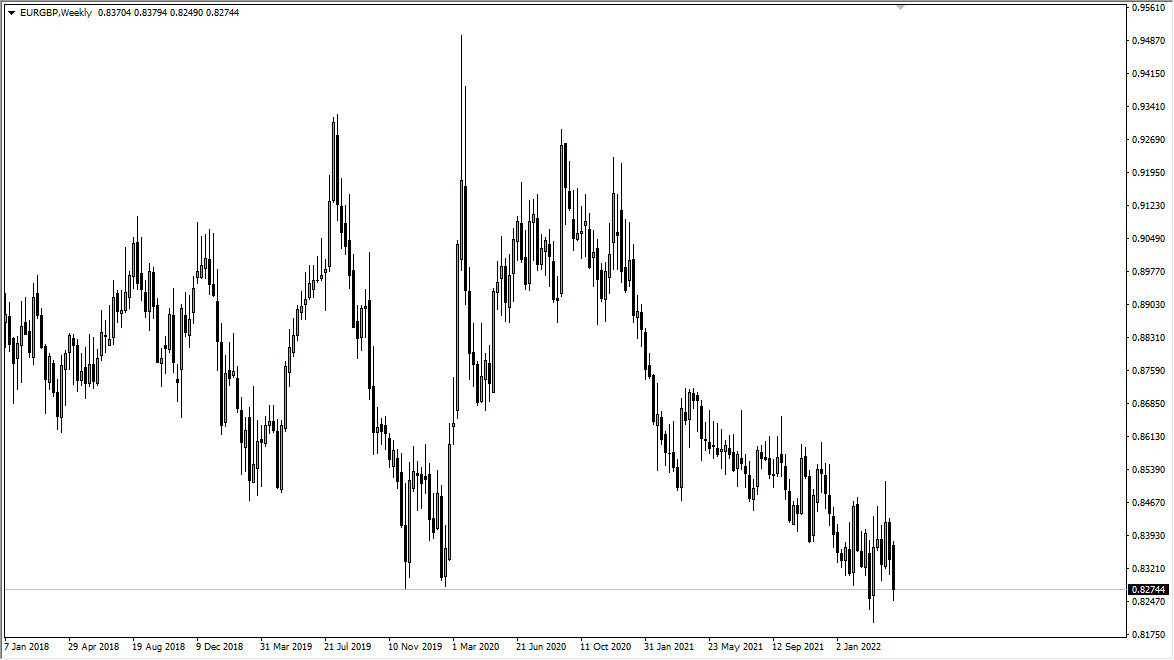

EUR/GBP

The Euro fell a bit during the week, slamming into the 0.8650 level which has been supportive more than once. At this point, this is a level that’s crucial to pay attention to. If we break down below there, then I think the Euro continues to fall as low as 0.83 over the next several weeks. Otherwise, if we get a bit of a bounce from here, we could rally as high as 0.88 over the course of the next several days.

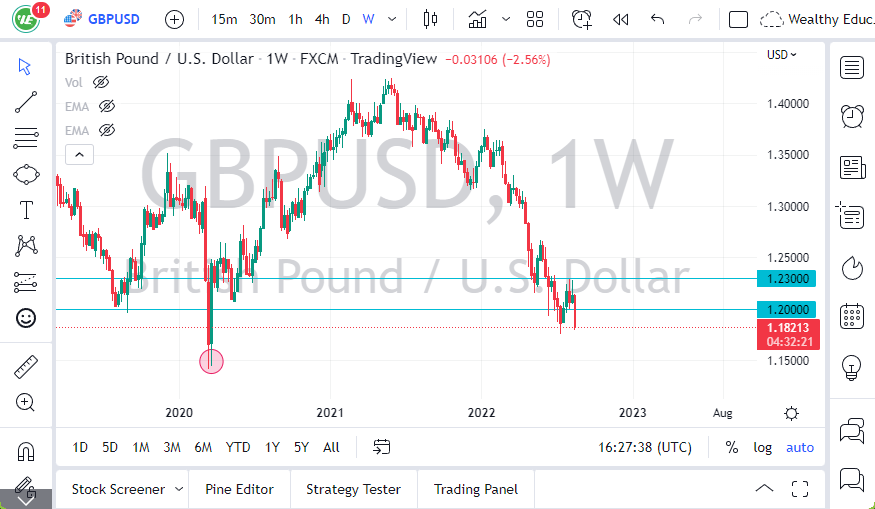

GBP/USD

The British pound has rallied during the course of the week, and even recovered nicely from a drop on Friday. At this point, I think that you should continue to look at this market is one that you pick up on dips, as it offers value. However, on the weekly chart you can see that I have both a support and resistance area marked in yellow, I think it’s going to take a lot of momentum to finally break out to the upside. Looking at this market, it is a longer-term range bound with an upward attitude, so I do like the idea of picking up value.

AUD/USD

Looking at the Australian dollar, we continue to chop around and I think that this market will continue to react to the US/China trade relations more than anything else. We are sitting above massive support extending down to the 0.68 handle, so at this point I think that the buyers will continue to pick up this market on dips as it offers longer-term value. The massive support underneath can be seen on the monthly chart as well, so that obviously is something worth paying attention to.

EUR/USD

The Euro continues to find support below at the 1.1250 level, and I think at this point it’s much like the Australian dollar in the sense that we are showing signs of support, and that support is massive. I think we continue to grind in an overall consolidation area extending to the 1.15 level that I like buying dips going forward.