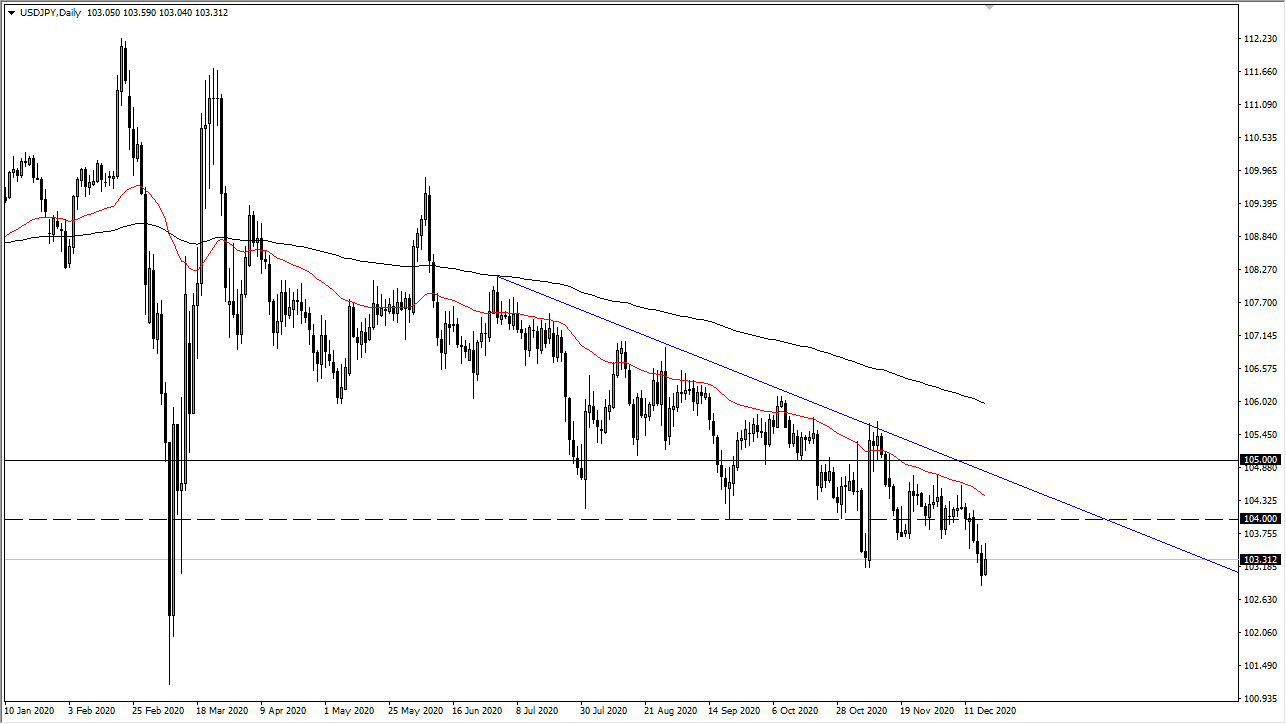

USD/JPY

The US dollar went back and forth during the trading session on Friday, as we see a lot of resistance at the 200 day EMA. The market has done very little during the week, and quite frankly the 61.8% Fibonacci retracement level is attracting a lot of attention as well. This is a market that is going to be a bit jittery, but I do think that there is enough resistance above that at the very least a pullback makes sense. Beyond that, the Federal Reserve is very soft so that should continue to weigh upon the greenback. Just above the 200 day EMA we also have a resistance barrier near ¥112, so I think there is more likelihood of falling than anything else.

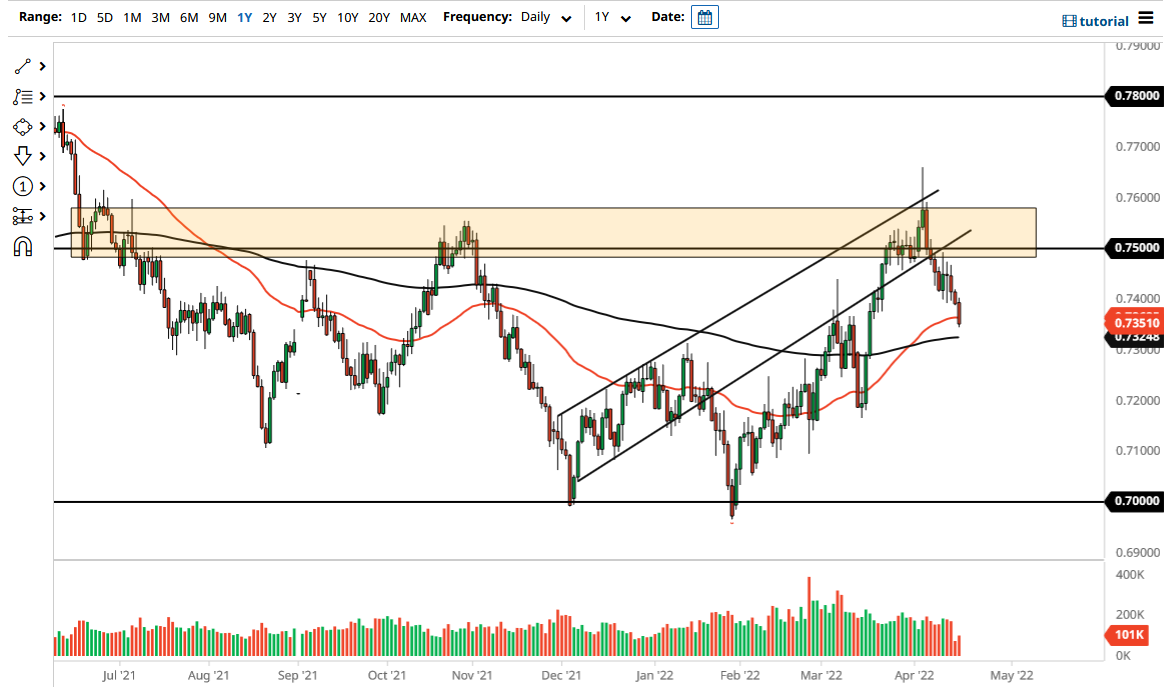

AUD/USD

The Australian dollar has rallied a bit during the trading session again on Friday, bouncing from the 0.7050 level, an area that has been rather supportive. Overall, I think support extends all the way down to the 0.68 handle on the monthly chart, so it’s going to be very difficult to short this market, and if we can get some type of good resolution to the US/China trade talks, that might be all that is needed to turn this entire trend around. In fact, that’s essentially what I think we are seeing here: an attempt to reverse the longer-term trend. This is almost always a messy affair so it would jive well with what we’ve seen lately. I like buying dips, with an eye on the 0.7250 level above as a major barrier to overcome.

If we can break above that level, then it’s likely that we go to the 0.75 handle, and then perhaps even higher than that. I like the idea of breaking out eventually, but in the meantime I keep buying dips and picking up little pieces of profit here and there.