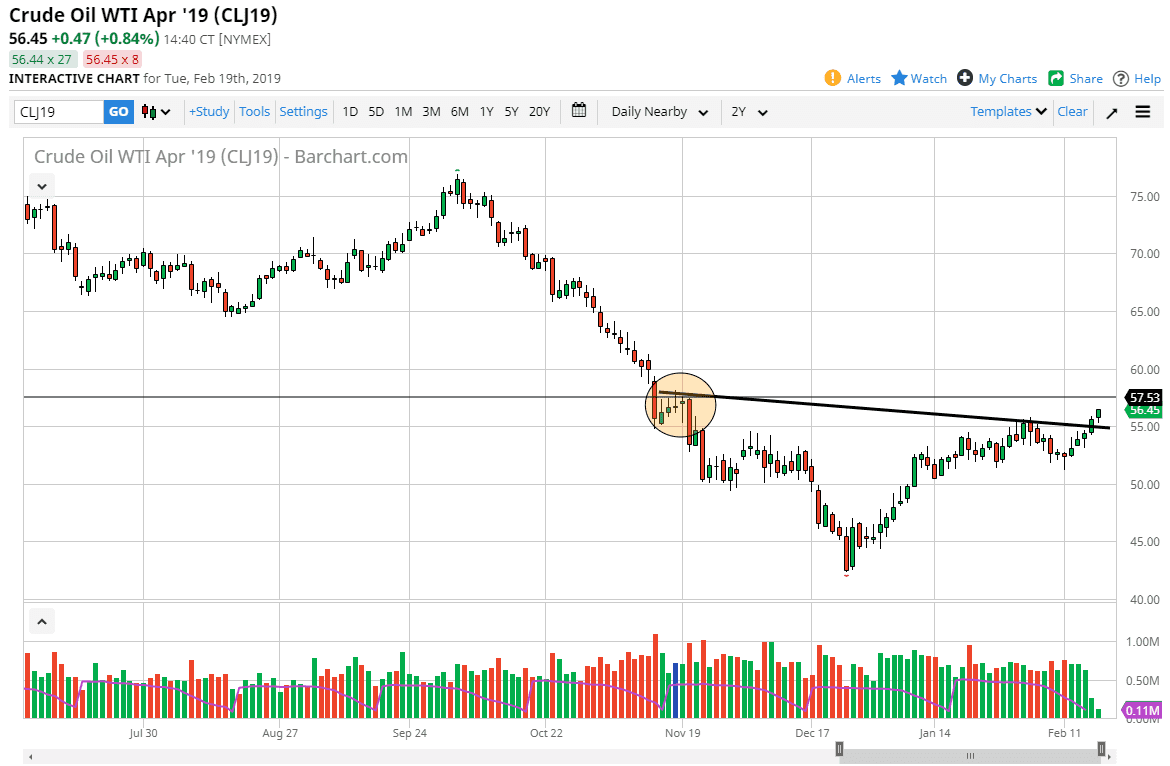

WTI Crude Oil

The WTI Crude Oil market found buyers after initially dipping during the trading session on Tuesday, testing the $55 level. We have found buyers from that level and have closed rather well to finish the day. I do see a bit of resistance above at the $57.50 level, but it’s clear that this market is trying to break out to the upside and go much higher. I like buying short-term pullbacks and believe that once we break above the $57.50 level, this market will probably really start to pick up momentum. A falling US dollar has helped, but if we can get some type of agreement between the US and China, this market could really take off as it should suggest more demand for petroleum. Recently, Saudi Arabia has suggested that they are going to cut production, and so far it seems to be working as far as price is concerned. I like buying dips, and don’t have any interest in shorting.

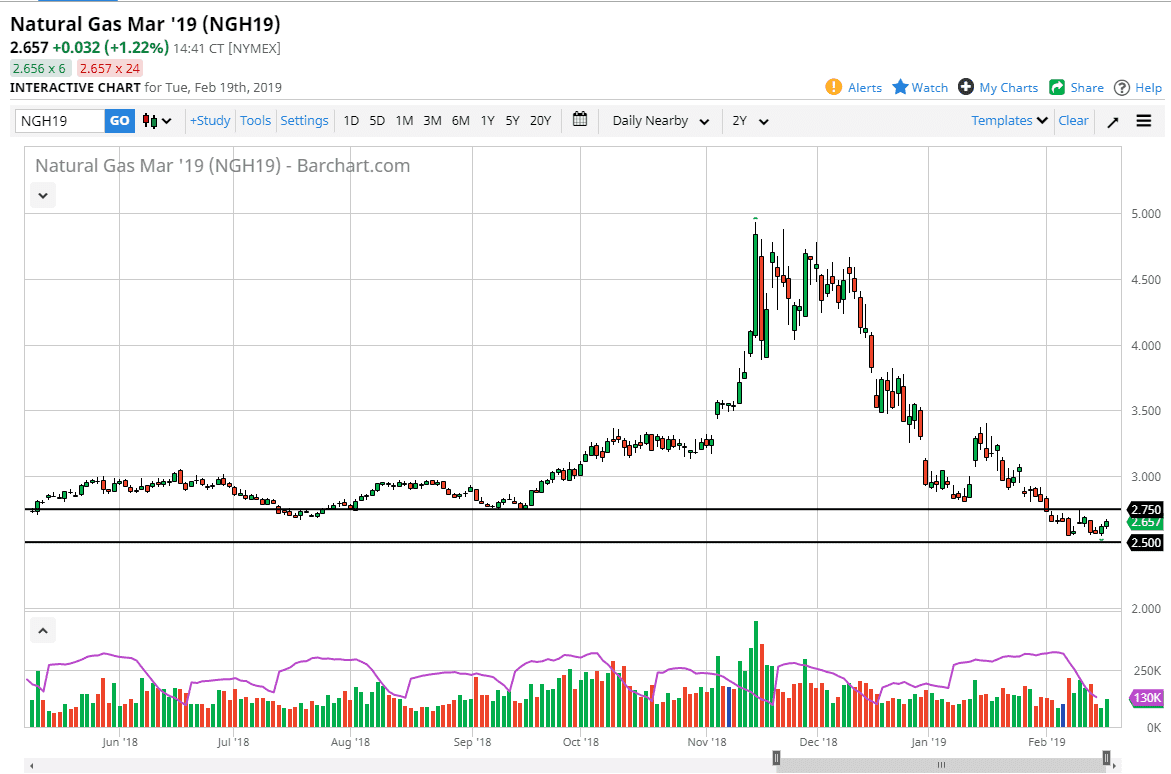

Natural Gas

Natural gas markets continue to go sideways overall, as Tuesday has seen more congestion. Overall, the natural gas markets are testing a major support level in the form of the $2.50 level, an area that should hold based upon longer-term charts. However, if we break down below there it’s very likely that the market will then go down to the $2.25 level next. That being said, I believe that it’s much more likely to break out to the upside and go looking towards higher levels as we have this oversold condition.

Ultimately, I think that the $3.00 level should offer resistance, just as the $3.50 level should as well. I like selling exhaustive candles above, and in the meantime am simply sitting on my hands and waiting for my opportunity.