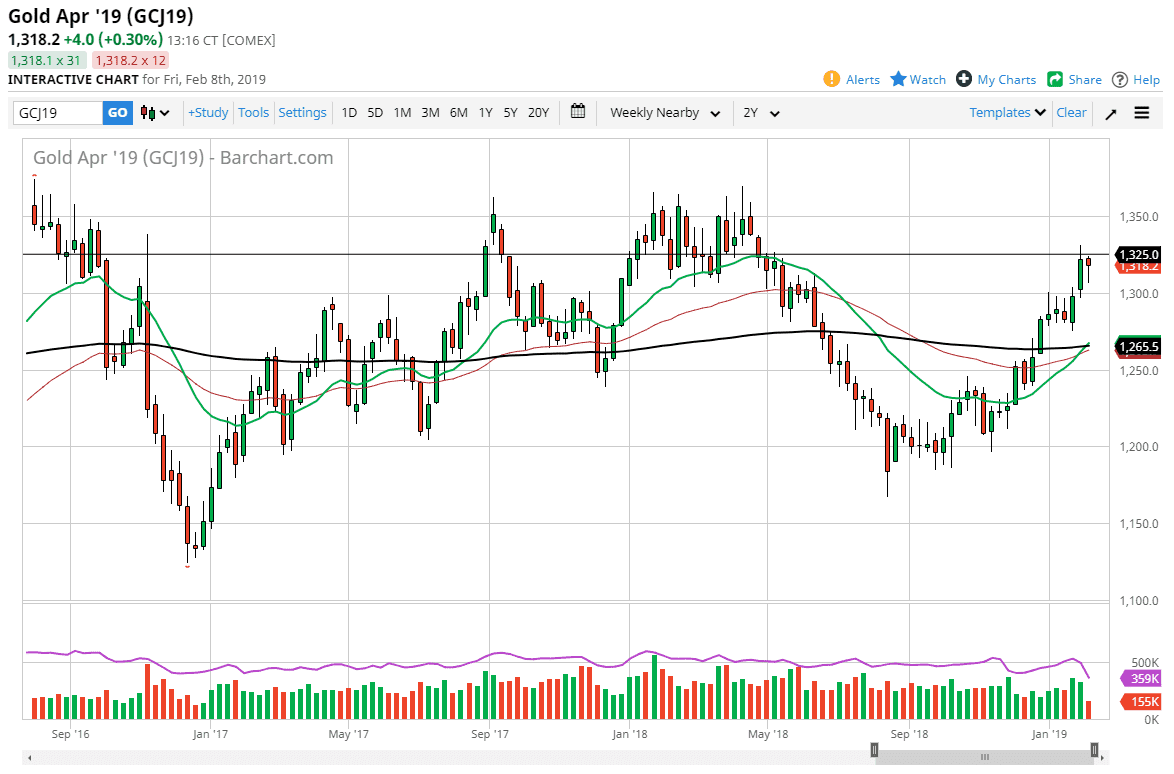

Gold markets initially pulled back during the week but found enough support near the $1305 level during the day on Thursday to turn things right back around and show signs of strength. On the daily chart, we have a massive hammer from the Thursday session that is offering support, and Friday saw more of the same. However, I also recognize that there is a lot of noise above so I think we are about to enter a very choppy phase of the move.

The fundamental factors that back the rising of gold include the Federal Reserve softening its stance, which of course puts bearish pressure on the greenback. That on the other hand then it sends the precious metals markets higher. We also have a lot of geopolitical concerns out there, and I think that the next couple of weeks could be a bit rough on the US dollar, as the government seems just about certain to shut down again. I believe that the market will punish the US dollar because of this.

Gold also can rally due to the US/China trade relations, or perhaps I should say the lack of. Overall, I believe that the market continues to show a proclivity to go higher, and with the hammer forming for the week, I suppose that short-term pullbacks should be buying opportunities. However, if we break down below the $1300 level, then we could go a bit lower, perhaps down to the $1275 level underneath. If that gets broken, then I think that the Gold markets will fall much further. Breaking the $1300 in and of itself is more than likely going to be a negative sign because then the candlestick becomes a bit of a “hanging man.” However, I do think that the longer-term move is still to the upside.