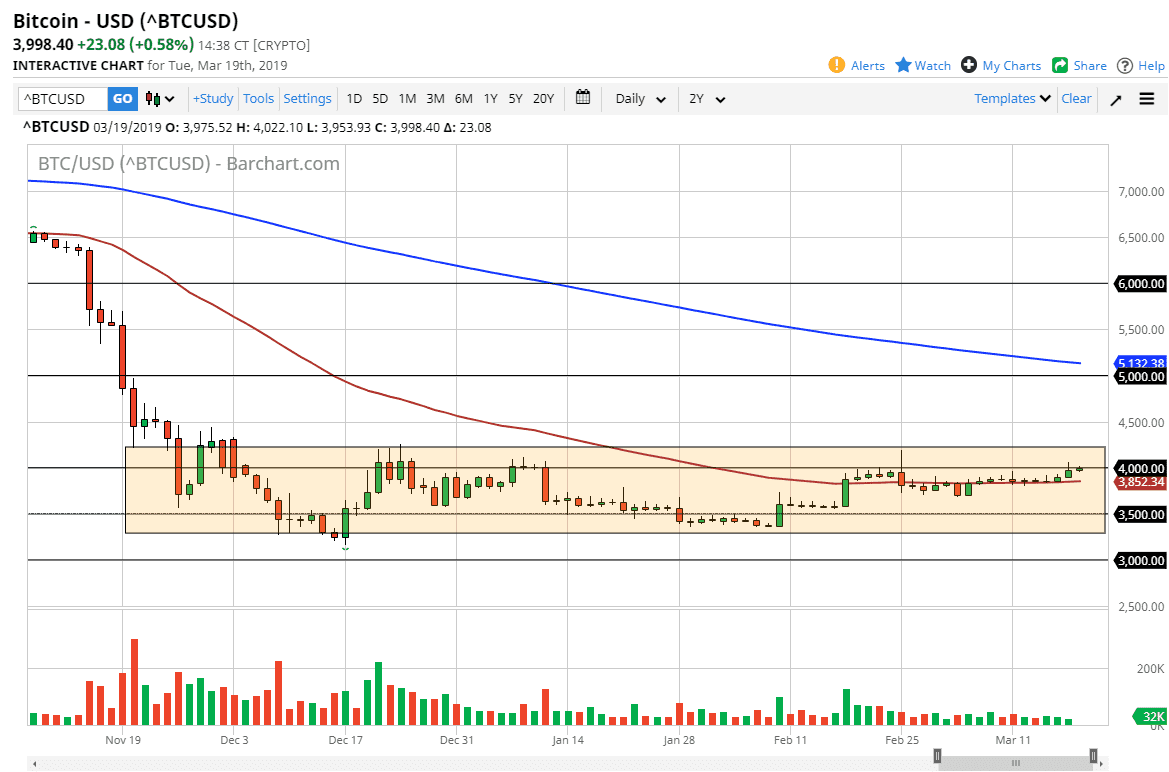

Bitcoin markets rallied again during the trading session on Tuesday, closing the end of the New York session close to the $4000 level. This of course is a very bullish sign, and it’s very likely that the fact that we are sticking to these higher levels that we will find more buyers jumping into the marketplace, pushing above the $4000 level yet again and reaching towards the important $4250 level above. That’s an area that has caused a bit of resistance recently, so if we can break above that level, it would be an extraordinarily bullish sign.

We could pull back towards the 50 day EMA, which is in red on the chart. That is at roughly $3850 and should offer a bit of support in this area. That would be a good sign if it holds, showing that there is a lot of demand underneath. After all, if we are trying to form a bit of a base, this is a very slow and painful process at times. You should not be buying Bitcoin at this point to make quick money, it’s very likely that most traders learn that lesson after the crash. After all, we were starting to see a lot of videos on YouTube and other places like that about how Bitcoin was making millionaires daily. The reality is most of it was just snake oil salesman trying to cash in on the latest thing.

Now that a lot of that money has been shaken out of the market, longer-term believers can start to put money to work. It’s very possible that we continue to see more of an accumulation, which this pattern that I have marked on the chart is starting to look like. It’s not that we can’t break down and crash from here, but the fact that we have seen so much in the way of resiliency, or at least just a simple lack of interest by the sellers, could send this market higher over the longer-term. Patience will be crucial though.