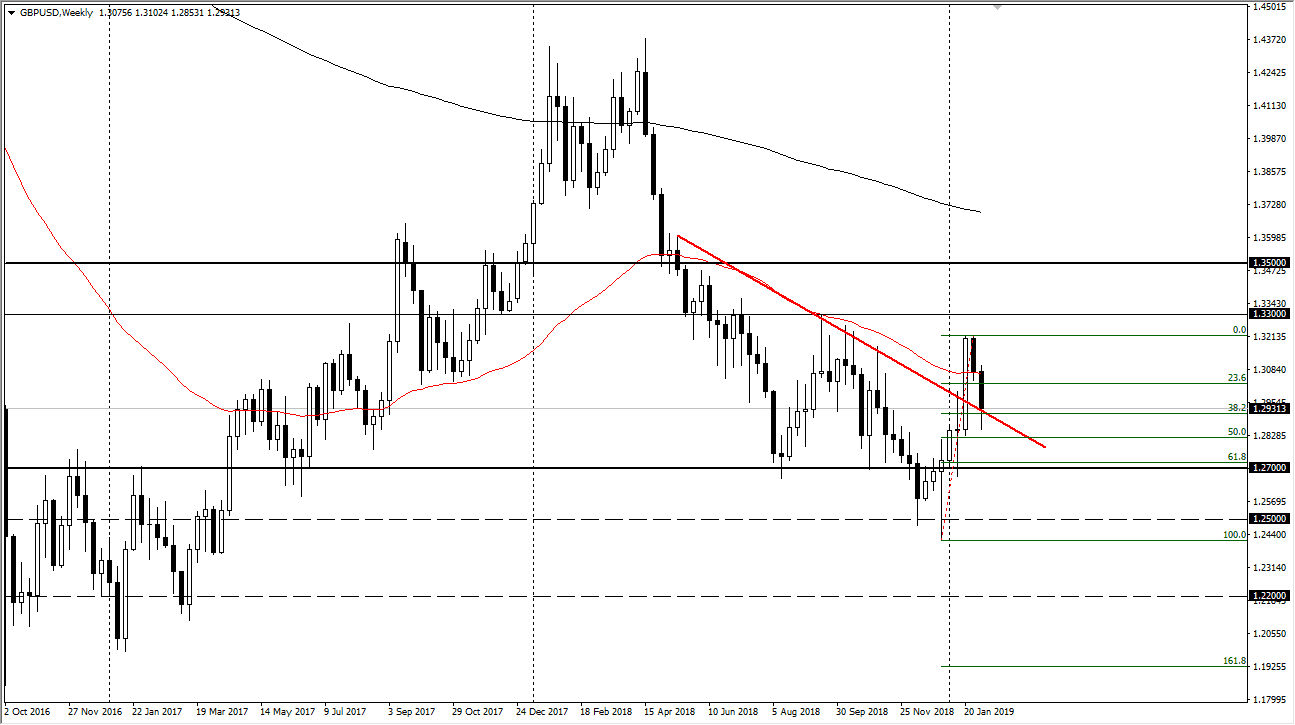

GBP/USD

The British pound fell rather hard during the week, but on Thursday ended up forming a nice hammer on the preceding downtrend line and the 38.2% Fibonacci retracement level. On Friday, we went somewhat sideways and it now looks as if the market is trying to respect this downtrend line. I think a bounce is likely, as the British pound continues to deal with the Brexit. I don’t think it’s going to be easy, but I’m not surprised at all if we see the British pound reached towards the 1.31 level during the week.

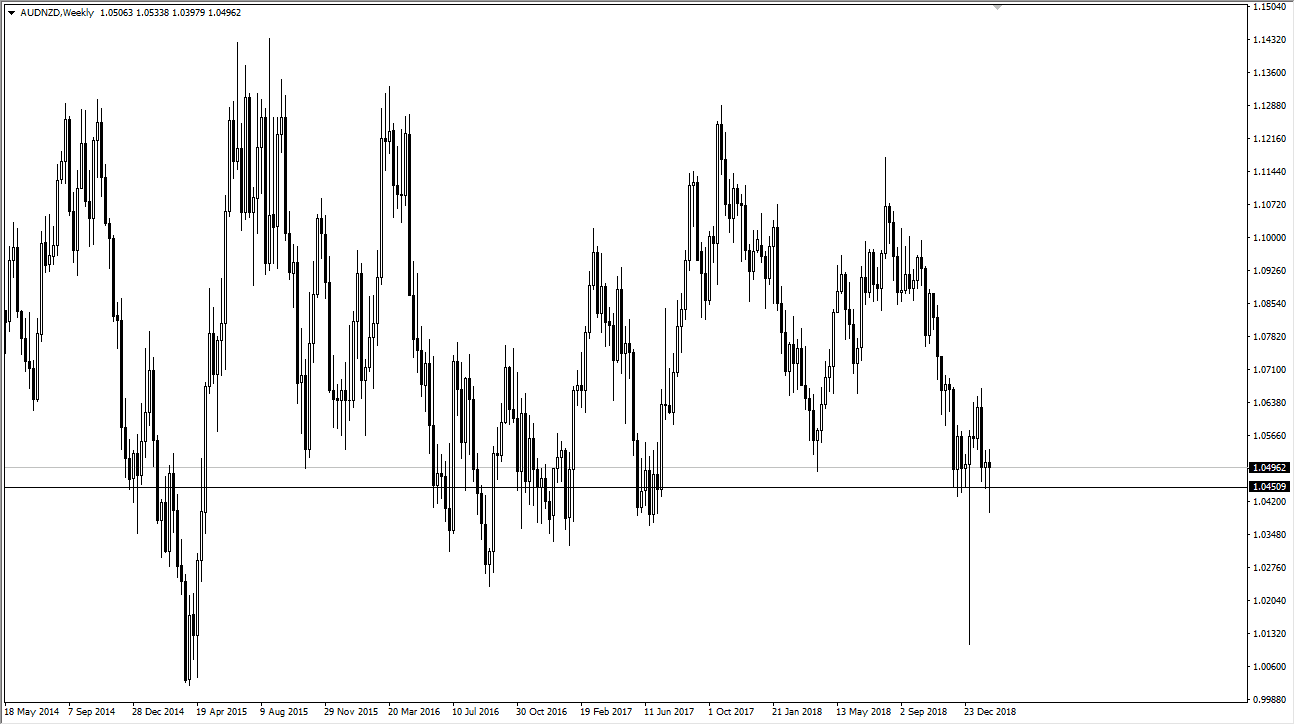

AUD/NZD

The Australian dollar fell against the New Zealand dollar during the week, reaching below the 1.0450 level. However, the reason I bring up this chart is because it shows just how much strength is building up underneath the Aussie. Because of this, I fully anticipate to see this market rally from here and go looking towards the 106.50 level. Beyond that, I believe that the Australian dollar is going to have a good week, and if you keep an eye on this chart, even if you don’t trade this pair you can figure out when it’s time to buy the Aussie.

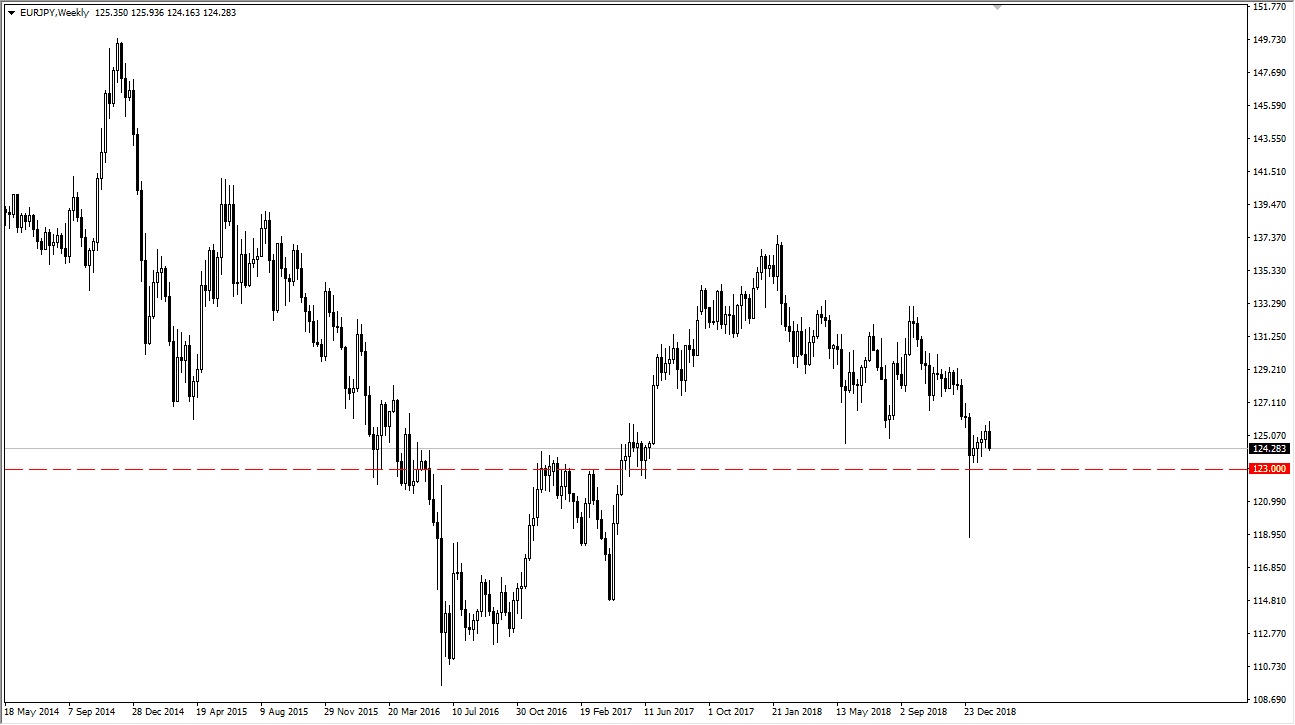

EUR/JPY

The Euro initially tried to rally during the week but turned around to dig into previous supportive action. The 123 young level should offer support though, and it should be pointed out that the EUR/USD pair is heading towards the support level as well. Because of this, I think it’s only a matter time before the buyers come back in. Look for a supportive bounce or candle to perhaps pick up a bit of value.

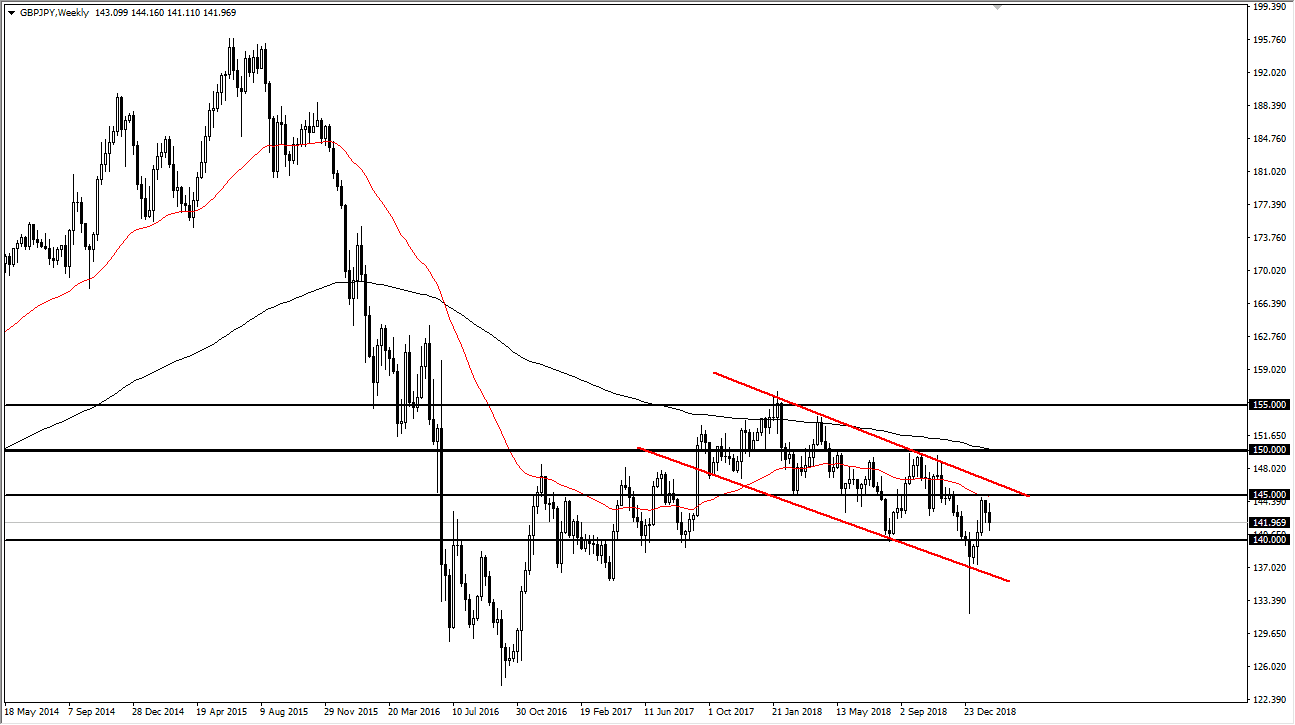

GBP/JPY

The British pound has been slightly negative against the Japanese yen during the week, but I think there is plenty of support underneath. If we can break out in the GBP/USD pair, that should send this market looking towards the ¥145 region. Otherwise, I think that the ¥140 level underneath should offer support if we do pull back.