BTC/USD

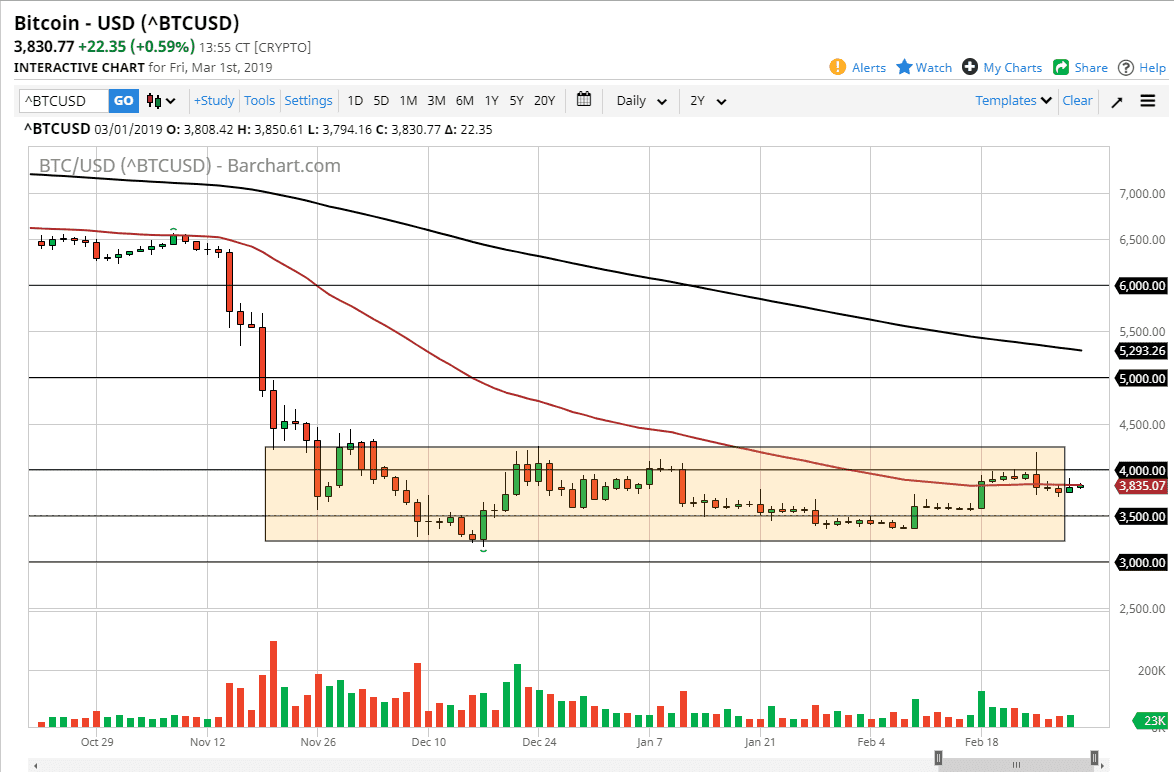

The bitcoin market rallied slightly during the trading session on Friday, as we continue to dance around the 50 day EMA. The market has lost all of its volatility with the exception of a handful of days of the last couple of months, and I think this shows that it is changing overall.

It’s a good thing though, because it is gotten a lot of the “hot money” out of the marketplace, but that same money will be an issue on the way up if we do break out to the upside. After all, there are a lot of retail traders out there that are deep underwater, so if we can get close to the entry point for most of these people, they will probably be the sellers, trying to end up breakeven. This will be the biggest problem for buyers if we do rally, but one thing that will help is that we don’t have a parabolic market anymore.

In the near term, we continue to see a lot of resistance near the $4200 level, but there is also a fair amount of support near the $3500 level. I think at this point it’s likely that we continue to go back and forth so if you have the ability to trade it quickly and with decent spreads, then you can make decent profit in this range bound market. On the other hand, if you are an investor and you believe in the longer-term picture, this gives you plenty of time to pick up bitcoin at relatively low levels.

For myself, I don’t believe in bitcoin longer-term but I have learned a long time ago to simply trade the charts as they present themselves. At this point, even though I have a negative bias, I am the first person to admit that this consolidation area has been very reliable.