USD/JPY

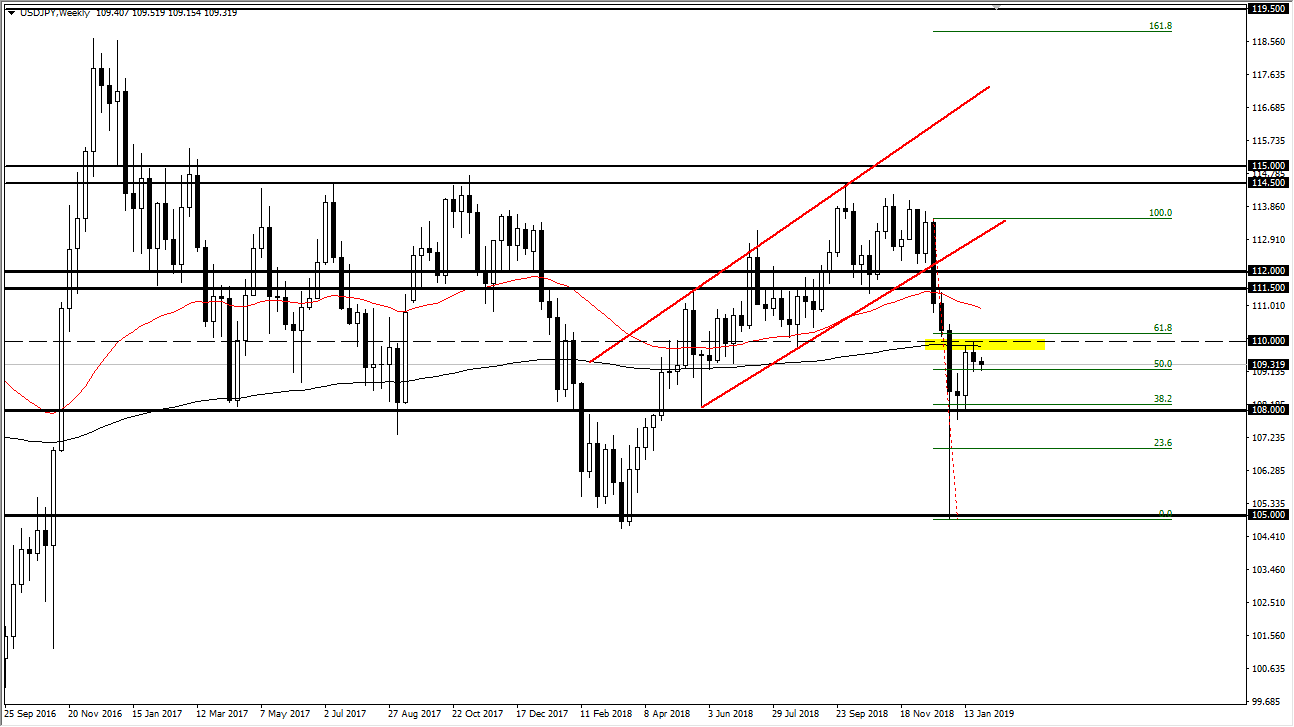

The US dollar has been rather noisy against the Japanese yen over the last several weeks, as we had plunged all the way down to the ¥105 level, before bouncing rather significantly in the “yen flash crash.” Looking at this chart, you can see that we turned around and broke all the way to the ¥110 level. That’s an area where we have the coinciding 61.8% Fibonacci retracement level as well, so I think that there is only a matter time before the sellers come back in and push this market lower. That being said, keep in mind that there are couple of different reasons why this market could go much lower, based upon the Federal Reserve and of course the potential risk events that could be out there.

All things being equal, it does look as if the Federal Reserve is looking to soften its stance a bit. That should drive down the value of the US dollar against many different currencies, but at the same time the Japanese yen is a safety currency so if we have some type of concern out there, and let’s face it - we quite often do - the trading community will run to Japan. With that being the case, and the fact that the 61.8% Fibonacci retracement level has just been tested and pushed market back lower, I do think that we continue to go much lower, perhaps down to the ¥108 level. If we break that level, then we probably go down to the ¥105 level. Ultimately, this is a market that has seen a lot of technical damage as of late, and that technical damage certainly will be remembered by traders. Because of this, I still believe that the path of least resistance is lower.