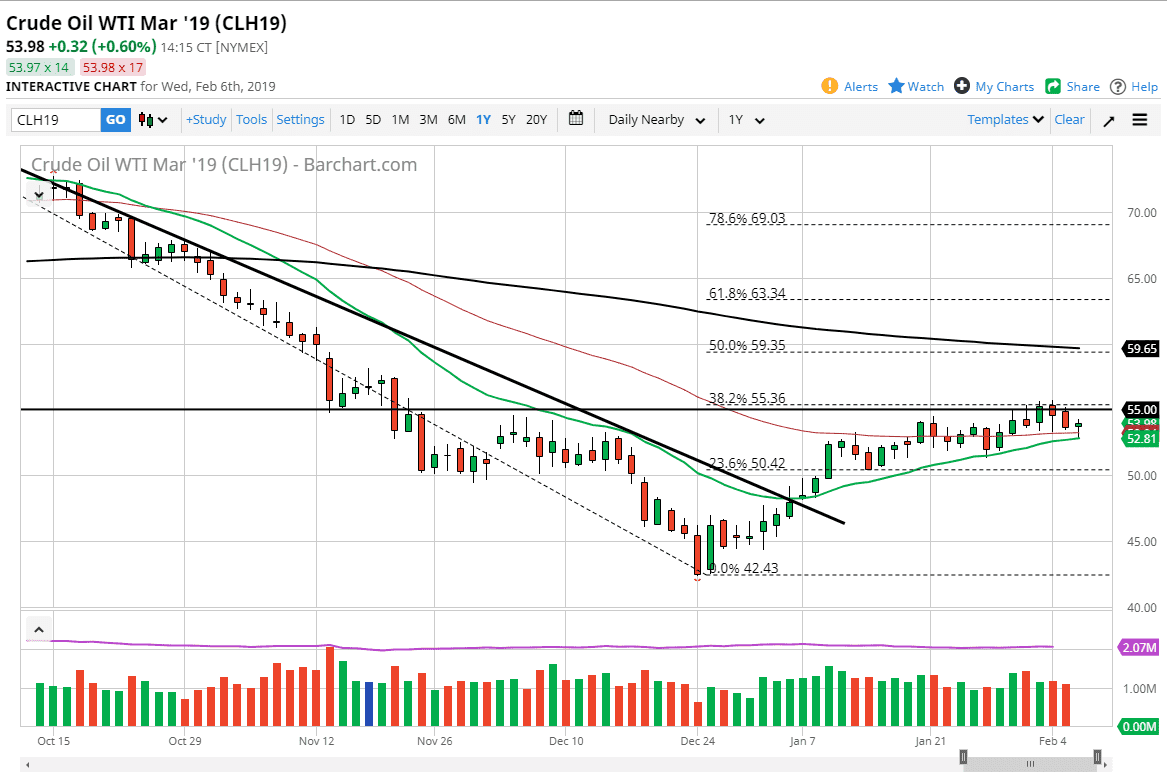

WTI Crude Oil

The WTI Crude Oil market fell during the trading session initially on Wednesday yet again, testing the 20 day EMA. However, we have turned around of form a hammer which of course is a bullish sign. At this point, you should be fully aware of the fact that we are simply grinding away under a major resistance barrier just above. If we can break above that resistance barrier, meaning the last couple of candles, then we could go higher as it would kick off an inverted head and shoulders pattern. At this point, if we do make that move then we are probably going to go looking towards the $60 level above. If we break down below the candle stick for the trading session on Wednesday, we probably have to pull back to the $51 level to build up more support.

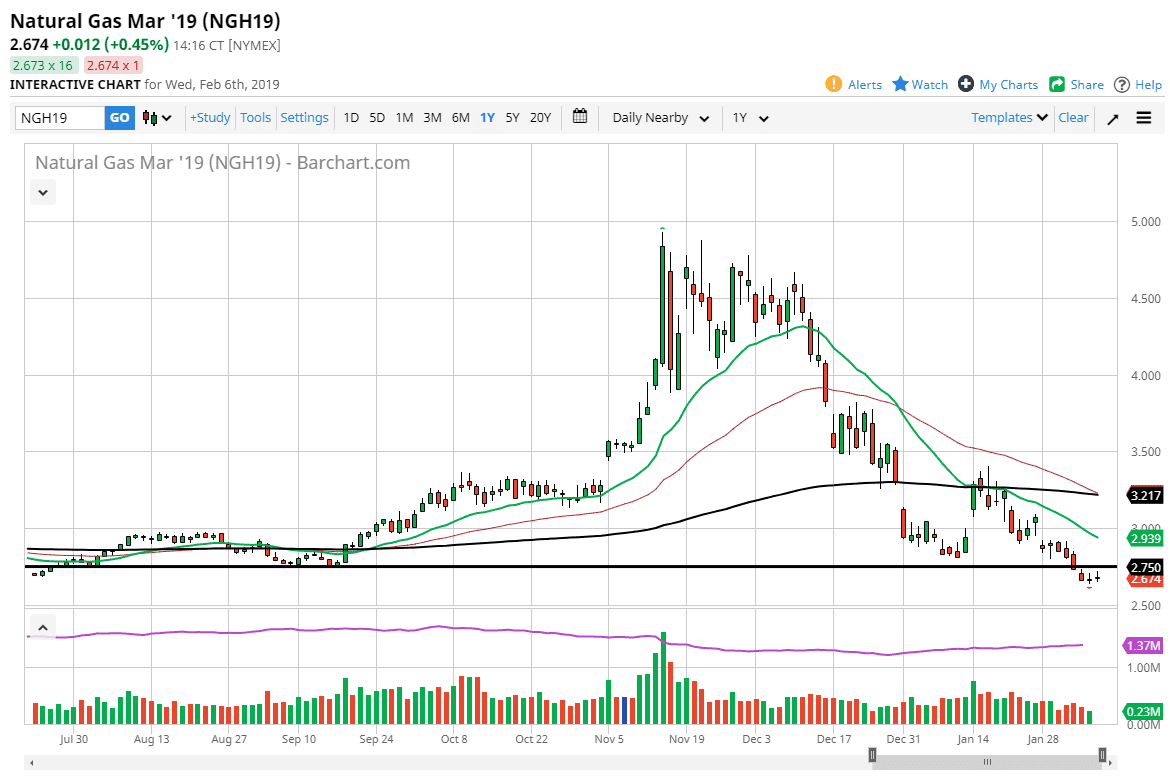

Natural Gas

Natural gas markets initially did try to break out again above the $2.75 level again on Wednesday, but yet again, we found sellers at that level. At this point, I think that the market needs to break above there so that we can continue to go higher and get a bit of a relief rally. I would not do much in the way of selling at this point, because we are just so oversold to begin with. With this in mind, I am a seller of rallies that clear the $2.75 level, and quite frankly I would like to see a lot of momentum after a couple of days suddenly dry up. That would be reason enough for me to start shorting. I’m very interested in shorting near the $3.00 level, and then possibly the $3.20 level above there. I believe that the market will eventually go looking towards the $2.50 level that we are oversold at this point.