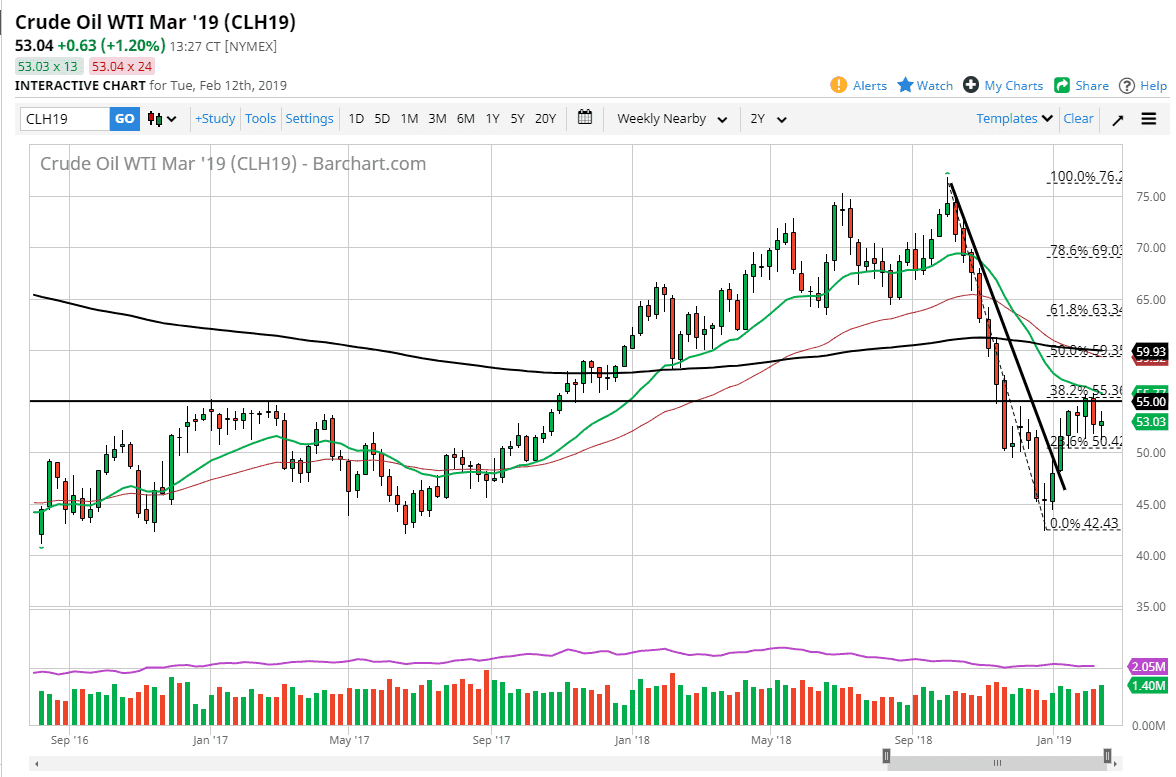

WTI Crude Oil

The WTI Crude Oil market went back and forth during trading on Tuesday, as the market continues to consolidate in the same general vicinity it has been in for several days. I look at the 50 days level underneath as massive support, just as the $55 level above has been offering significant resistance. If we can break out of this five dollar range, we can either be buyers or sellers depending on the direction. At this point, I believe that until then you need to be looking at something akin to 15 minute chart.

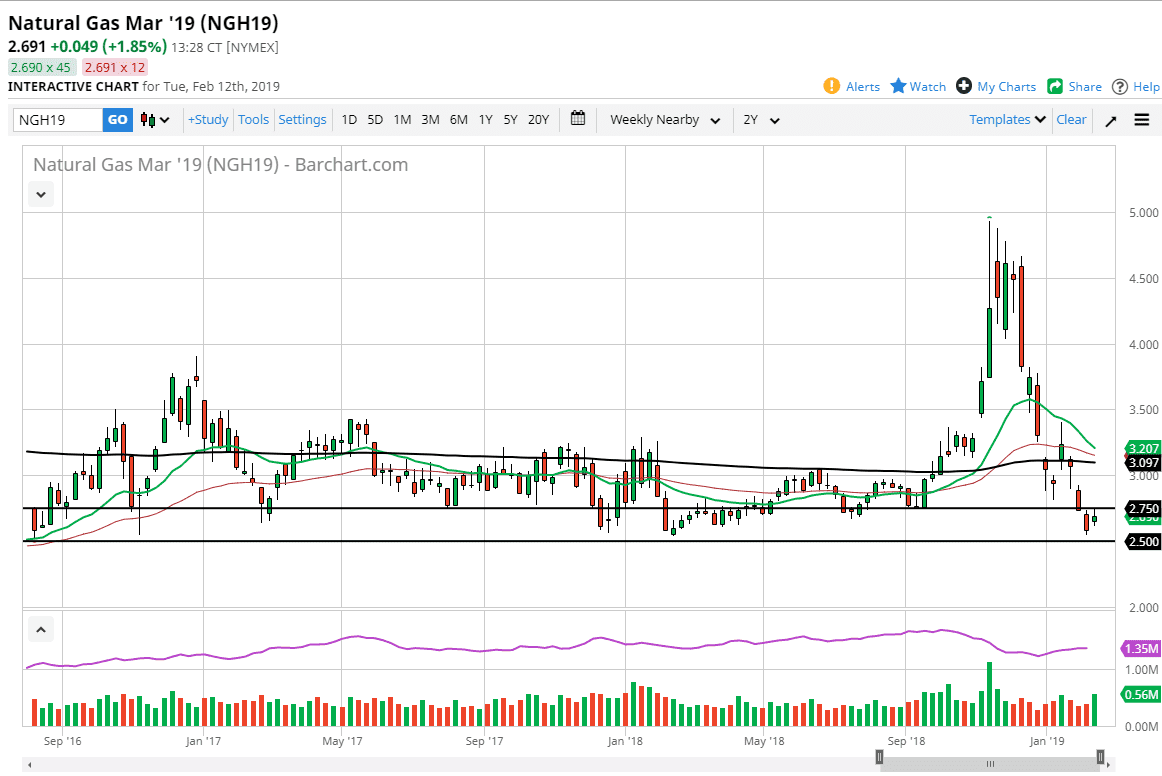

Natural Gas

Natural gas markets rallied initially during the day, gapping higher on Tuesday. However, the $2.75 level continues to offer a lot of resistance. As we reached towards that level, we pulled back to show signs of exhaustion. By doing so, it’s very likely that the market will continue to reach down towards the $2.50 level. That’s an area that is massive support on longer-term charts, so I think at this point it’s very likely that buyers will continue to be repudiated above, and I think that we need some type of relief rally to take advantage of it over extension in a market that is decidedly bearish. I believe that the $3.00 level above will be massive resistance and I would be very interested in shorting there. I would not be a seller down here.