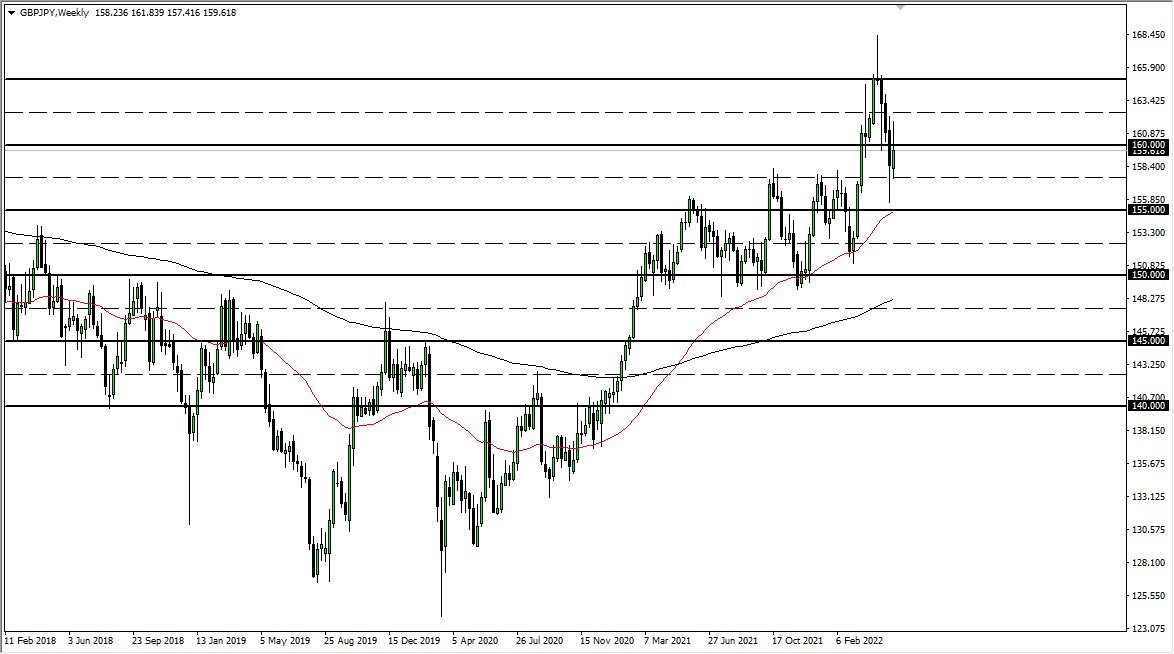

GBP/JPY

The British pound went back and forth against the Japanese yen during the bulk of the week, but Friday saw a lot of buying pressure. We are seeing the British pound pick up a bit of momentum against many other currencies, so I think at this point it’s very likely that pullbacks will continue to be bought, especially if there is more of a “risk on” attitude around the world. I believe that the ¥140 level underneath continues offer significant support as well.

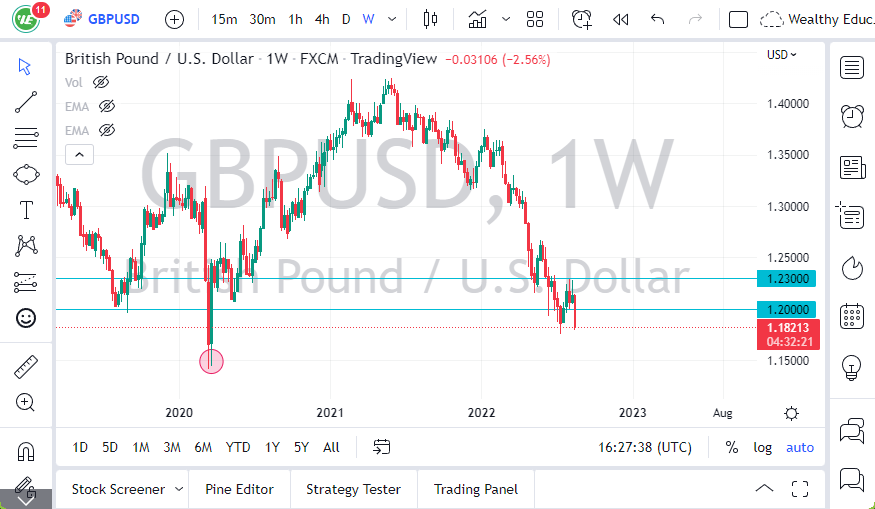

GBP/USD

The British pound fell during most of the week, but Friday was such an explosive move to the upside it looks very likely that we are going to continue to find buyers underneath as we have formed a nice-looking hammer based upon the 50% Fibonacci retracement level in the previous downtrend line. With that being the case, I think that buyers will continue to flock to the British pound on pullbacks as it is extraordinarily undervalued.

EUR/USD

The Euro fell rather hard during most of the week, but then recovered to reach towards the 1.13 level. That is a hammer now being formed and that, of course, is a very bullish sign. I think that the market continues to rally from here, but we may get the occasional pullback. The pullback should end up being nice buying opportunities as we are at a major support level in this market, and an area that I think is the bottom of the overall consolidation that reach towards the 1.15 handle.

USD/CAD

The US dollar went back and forth during the week, using the 1.3250 level as a bit of a pivot. At this point, I think the market is trying to figure out where to go next, but after the explosive move by the US dollar during the previous week, I favor the upside but only if we can break above the candle stick for this past week.