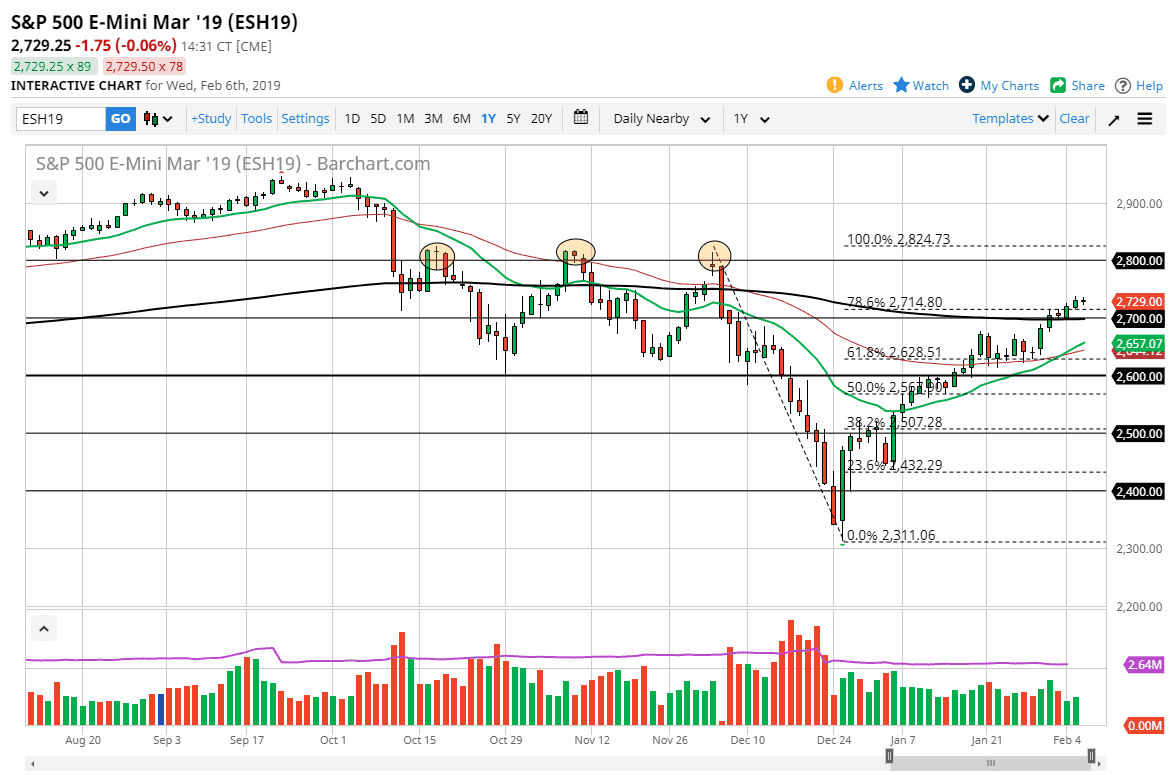

S&P 500

The S&P 500 went back and forth and essentially did nothing during the day on Wednesday, as we are starting to get overextended. We are above the 200 day EMA though, so that obviously is a bullish sign. We are at an area that had seen a lot of selling pressure previously, and now we are starting to pay attention to earnings season a bit more. I think we probably continue to grind towards the three levels that I have circled near the 2800 level, but it is going to take some time to get there. I believe that if we break down below the 200 day exponential moving average though, we may very well rollover. At this point, there’s no point in trading this market as we have started to stall.

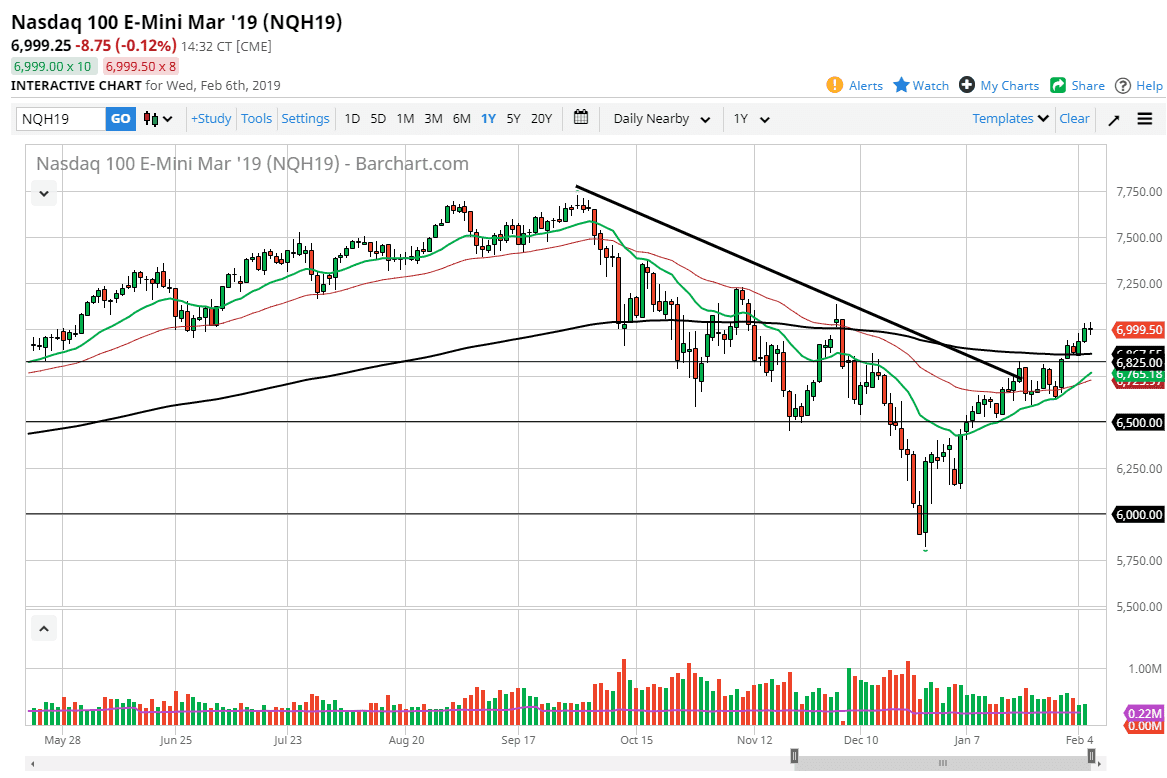

NASDAQ 100

The NASDAQ 100 is also phasing major resistance at the 7000 level, and that’s an area that could cause a bit of a pullback. However, I would expect support at the 200 day EMA, so I am more than willing to buy that pullback if a hammer shows up near that level. If we break down below the 6025 level, we could then go down to the 6750 level after that. 7000 of course is a large, round, psychologically significant figure, so breaking above there of course is going to be a very good sign. However, this is overdone and we are starting to look a bit exhausted at this point, something that would make sense after this massive “V-shaped” recovery. I anticipate a couple of days of negativity are probably necessary at this point.