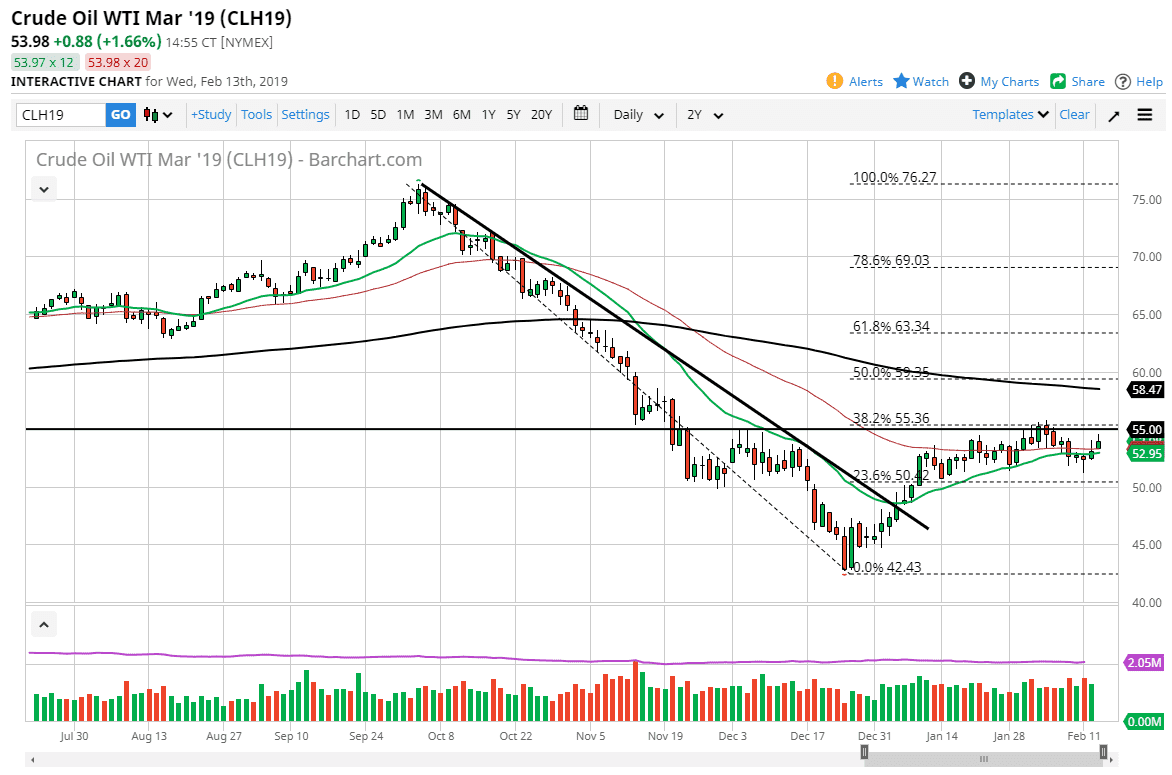

WTI Crude Oil

The WTI Crude Oil market rallied a bit during the trading session on Wednesday, but we continue to struggle with the idea of breaking above the $55 level. This is probably one of the most obvious resistance areas that I cover in any market, so I do think that if we can finally break above this level with any type of momentum, this could be a massive move higher. Based upon the inverse head and shoulders, we could be talking about a move to the $67.50 if the measurement pans out. I’m not ready to make that trade yet, but I do recognize that short-term pullbacks continue to be bought. The $50 level underneath is massive support, and it certainly favors the buying of dips at this point. Ultimately, this is a market that is trying to build up momentum for a bigger move.

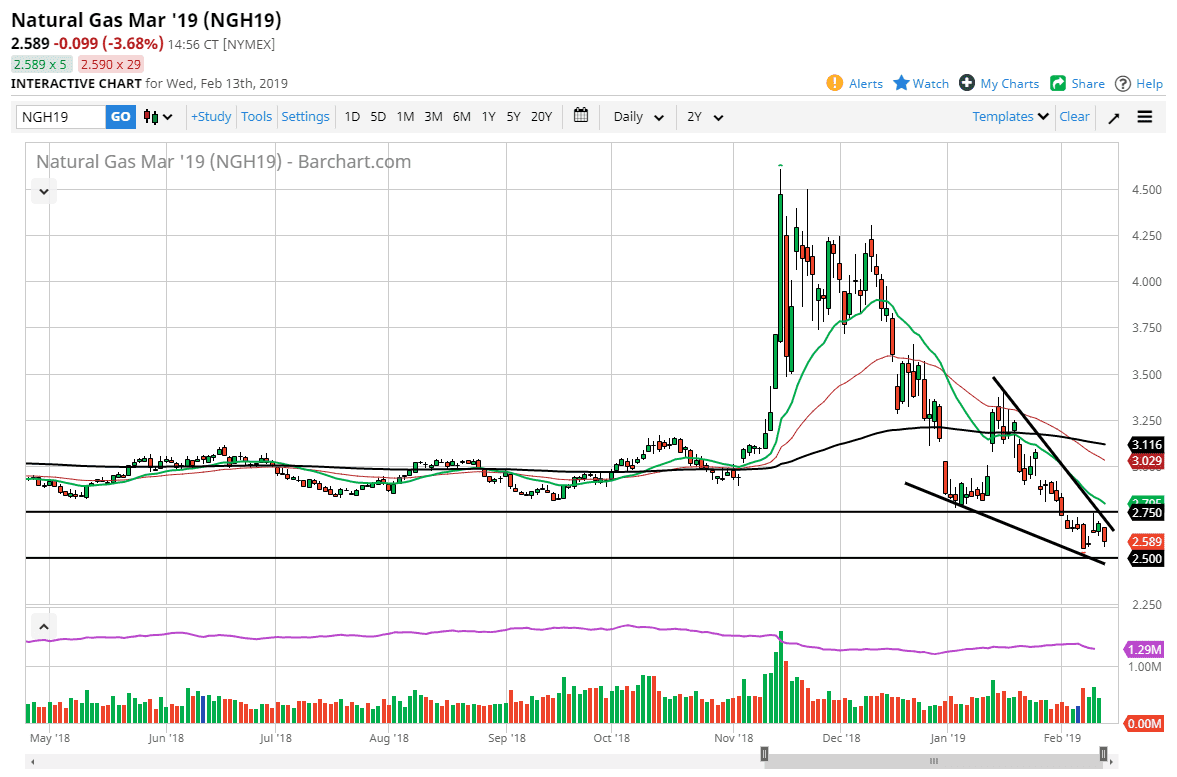

Natural Gas

Natural gas markets fell during the trading session again, but at this point I’m starting to see a potential “falling wedge.” That of course is a bullish pattern, but at this point I would not be looking to buy this market under any circumstances. I want to see this market rally so I can simply sell it later. I think we could get a massive short covering rally rather soon, but I also recognize that a move below the $2.50 level would be extraordinarily negative. Ultimately, I believe that the biggest question that we have right now is whether or not there’s going to be demand for natural gas as we head into the spring months, and of course have to worry about global demand due to global growth slowing down.