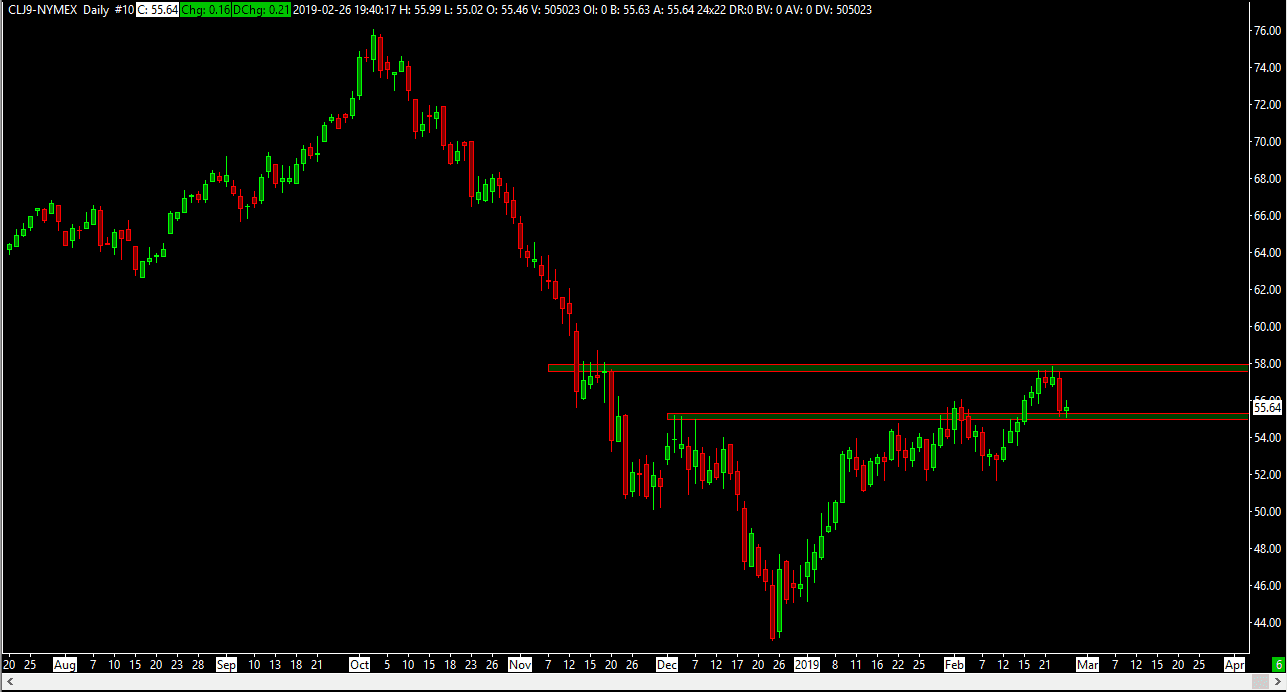

WTI Crude Oil

The WTI Crude Oil market bounced a slight bit during trading on Tuesday, as we continue to see a lot of interest near the $55 level. As you can see on the chart, I have the $55 level offering support, as it was previous resistance. Above there, then we have significant resistance at the $58 level. At this point we continue to grind sideways overall, and I do believe that the $55 level will continue to attract a lot of attention. With all of that in mind, I do expect that we will probably see a bit of a bounce, as we try to build up the necessary momentum to finally break out. However, a daily close below the $54 level would more than likely open up the door to the $52 level next.

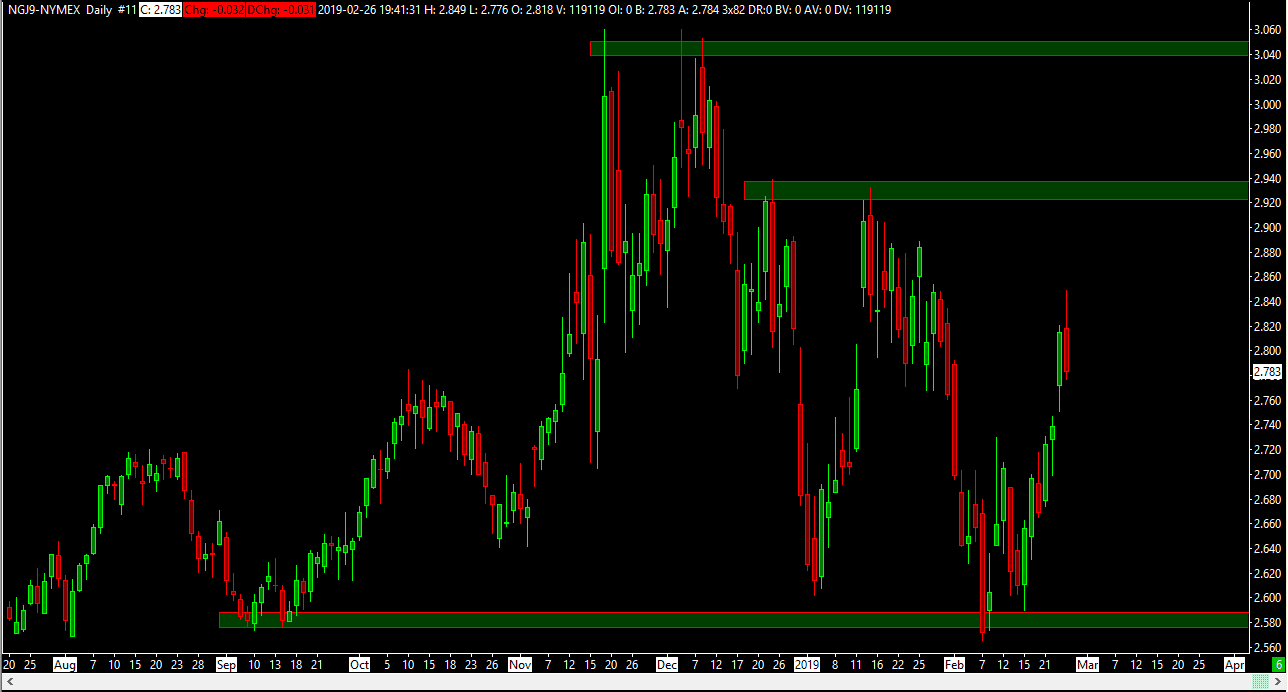

Natural Gas

Natural gas markets initially tried to rally on Tuesday but gave back the gains as we lost $0.03 towards the end of the day. That being said, I am waiting for a selling opportunity at higher levels, somewhere between the $2.92 level and the $3.04 level. At the first sign of exhaustion in that area, I’m more than willing to jump into this market and push lower. I have no interest whatsoever in trying to buy this market, and therefore I am simply sitting on the sidelines. That being said, if we can break down below the $2.75 level, we may have the ability to short this market down to about $2.60 for a short move. Overall though, I think it’s much easier to short this market after at rallies as it gives us real estate to work with. Natural gas continues to be oversupplied for the foreseeable future.