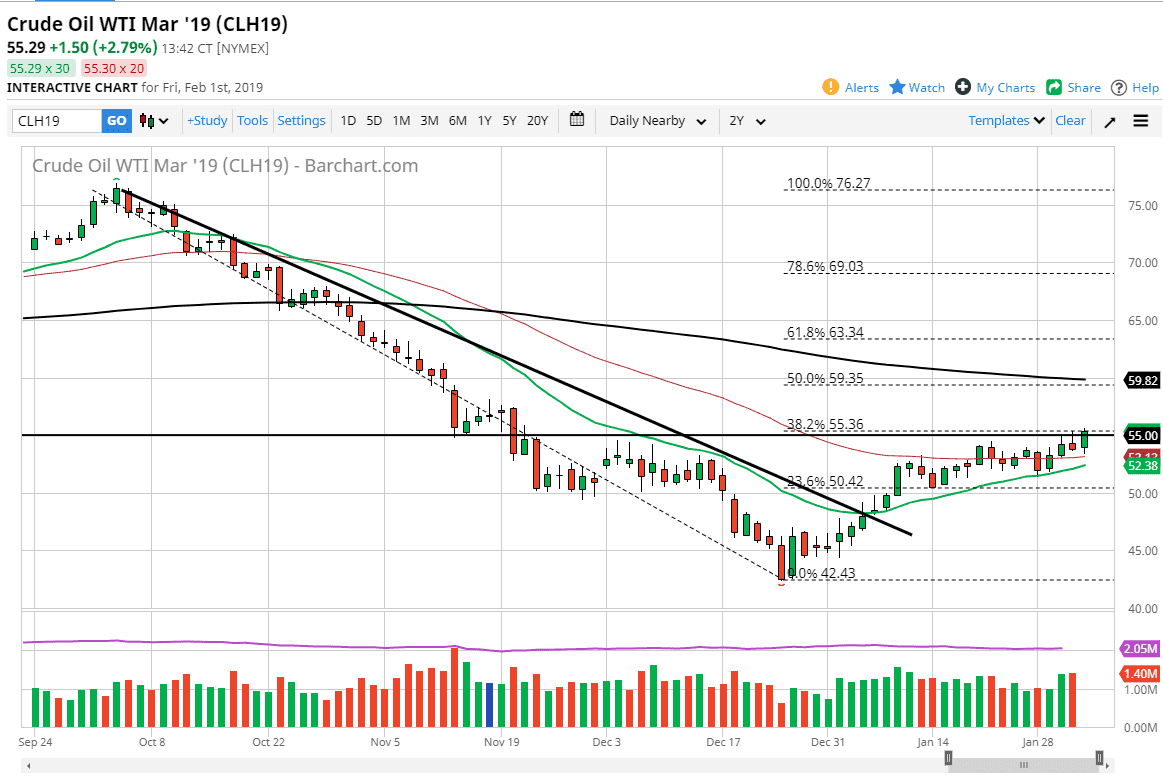

WTI Crude Oil

The WTI Crude Oil market pulled back slightly during the trading session on Friday, but found enough support at the 50 day EMA, which of course is a major technical indicator. The market more importantly broke above the $55 level and made another high again during the day, showing just how much underlying demand that there could be in the market. I think at this point we are looking at a scenario where market participants are simply trying the best they can to break above the resistance, and kickoff a major inverse head and shoulders. That could send this market up roughly $12.50 in a relative short amount of time. I do expect the occasional pullback but those should be thought of as value that you can take advantage of. With that being the case, I do not think you should be looking for short opportunities right now.

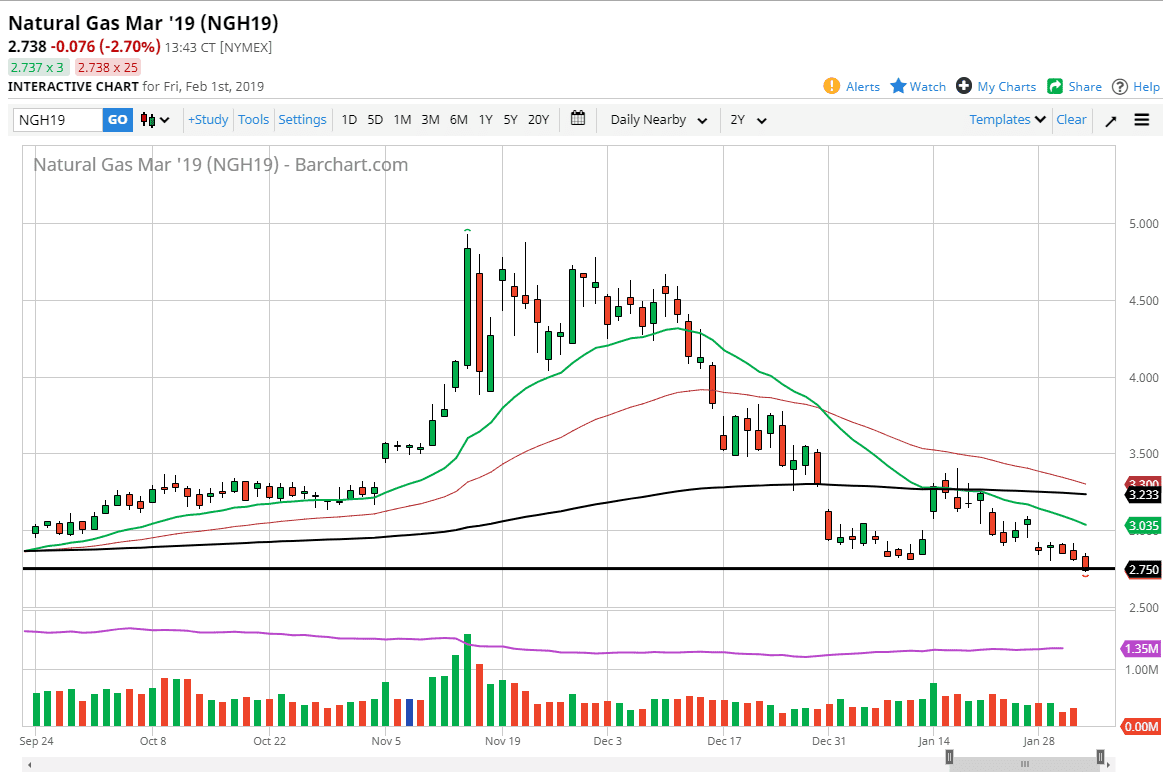

Natural Gas

The natural gas markets fell during the trading session on Friday, slicing towards the $2.75 level. That being the case, the market looks as if it is trying to continue the beriberi attitude that we have seen as of late, but I think it is more than likely going to see a bit of support and perhaps a bounce. Any bounced at this point should be sold at the first signs of exhaustion though, because this is a horrifically negative market. There has been more than enough supply of natural gas for the most part for ages, and I don’t think that changes anytime soon. The $3.00 level causes a lot of interest for sellers, just as the $3.25 level will. An exhaustive looking candle is an invitation to start shorting again.