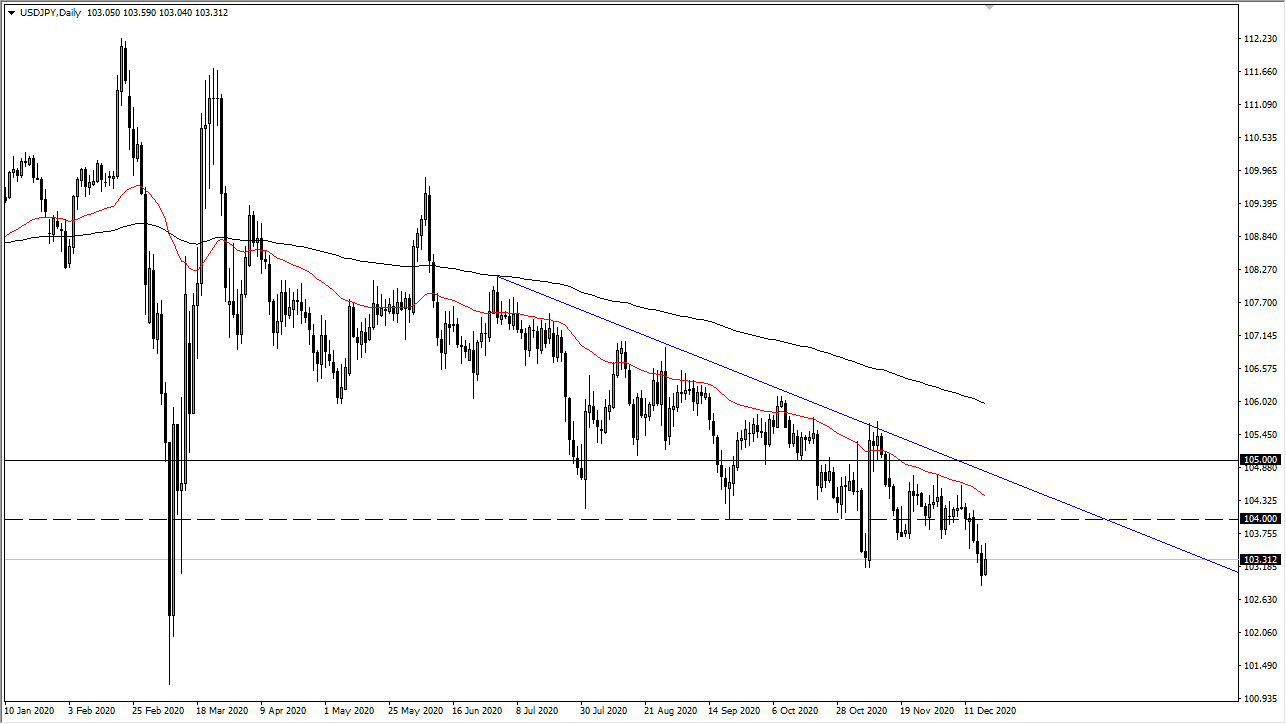

USD/JPY

The US dollar rallied a bit during the trading session on Monday, breaking above the 61.8% Fibonacci retracement level. This is an extraordinarily bullish candle, but there is a ton of resistance just above. I think at this point, it’s very tenuous as far as buying is concerned, and I think the 200 day EMA above is likely to offer resistance as well. Quite frankly, if I wish to short the Japanese yen, I will do it with other currencies that could move a bit quicker. As far as this market is concerned, I much more interested in shorting it if we can get below the ¥110 level. If we do go further to the upside, the 200 day EMA and then the ¥111.50 level will both cause quite a bit of resistance.

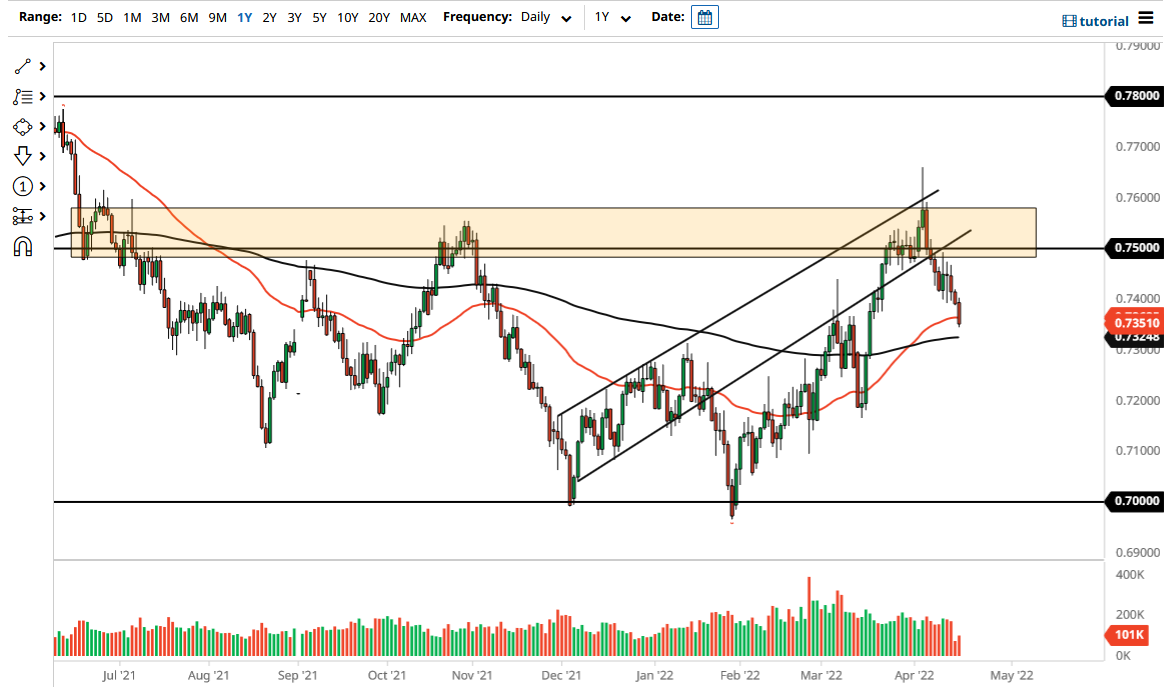

AUD/USD

The Australian dollar has initially tried to rally a bit during the trading session on Monday, but then turned around to break towards the 0.7050 level, which is the bottom of the Friday hammer. At this point, it’s going to be interesting to see what happens next, but I do think that there is plenty of support underneath that should continue to get plenty of attention in this area, especially near the 0.70 level after that. At this point, I believe that the market below the 0.70 level is support all the way down to at least the 0.68 level. That is massive support on the monthly charts.

Beyond that, I think that if we get any good news whatsoever out of the US/China trade relations, that will send the Australian dollar much higher as it is a proxy for the Chinese economy and all things China related. Overall, it’s likely that we will probably continue to see a lot of volatility but I think it’s only a matter time before the buyers return.