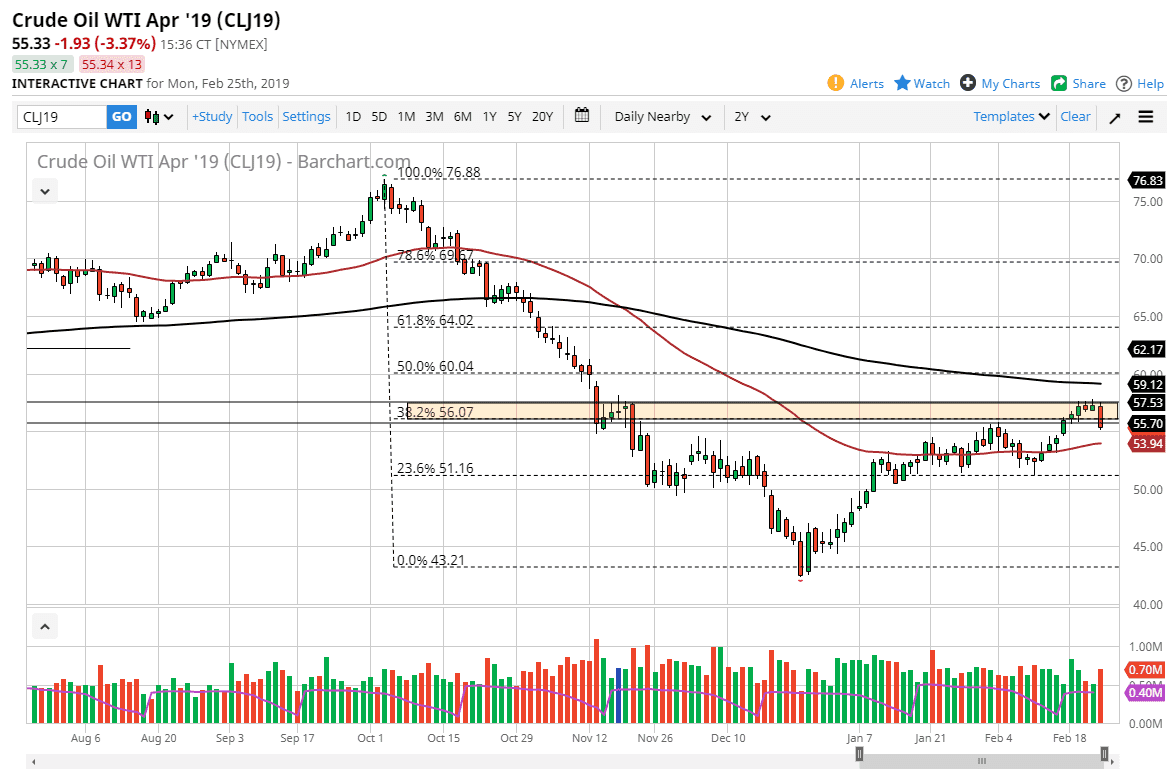

WTI Crude Oil

The WTI Crude Oil market broke down significantly during the trading session on Monday, as we had reached a significant resistance barrier, and then Donald Trump of course tweeted that OPEC needs to do something to bring down the price of crude oil, and then the market suddenly believed that Donald Trump was the head of OPEC. Nonetheless, we have found a bit of support near the $55 level so it’ll be interesting to see how this plays out the next session or two. As we are at a significant resistance barrier, a continuation downward pressure is possible, and a break down below the $55 level will probably have this market looking towards the 50 day EMA. The alternate scenario is that we turn around trying to regain this candlestick and go looking towards the $60 level above which is the scene of a gap, something the futures markets quite often do. All things being equal, you should probably be on the sidelines for the next 24 hours and wait to see what the next candlestick is as it will give us more clues as to where we are going next.

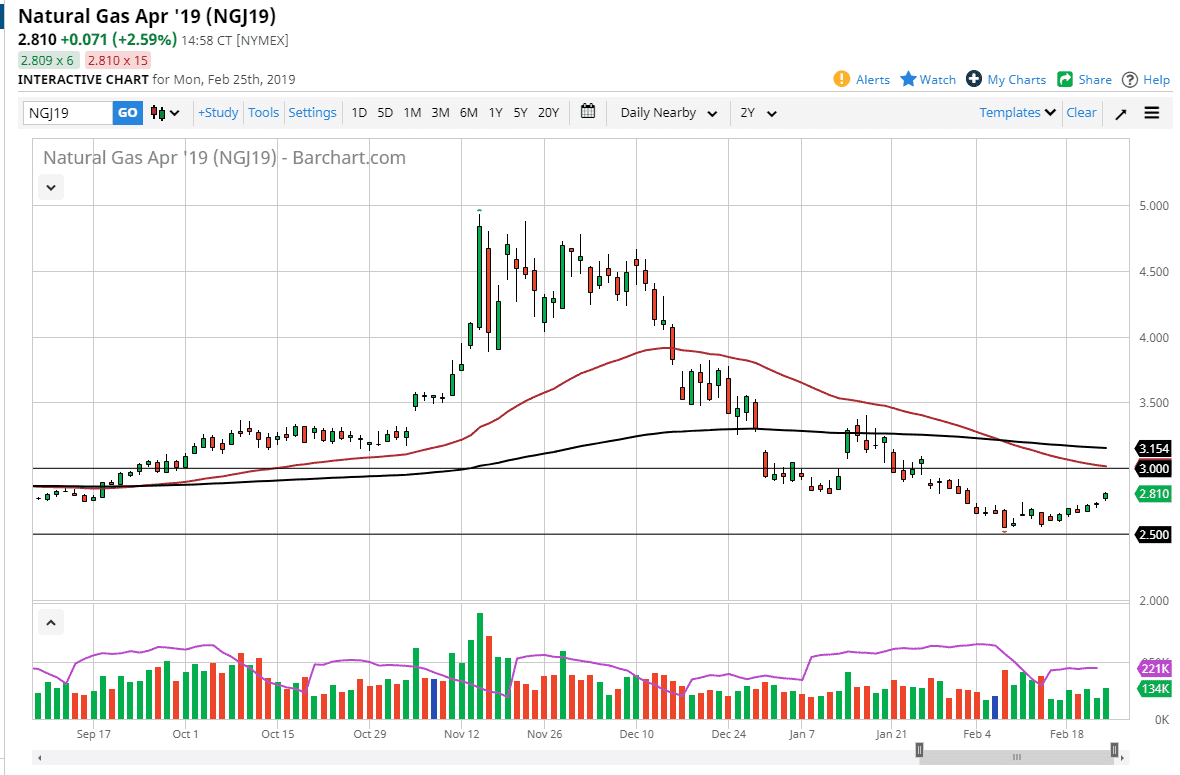

Natural Gas

Natural gas markets gapped higher during the trading session on Monday, to kick off the week and show signs of continued strength. I see quite a bit of resistance above though, especially at the $3.00 level, as it is not only the scene of a gap, but also the 50 day EMA. If we get close to the $3.00 level, and show the slightest scene of exhaustion, I am more than willing to start selling here. Beyond that, the 200 day EMA is at the $3.15 level, so that could be another place to start selling. I have no interest whatsoever in buying.