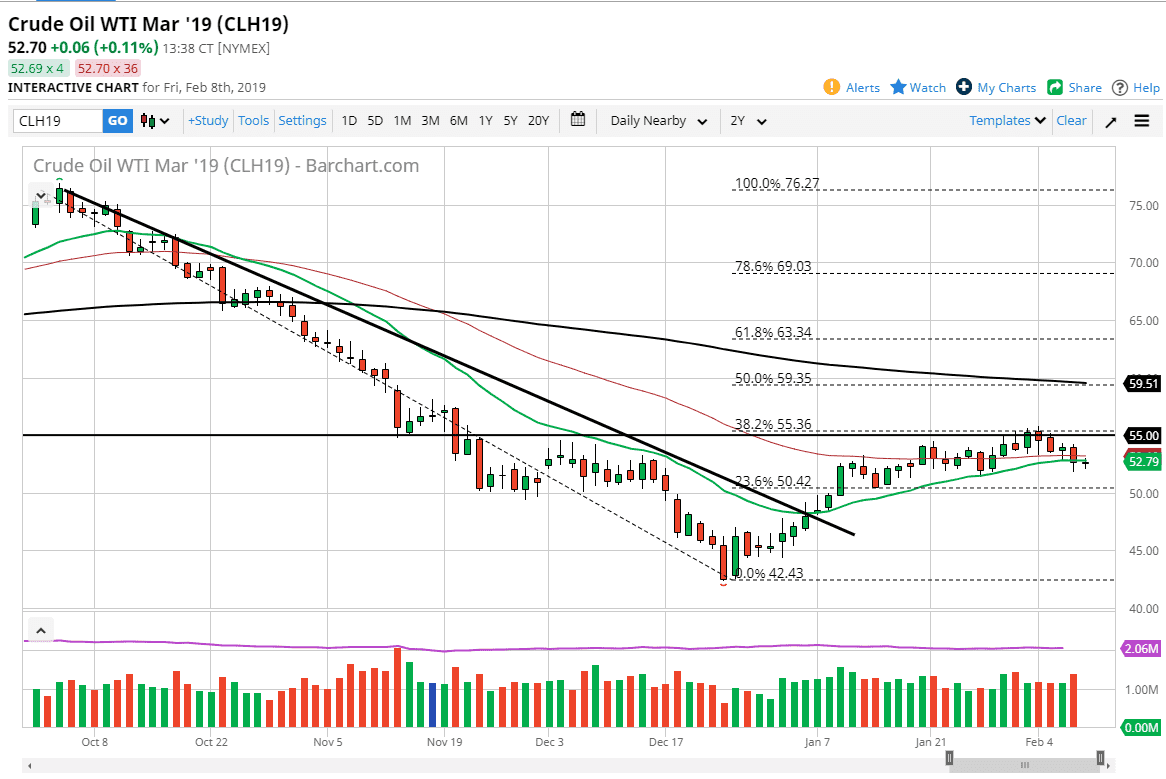

WTI Crude Oil

The WTI Crude Oil market did very little during trading on Friday as we continue to see a lot of consolidation. We have been hanging below a major resistance level, in the form of the $55 level and that continues to be the case. With this in mind, I think that the crude oil markets are gauging whether or not there’s going to be enough global demand to lift pricing. So far, it looks as if we are willing to tread water and kill time in this general vicinity. Because of this, I believe that the $50 level is going to be fairly significant support, but things don’t look as rosy as they once did. If we break down below there, then crude oil will continue to fall. Otherwise, on a supportive candle or a bounce just below, we will probably have another run towards the $55 level.

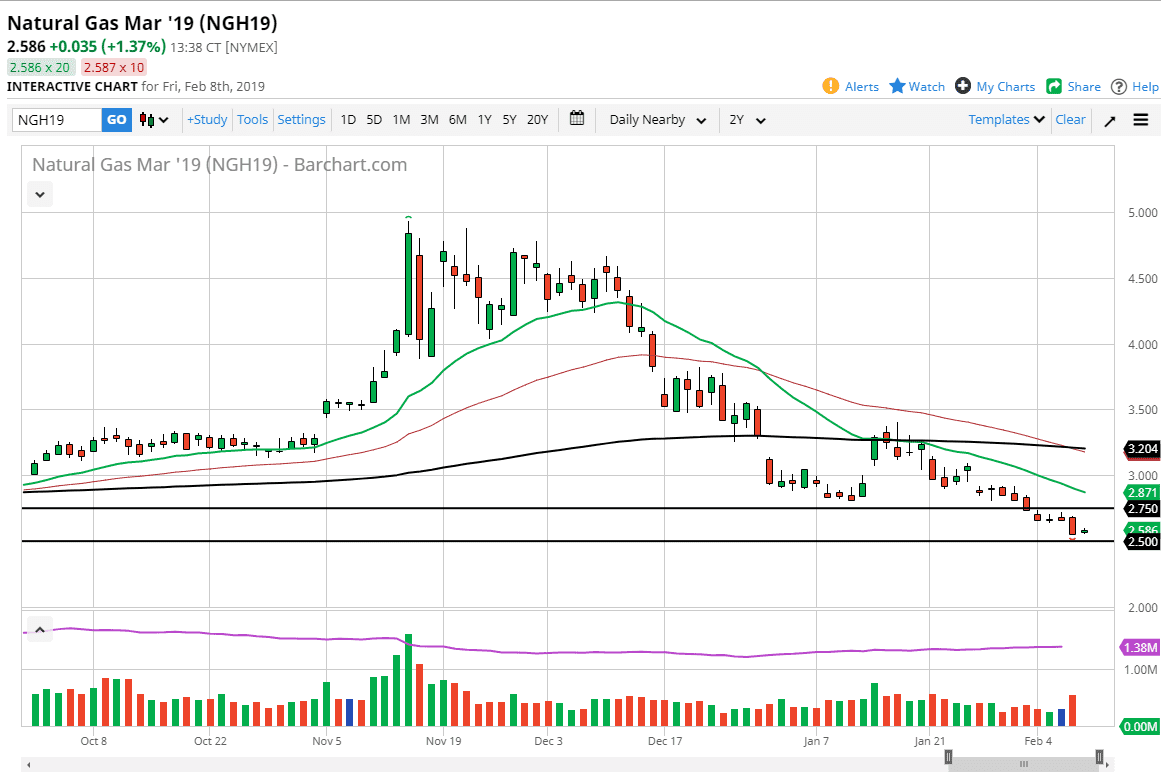

Natural Gas

Natural gas markets continue to be negative overall, but we did get a slightly positive candle stick for the trading session on Friday. Overall, we are getting so close to the massive support at the $2.50 level that I think a bounce is eminent. It’s difficult to sell this market at this extraordinarily low level, because it has been so supportive going back several years. I think a bounce should be a nice selling opportunity, as we have such a bearish trend. I believe that the 20 day EMA near the $2.87 level should be an area where sellers will probably come back in. If we break above there, then I believe that the $3.00 level is also resistance as well. Sometimes we have to wait for the market to give us an opportunity to trade, this is one of those times.