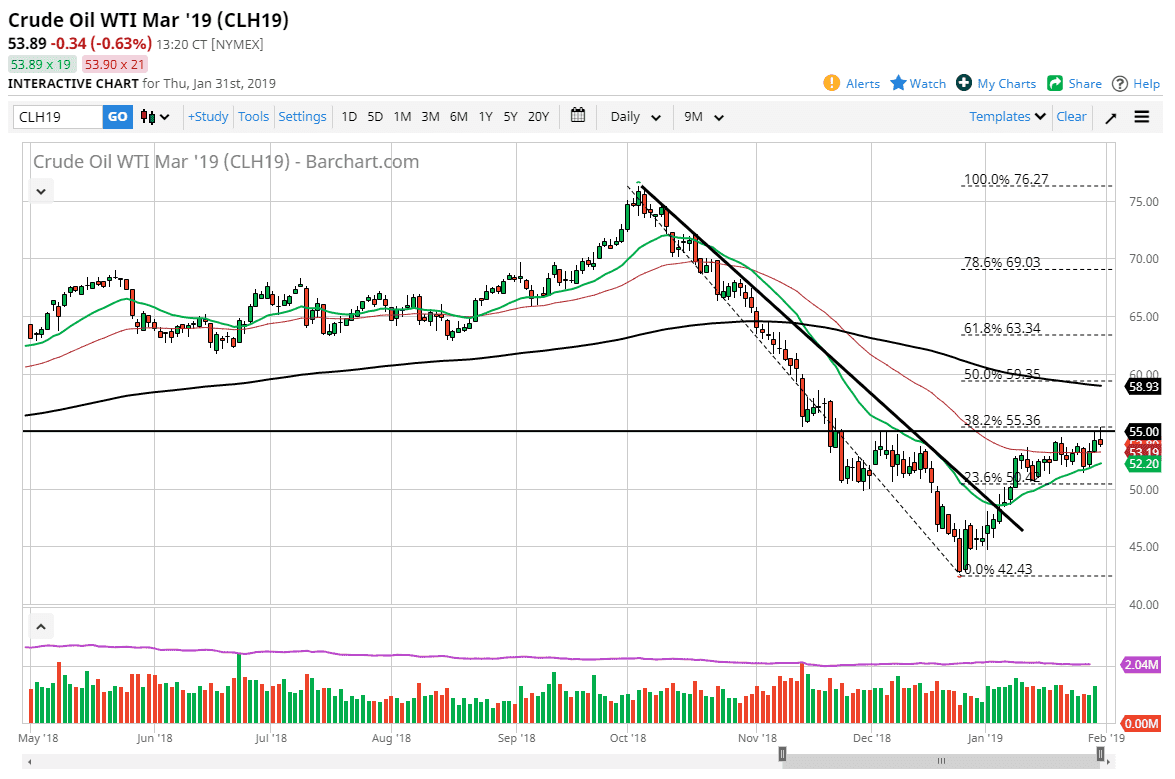

WTI Crude Oil

The WTI Crude Oil market rallied significantly during the trading session on Thursday but gave up a lot of momentum above the $55 level, as traders closed position that the jobs number. The fact that we could not close above there tells me that there is still plenty of resistance and that level, so if we are to turn around and break above the top of the daily range for the trading session on Thursday, that would be an extraordinarily strong sign. Otherwise, we are simply relegated to bouncing around between the $55 level on the top and the $52.50 level on the bottom. I think that we probably have a little bit of a pullback ahead of us, but I would not be surprised at all to see buyers come back into push it back towards the crucial $55 resistance level above.

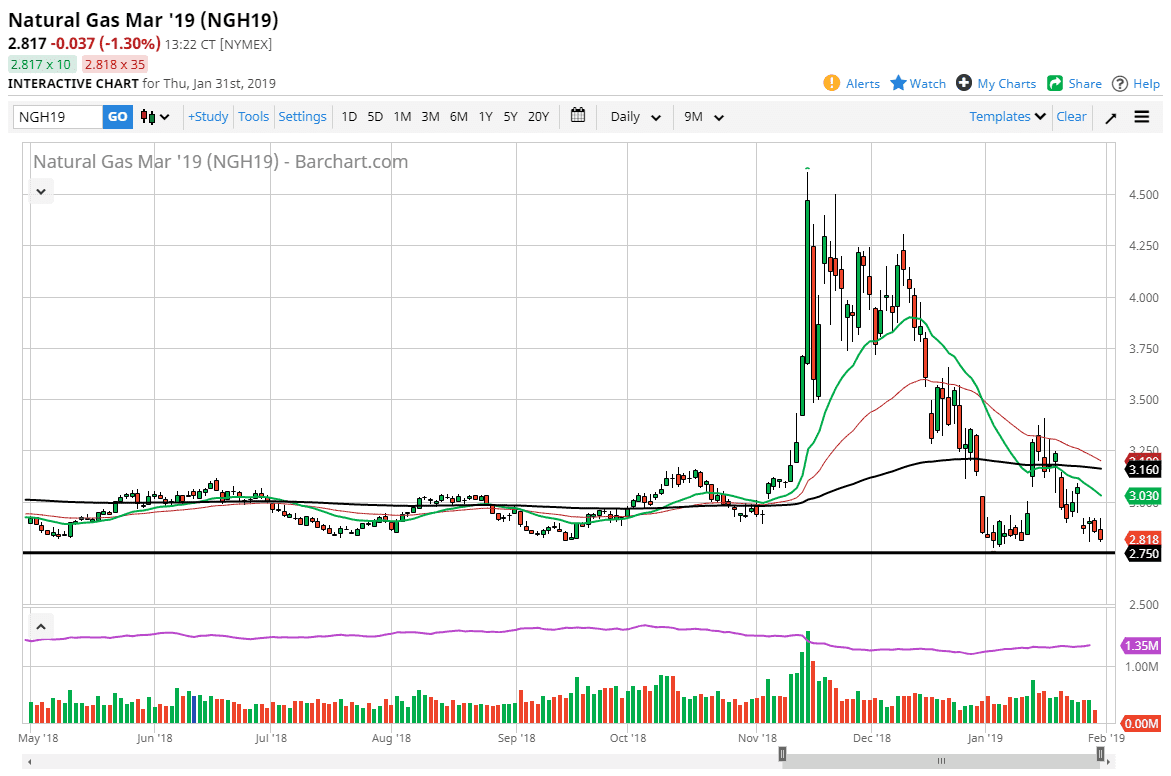

Natural Gas

Natural gas markets initially tried to rally during the trading session on Thursday but gave back quite a bit of the gains as even though we are in the middle of the major cold snap in the United States, we simply cannot take off to the upside. Rallies at this point are not to be trusted, and I think they offer plenty of selling opportunities above. The three dollars level of course is a large, round, psychologically significant figure, but I think we could even break above there and go looking towards the $3.15 level, maybe even the $3.25 level after that. Signs of exhaustion in the form of long wicks on the daily chart will be used to signal when it’s time to start shorting. Being patient is probably the best way to go when it comes to putting money to work.