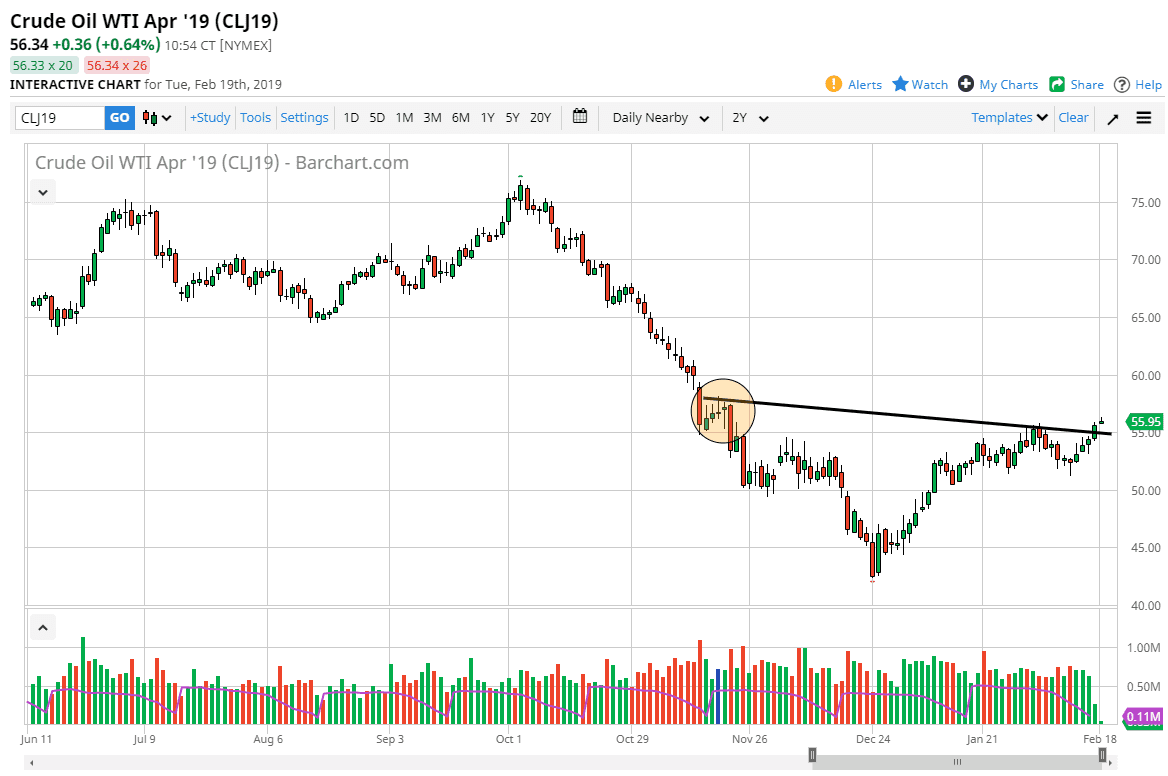

WTI Crude Oil

The WTI Crude Oil market rallied slightly during the trading session on Monday, as we continue to see strength in crude oil overall. However, we are approaching an area that could cause a bit of trouble, as there was a cluster of selling and buying in this area in the past that was rather significant. I believe that there is a lot of noise between here and the $60 level, but it does look like we are trying to go higher. Pulling back from here should be a buying opportunity, if we can continue to see support near the $55 level. The line that I have drawn on the chart could be thought of as a neck line for the inverted head and shoulders that has potentially found its way on the chart. Nonetheless, I do think that with the Saudi government cutting back on production, crude oil will probably continue to find buyers on dips.

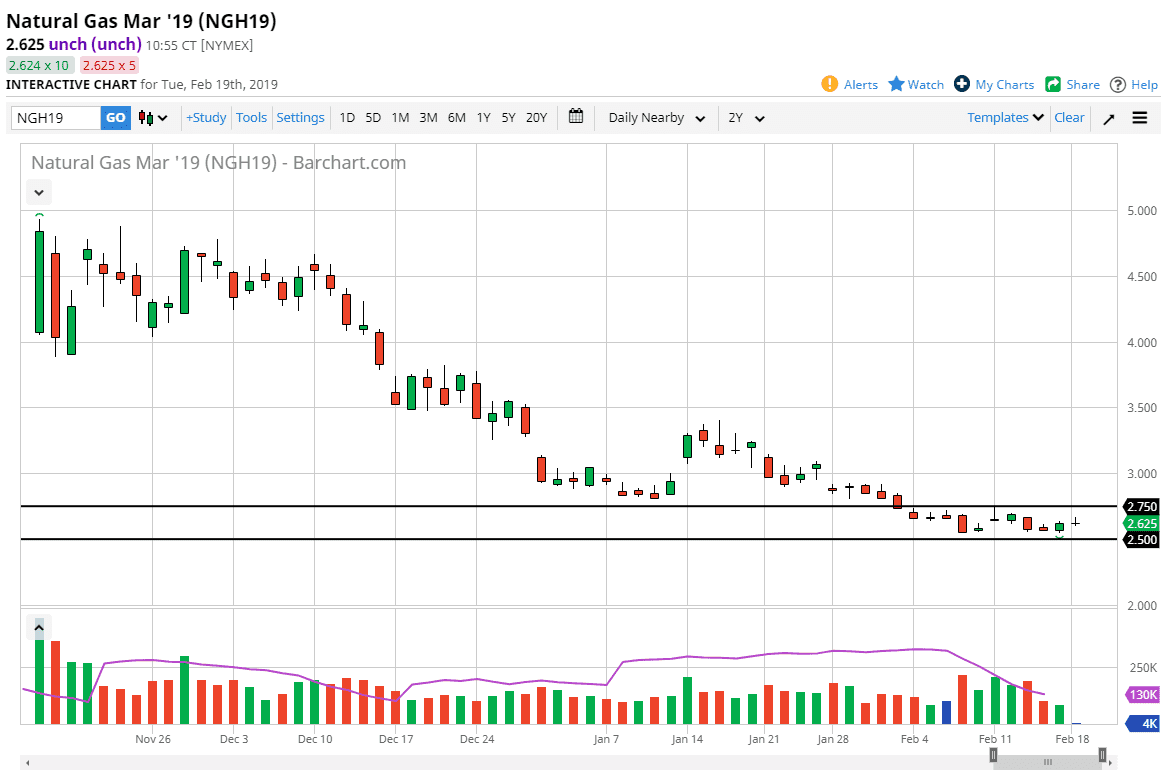

Natural Gas

Natural gas markets did almost nothing during the trading session on Monday which of course isn’t much of a surprise due to the fact that the United States was celebrating Presidents’ Day, which while not a major holiday it is one that a lot of banks will participate in. Because of this, the markets had a short trading session, closing at noon in America. That makes a huge difference in what happens in the natural gas markets particular, because almost all of the volume comes out of North America.

At this point, the market has been oversold for some time, and I think we are trying to form a little bit of a base just above the $2.50 level, an area that has been important for some time. If we can bounce from here, and I think we will eventually, it should be a selling opportunity above on signs of exhaustion near the $3.00 level, perhaps even the $3.25 level after that. I have no interest in buying.