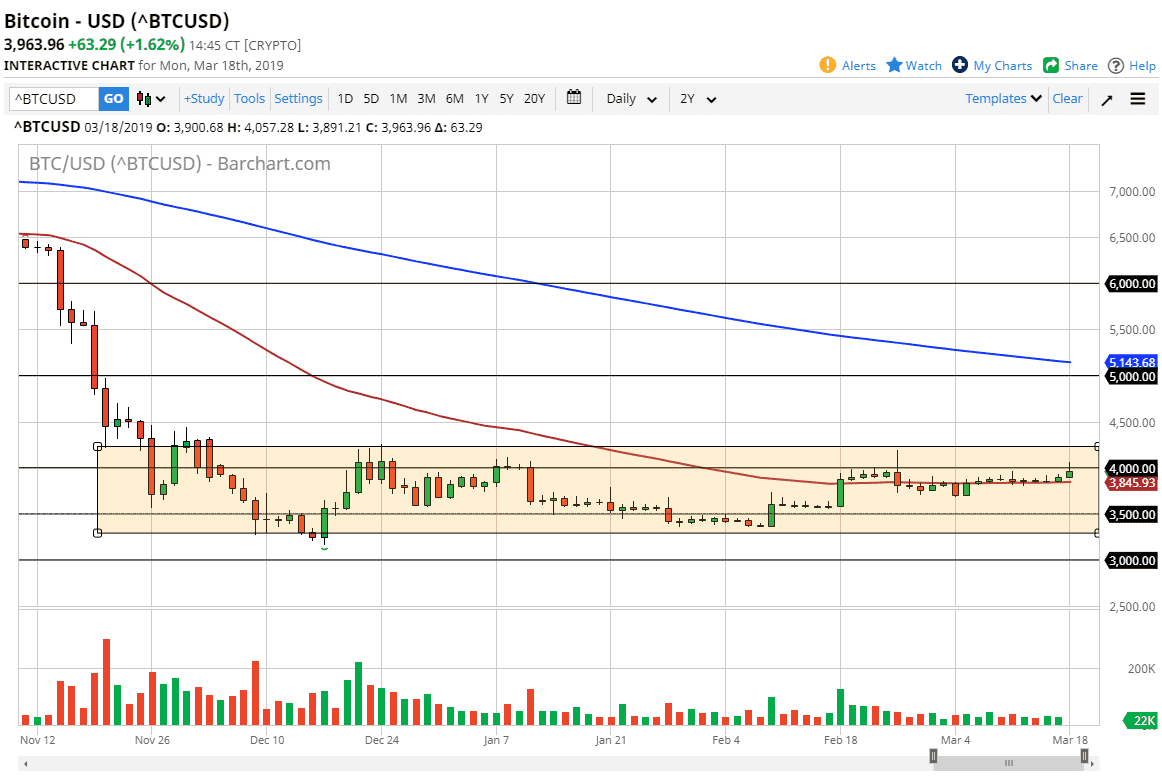

Bitcoin markets rallied during the trading session on Monday, breaking above the $4000 at one point. While this is a bullish sign, we have given back the gains above that level so it looks like there are still sellers just above there. The question now is whether or not we have enough momentum to continue going higher? At this point, it doesn’t look like we are quite ready to do so but one thing that is for sure: we have been grinding higher.

The 50 day EMA sits just below, and that of course could cause a bit of support. It is found at the $3845 level currently and starting to tell higher. That is a bullish sign, and ultimately there should be buyers underneath that level. While we have not been able to break out to the upside, it’s very likely that we are going to continue to try to get above there. The daily candle is a bit of a shooting star though, so that is what tells me we are quite ready to do so.

In the short term, it looks as if we are starting to see people come in and try to accumulate Bitcoin, which of course is a very bullish sign. That’s exactly what would be needed to turn the market around longer term. However, that’s a slow and painful process so unless you are willing to hang onto Bitcoin for a significant amount of time, possibly months if not years, buying it isn’t going to be very easy to do.

To the downside, if we break down below the 50 day EMA with an impulsive red candle, then I think we could be going down to the $3500 level underneath which has proven itself to be important more than once. If the US dollar falls, that could also help this pair.