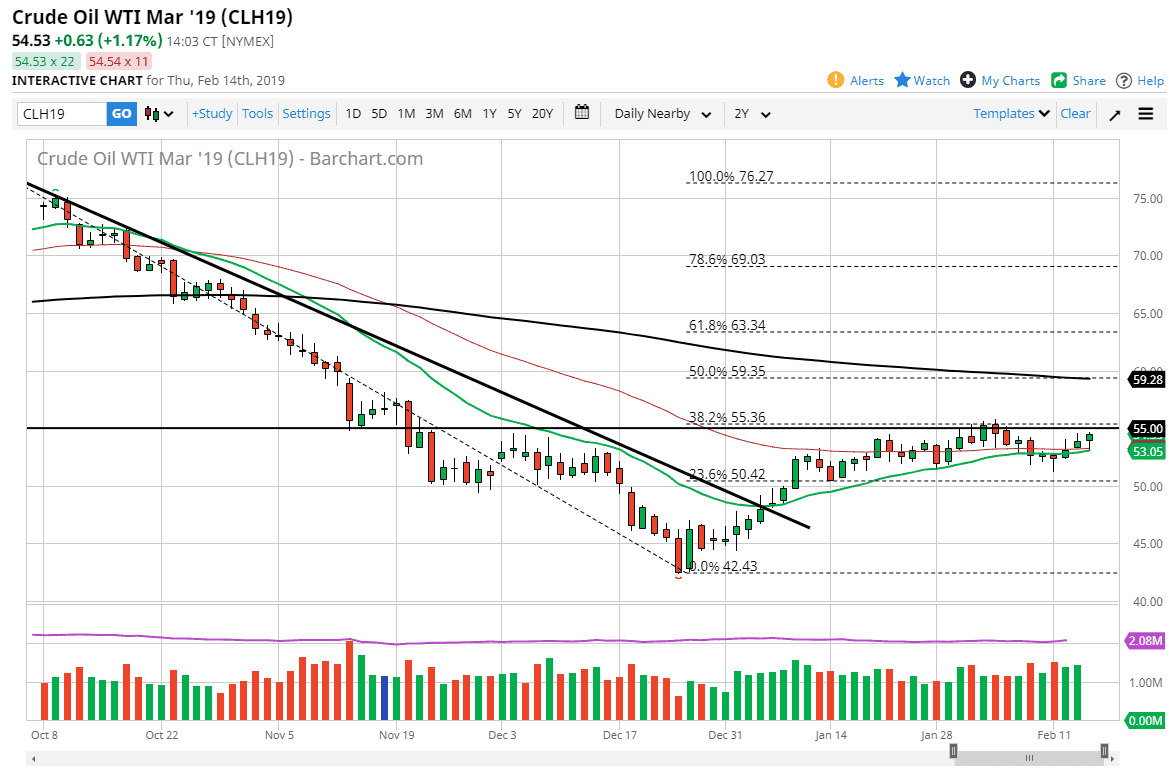

WTI Crude Oil

The WTI Crude Oil market initially pulled back during the day on Thursday but found enough support near the $53 level to turn around and form a bit of a hammer. That isn’t necessarily the all clear signal though, because we have so much in the way of resistance above. At this point, I think it was a reaction to the technical consolidation that we have been in. It’s worth noting that both the 20 and the 50 day EMA indicators are just below, and it looks like we are trying to push to the upside. If we can finally clear the $55 level with significant on a daily close, that would be your signal to go long. Until then, I anticipate that we will simply meander back and forth in this relatively tight range.

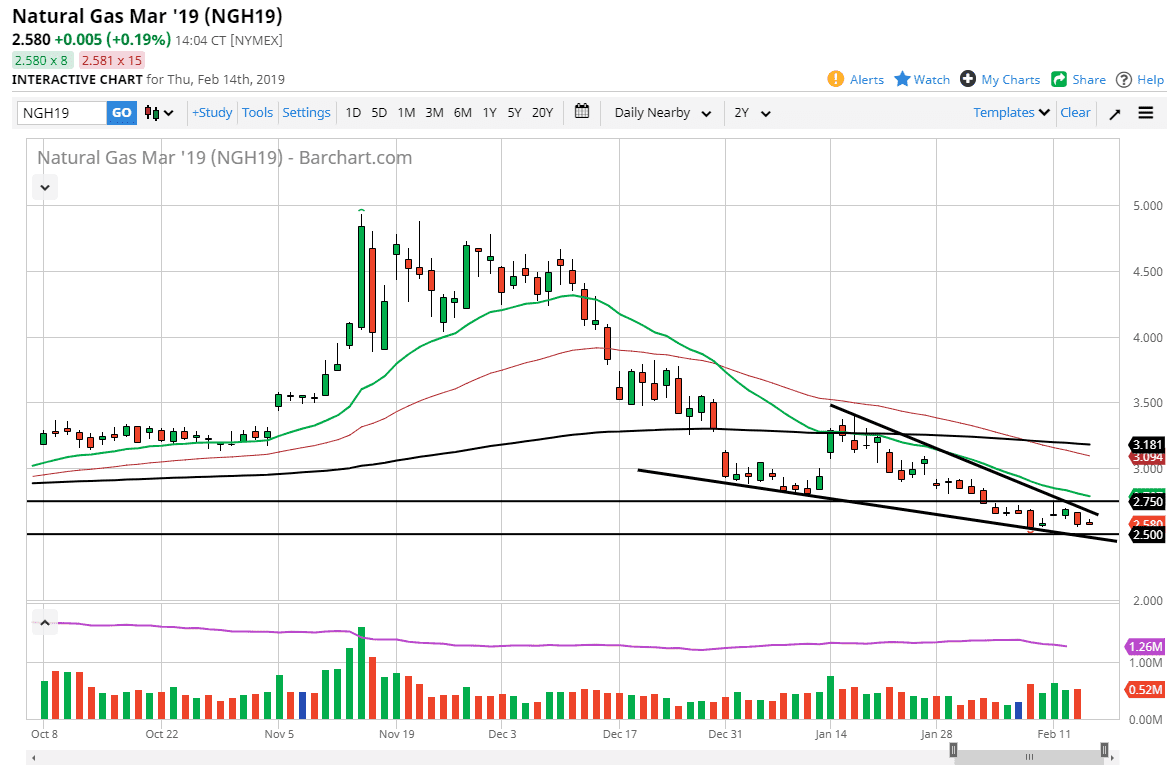

Natural Gas

Natural gas markets have basically stopped going anywhere. Where the bottom of a rising wedge and supported by the massive $2.50 level which going back on a continuous contract for years has been important. I think we are likely to see a break out to the upside given enough time, but I’m not willing to put money into the market in that direction. I believe that the break out should offer nice selling opportunity above, so look for signs of exhaustion after a breakout, especially if it is close to the $3.00 level, which of course will bring in a certain amount of psychological importance as well as the retest of a gap from January 28. If we do break down below the $2.50 level, we will probably go looking towards the $2.00 level next. I’m a seller though and am looking for opportunities to do so from higher levels.