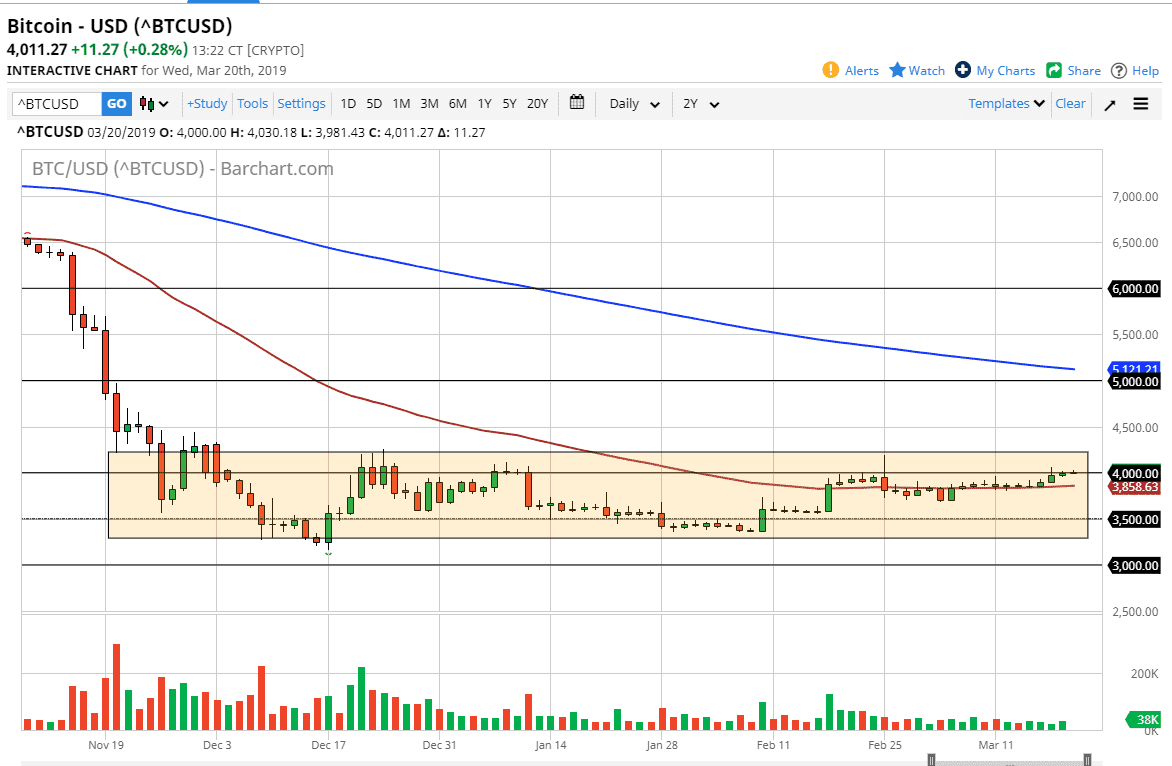

Bitcoin markets rallied slightly during the trading session on Wednesday as we continue to see a quiet rally form. The $4000 level is now starting to become an area that is very comfortable, and that of course is a good sign. Ultimately, the market looks likely to see a bit of hesitation in this area, perhaps extending all the way to the $4250 level above. After all, this is an area that has been very resistive recently, so if you can break above there it’s likely that we could go much higher.

If that breakout does in fact happen, it’s very likely that Bitcoin could reach towards the $4500 level, and then possibly even the $5000 level. Pullbacks at this point are going to be buying opportunities as bitcoin seems to be forming a bit of a base for the longer-term. In this potential accumulation phase, it seems as if the market is going to grind away and have the occasional pullback, but it’s obviously an area that a lot of buyers are jumping and as we simply have stopped falling.

Bitcoin has obviously been sold off rather drastically, so the fact that we can hold our own in this area is a good sign. I think that support extends all the way down to at least the $3500 level, possibly even down to the $3250 level. There is quite a bit of opportunity for the longer-term trader, but the shorter term trader is going to be relegated to micro-movements, assuming they even have the ability to trade with decent spreads, something that we are not seeing anymore. Because of this, it’s very likely that you are going to have to be very patient to take advantage of a longer-term move that may be getting ready to form.