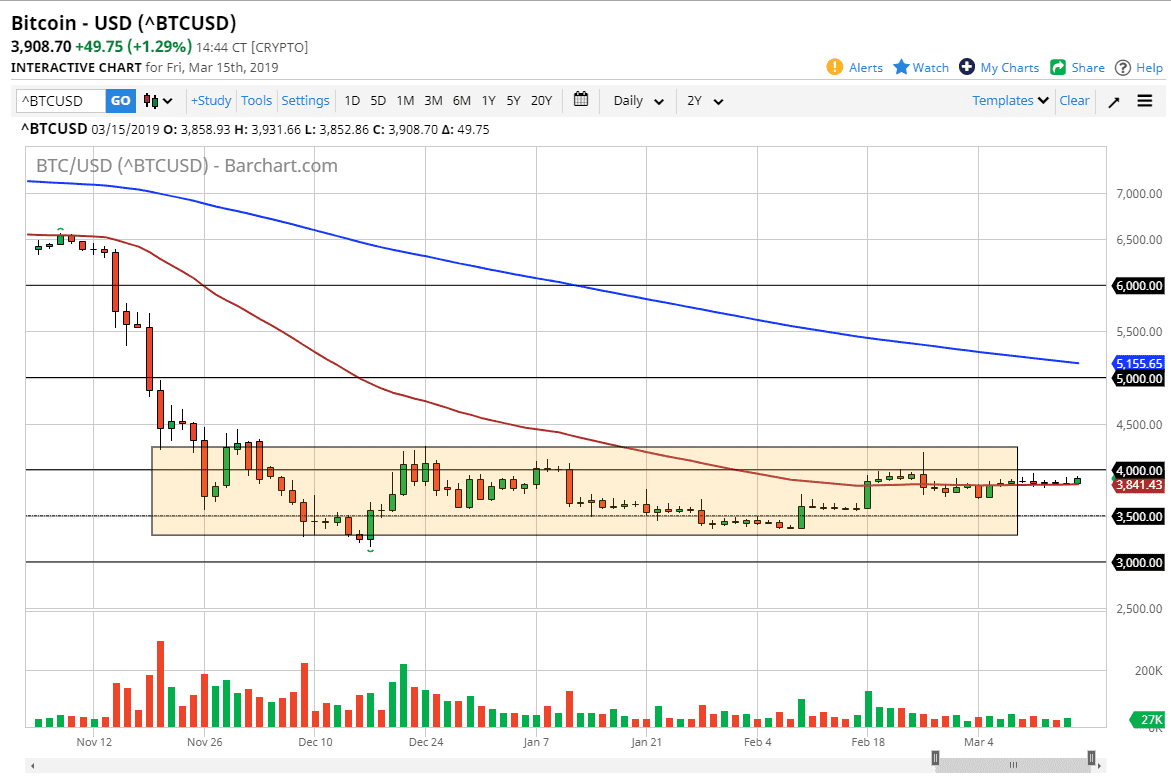

Bitcoin rallied significantly during the trading session on Friday, but unlike many of the other rallies that we have seen lately, we actually kept the gains towards the end of the day. Recently, we have been rallying towards the $4000 level, only to see the market pull back from that level until Friday.

We are currently is sitting on top of the 50 day EMA, which of course has flattened out so it looks likely that we are trying to build up enough pressure to go to the upside. If we can get a daily close above the $4000 level that could send this market much higher, initially towards the $4250 level, and then eventually breaking above there in reaching towards the $5000 level.

The alternate scenario of course is that we break down below the 50 day EMA, reaching down towards the $3750 level, perhaps reaching down to the $3500 level. At this point, the market looks very likely to jump back and forth overall, but it does look like we are trying to turn this into a bit of an accumulation phase, which of course is very crucial for a potential trend change. That being the case, the market looks likely to be noisy, but if we can pick up a little bit of bullish momentum it’s very likely that we will get people jumping into the marketplace with a “fear of missing out.”

Ultimately, if we break down below the $3250 level, the market will more than likely reach down to the $3000 level, perhaps even lower than that. All things being equal though it looks as if we are trying to make a bullish move finely as bitcoin has stopped falling, which of course is the first thing that turned the trend around.