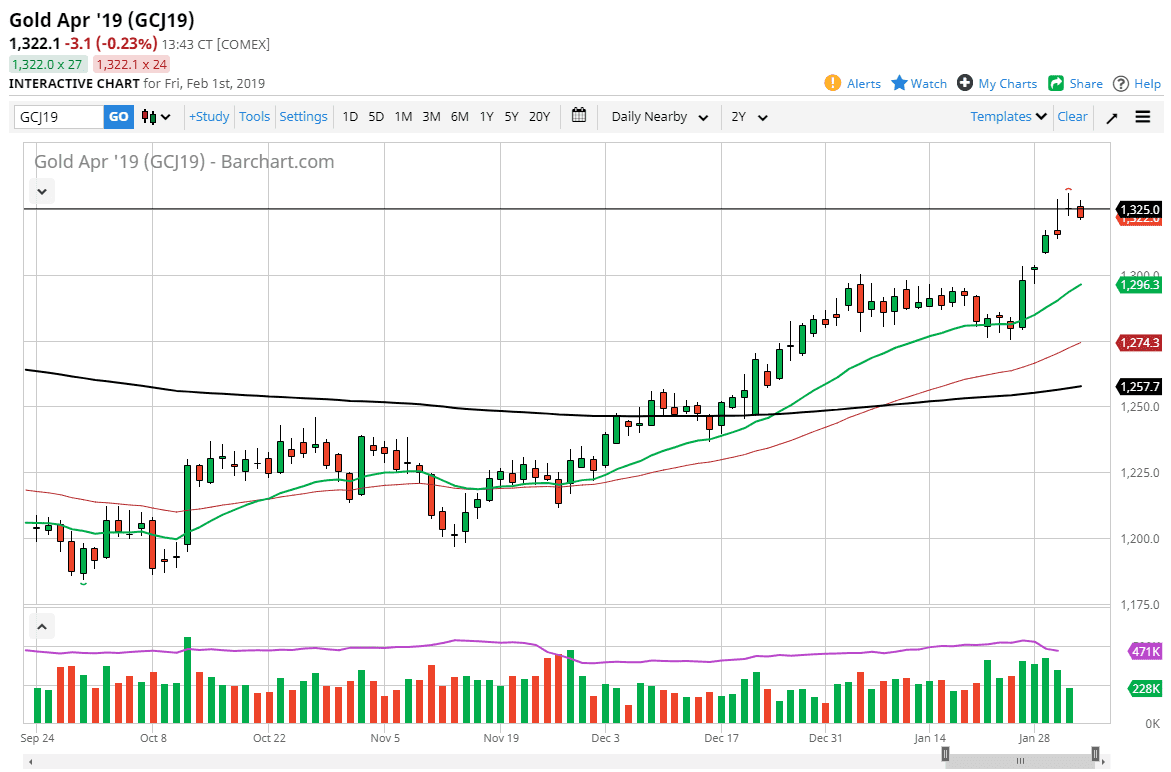

Gold markets pulled back a little bit during the trading session on Friday, as the $1325 level has caused too much resistance. We ended up forming a shooting star on both Wednesday and Thursday, so that of course is very bearish. It shows signs of exhaustion, and perhaps we had gotten a little too far ahead of ourselves. Overall, I think that the market needs to pullback but the trend is still most certainly to the upside. With that being said, I think that a retest of the $1300 level makes a lot of sense, as the 20 day EMA is sitting right there. Beyond that, the $1325 level has been important more than once in the past, so it makes sense that we had to stop. The US dollar has drifted a bit lower in general, so I think that should continue to propel gold to the upside but I’m not looking for a major move in the short term.

If we can break above the shooting star from the Thursday session, then I think that the market has a real opportunity to go looking towards the $1350 level, and then possibly even the $1400 level as it is the top of the longer-term consolidation area that has been so important in this market for so long. I think that the Gold markets will continue to be boosted by a softer Federal Reserve, and then perhaps geopolitical concerns as well. It seems like we can’t get a lot of good news on that front, as we have trouble in Syria, trouble with the US/Russian relations, trouble with the US/China relations, and then the possibility of another government shutdown in just a few weeks. Overall, there is a lot of tension and concern out there so gold should continue to attract a lot of interest.