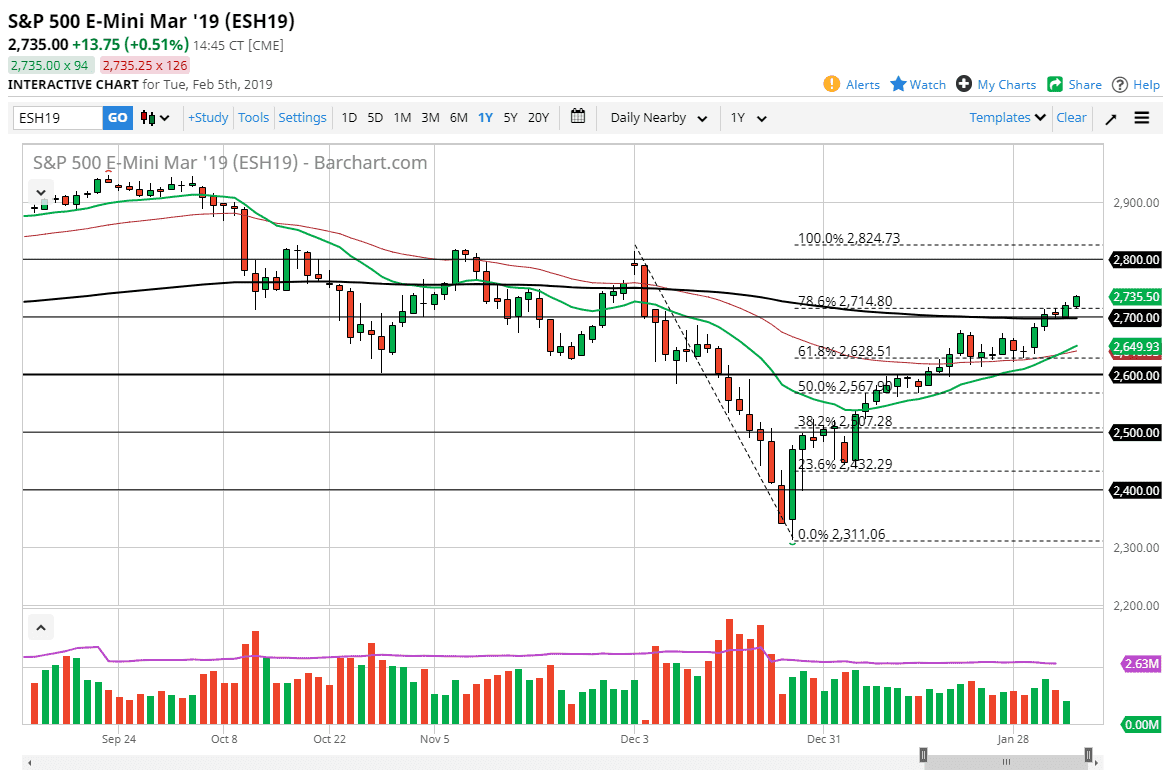

S&P 500

The S&P 500 rallied during the trading session again during the day on Tuesday, breaking above the 2725 handle. By doing so, it looks as if the 200 day EMA is now going to offer support, which coincides quite nicely with the 2700 level. At this point, the 2800 level above should be a target, and now that we are looking at the 61.8% Fibonacci retracement level in the rearview mirror, it wouldn’t surprise me at all to see this market reaching towards the 100% Fibonacci retracement level. With this in mind, I think that dips will continue to be buying opportunities, as this market has shown an extraordinarily resilient attitude overall through earnings season. I think this comes down to the Federal Reserve more than anything else.

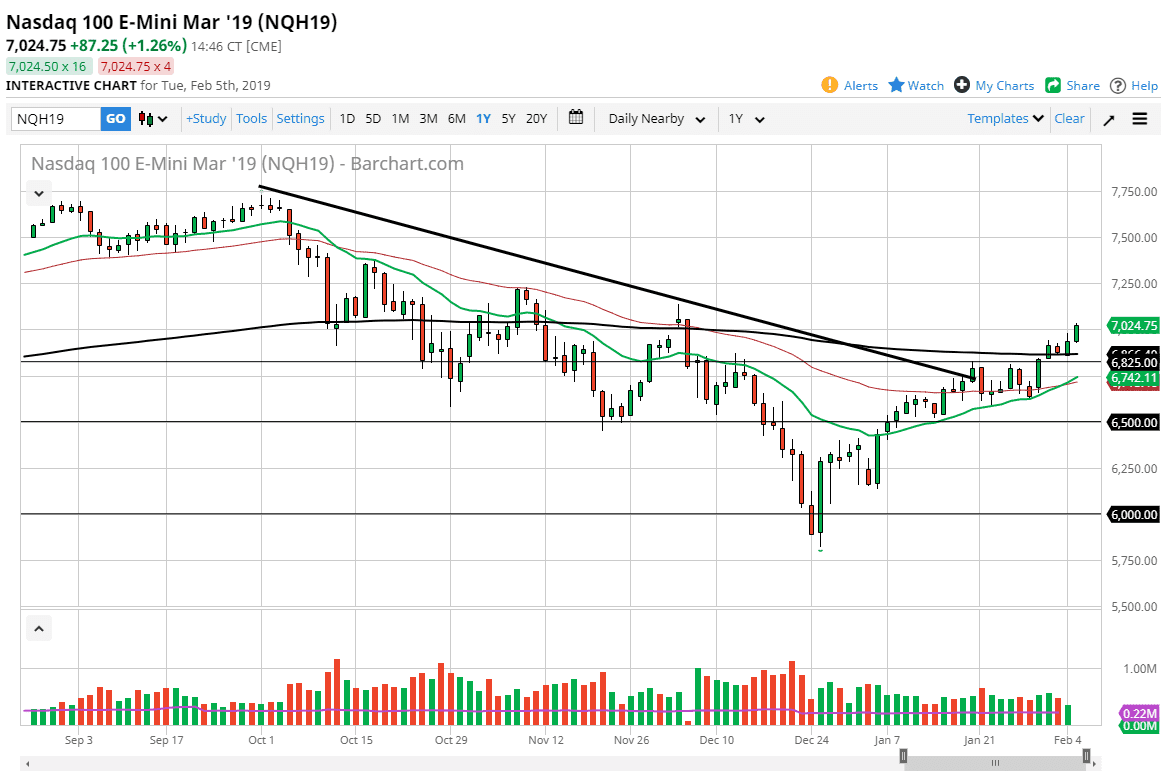

NASDAQ 100

The NASDAQ 100 broke higher during the trading session on Tuesday, clearing the 7000 level. At this point, I think any short-term pullbacks should be a buying opportunity as the 200 day EMA should be nice support now that we are above it. The NASDAQ 100 certainly looks as if it is ready to go higher as we have been in a nice uptrend channel. However, there are a lot of concerns out there that could turn this market rent around, but right now it looks as if the buying the dips continues to be the best route going forward. The 20 day EMA is now crossing over the 50 day EMA, which of course is a very bullish sign as well. I think that as long as the Federal Reserve sounds dovish, and it certainly looks as if more of the members are, there’s a good chance that we should see stock markets in general rally.