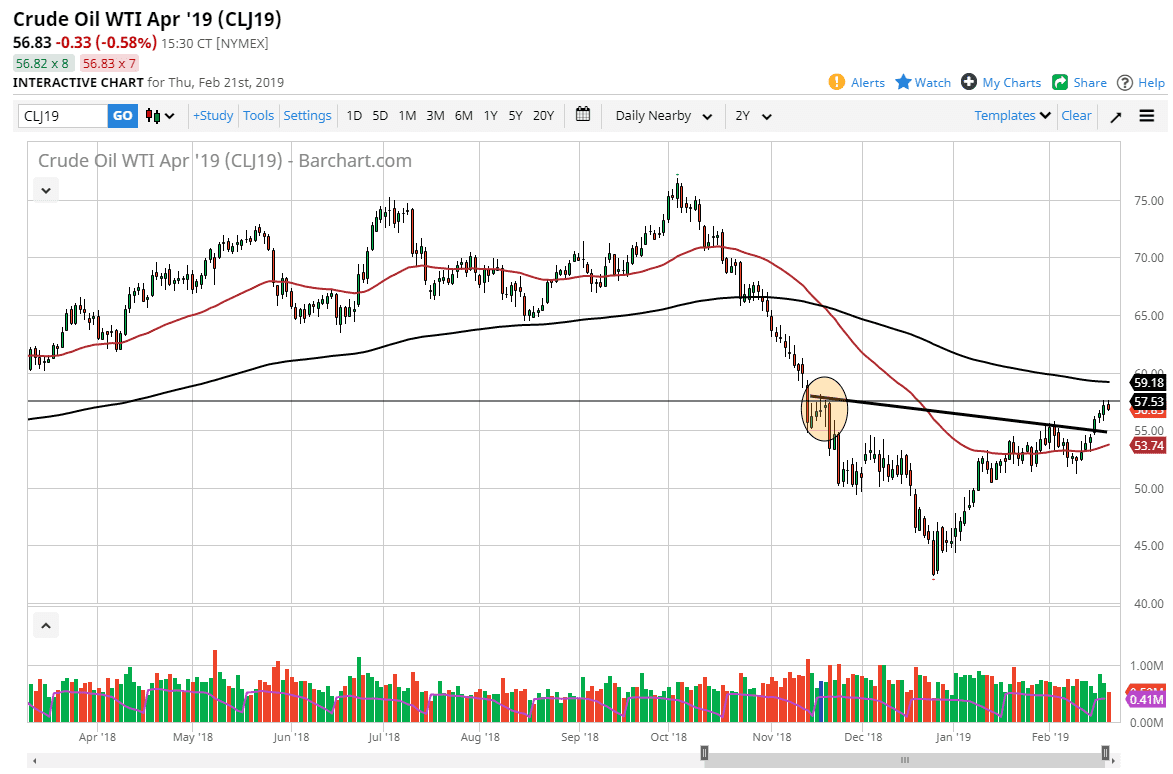

WTI Crude Oil

The WTI Crude Oil market pulled back during Thursday’s trading, as we continue to see a lot of resistance at the $57.50 level. I think that extends to the $58 level and therefore it’s very difficult to break out quite yet. In fact, it’s likely that we may see a short-term pullback in order to build up the necessary momentum to go to the upside. I believe that there is a bit of a “floor” in the market at the $55 level, so therefore I don’t have any interest in shorting this market, although I do recognize that pullbacks are probably necessary. Being Friday, it’ll be interesting to see whether we can break out, but there is still a gap near the $60 level that coincides nicely with the 200 day EMA that I think we will go looking for given enough time.

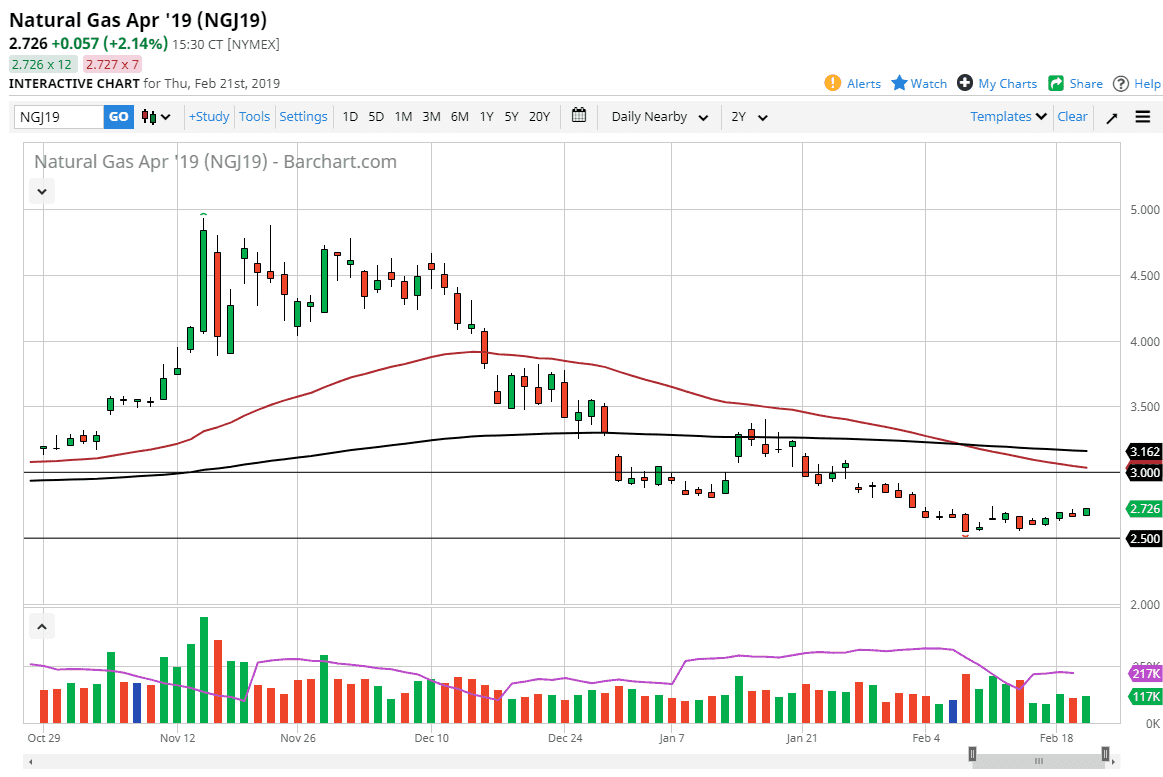

Natural Gas

Natural gas markets rallied again during the trading session on Thursday, as we got slightly bullish inventory numbers. However, I think at this point it will just give us an opportunity to start selling again, especially near the $3.00 level above. I like the idea of fading rallies as they happen, and therefore I have decided to be very patient and sit on the sidelines waiting for a nice exhaustive candle to take advantage of, perhaps something along the lines of a shooting star on the daily chart. The 50 day EMA coincides with the $3.00 level as well, so that’s exactly where I’m looking for weakness to take advantage of. I don’t have any interest in shorting this market down here, and I certainly don’t have any interest in trying to buy the bounce.