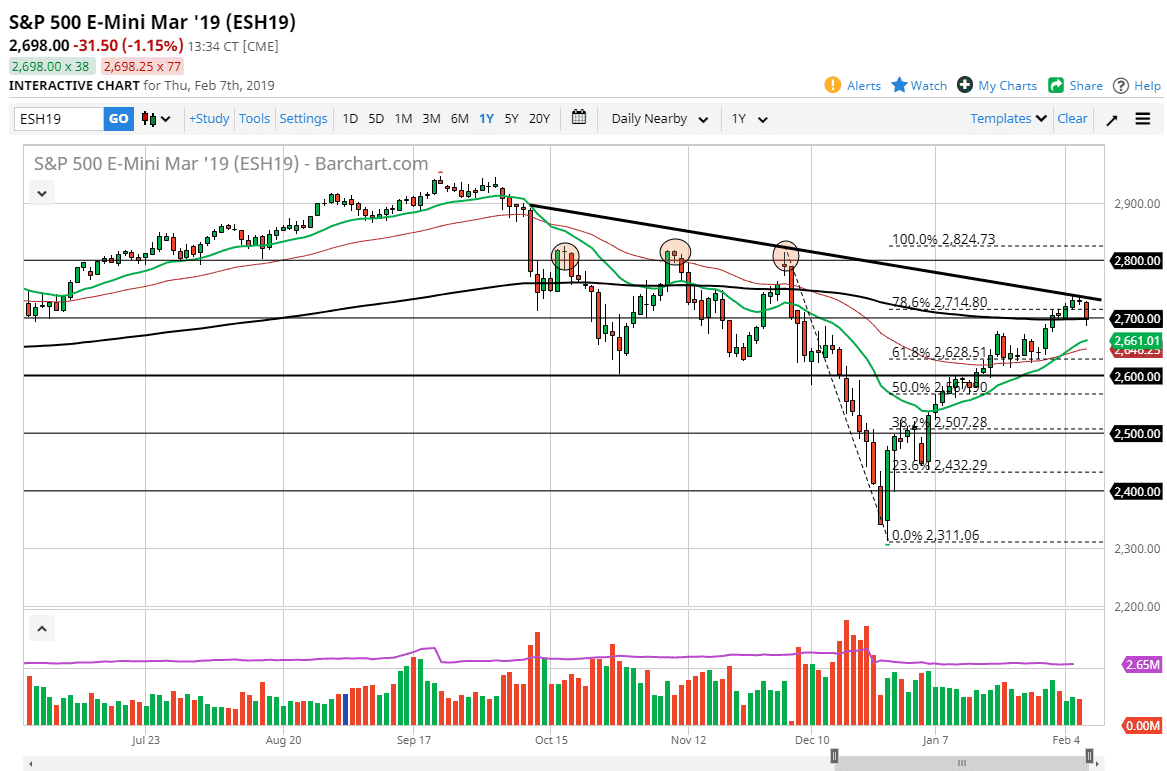

S&P 500

The S&P 500 broke down a bit during the trading session on Thursday, reaching towards the 2700 level. We did break down below there at one point but it looks as if we are trying to find buyers in this general vicinity. It happens to be the 200 day EMA, so it’s very likely that we will continue to see a lot of noise in this market, and there is a lot to chew through in this area. At this point, I believe that the market probably finds buyers on a dip, as the market has been so resilient over the last couple of weeks, it’s very likely that we need some type of cooling off. At this point, I would look for value underneath as we probably need to build up momentum. If we break down below the 20 day EMA, which is green on the chart, then I think you need to start worrying.

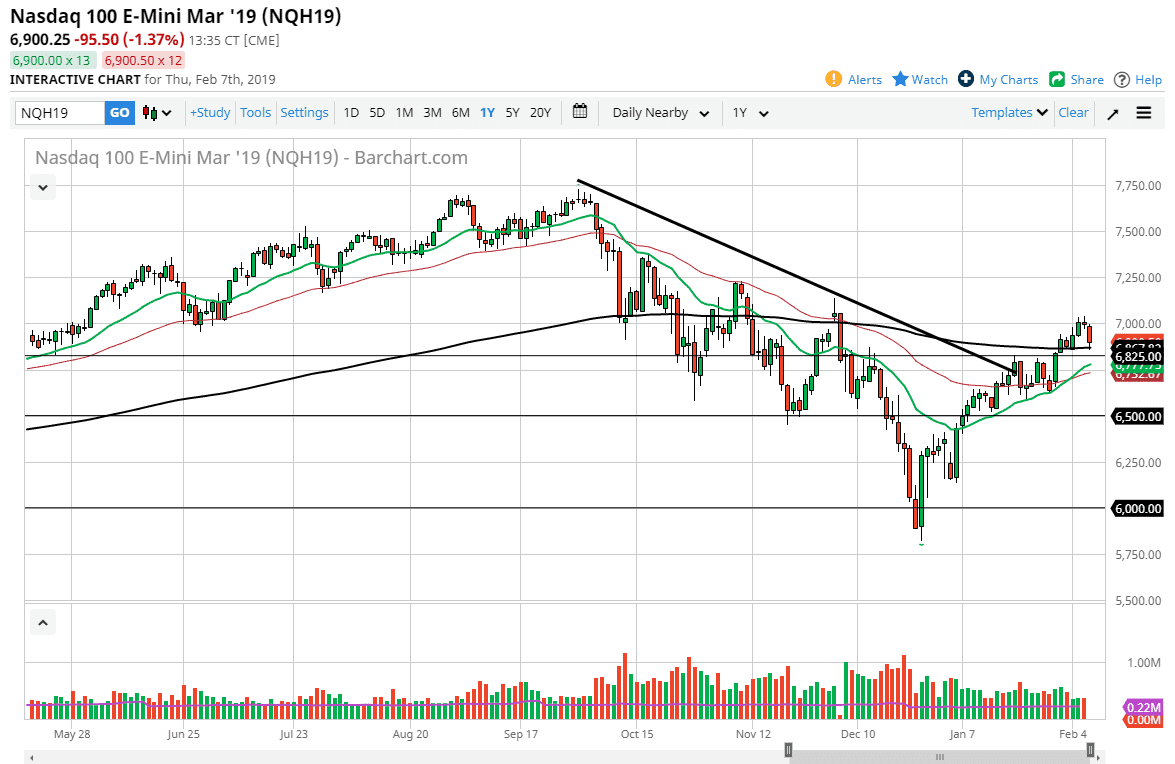

NASDAQ 100

The NASDAQ 100 fell significantly during the trading session as well, breaking below the 7000 level. The 200 day EMA did offer support, so it looks as if the market is trying to go higher and perhaps reach towards higher levels. The 20 day EMA is currently just below the 2800 level, and then I think we are probably going to see market participants try to push this market higher. Remember that this is highly sensitive to Asia as well, and of course with a lack of news coming out of China this week, it gives us a bit of a reprieve. We are approaching significant resistance in the form of the 7000 handle, but as long as we can stay in this general vicinity, I think we are simply trying to grind time away before we break out to the upside.