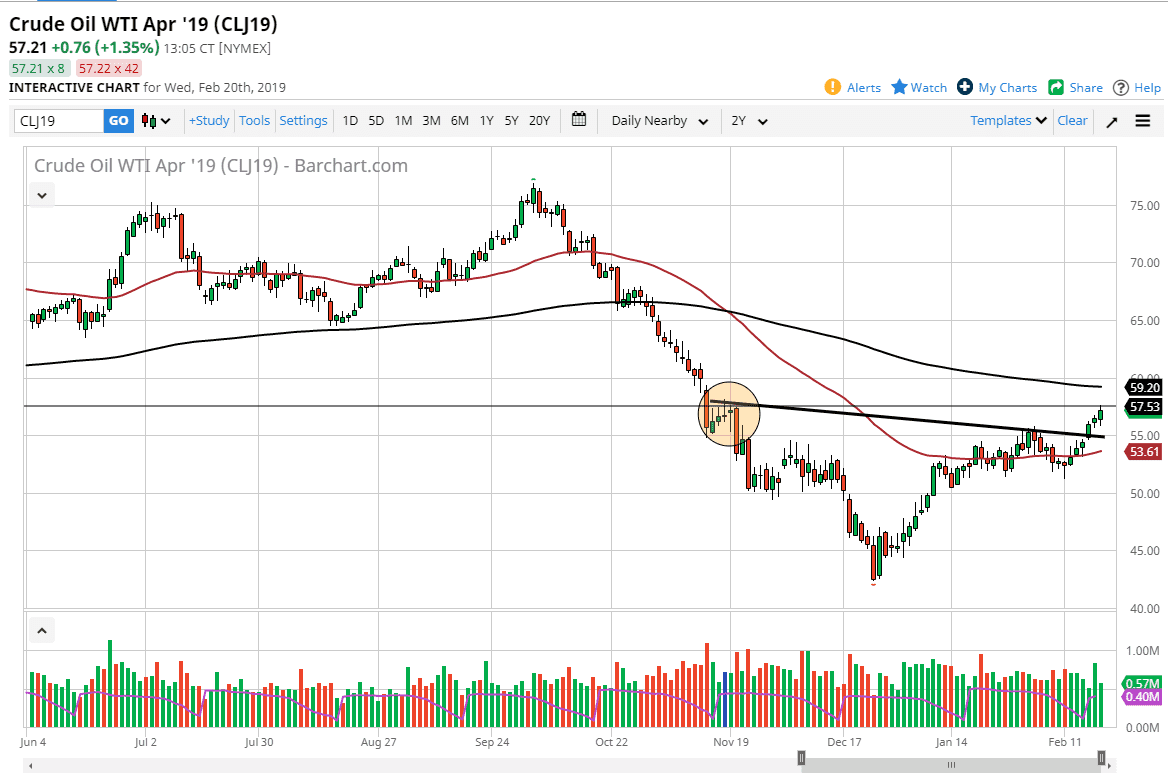

WTI Crude Oil

The WTI Crude Oil market went back and forth during the trading session initially on Wednesday, as we get the FOMC Meeting Minutes adding volatility to the market, but overall it looks as if the oil markets continue to grind higher. The $57.50 level is the beginning of that little area that I was talking about yesterday, so we are essentially stuck in the short term, and it looks like we are going to need to pull back on small time frames to finally bust out. Nonetheless, the $55 level underneath is massive support, and that of course could influence the market as well. I think that we have more upward mobility given enough time, but the market is probably going to be very noisy. Given enough time, look for value that you can take advantage of based upon supportive candles. Once we clear the $58 level, it’s very likely that we go higher.

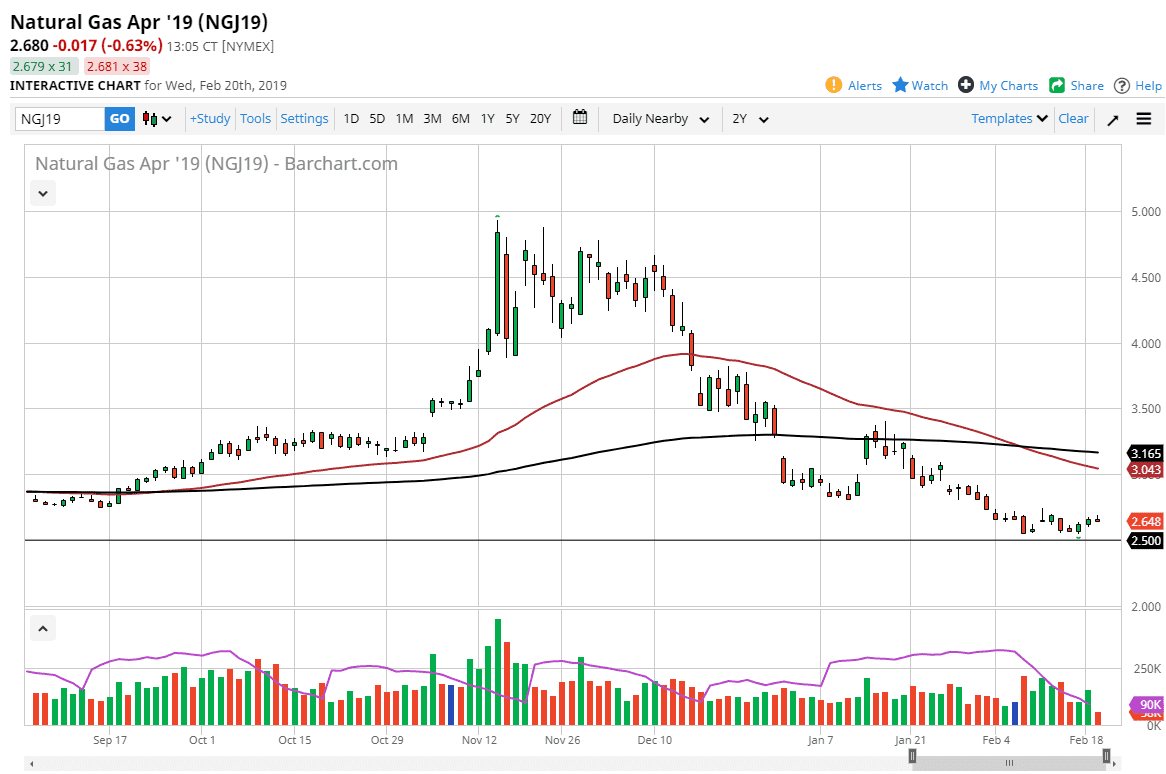

Natural Gas

Natural gas markets continue to go sideways in general, and therefore I think we are probably going to eventually get some type of relief rally that we can take advantage of. As you know, I am very bearish on natural gas from a longer-term perspective, simply because we are oversupplied of the commodity. With this in mind, I’m looking for exhaustive candles above that I can short, and although I recognize that we probably will get some type of pop from these ultra-low levels, at the end of the day I just don’t find it a good use of my trading capital. The $2.50 level has been massive support on longer-term charts, and there’s nothing to suggest that it won’t continue to be. The $3.00 level above will be resistance, just as the $3.25 level is.