BTC/USD

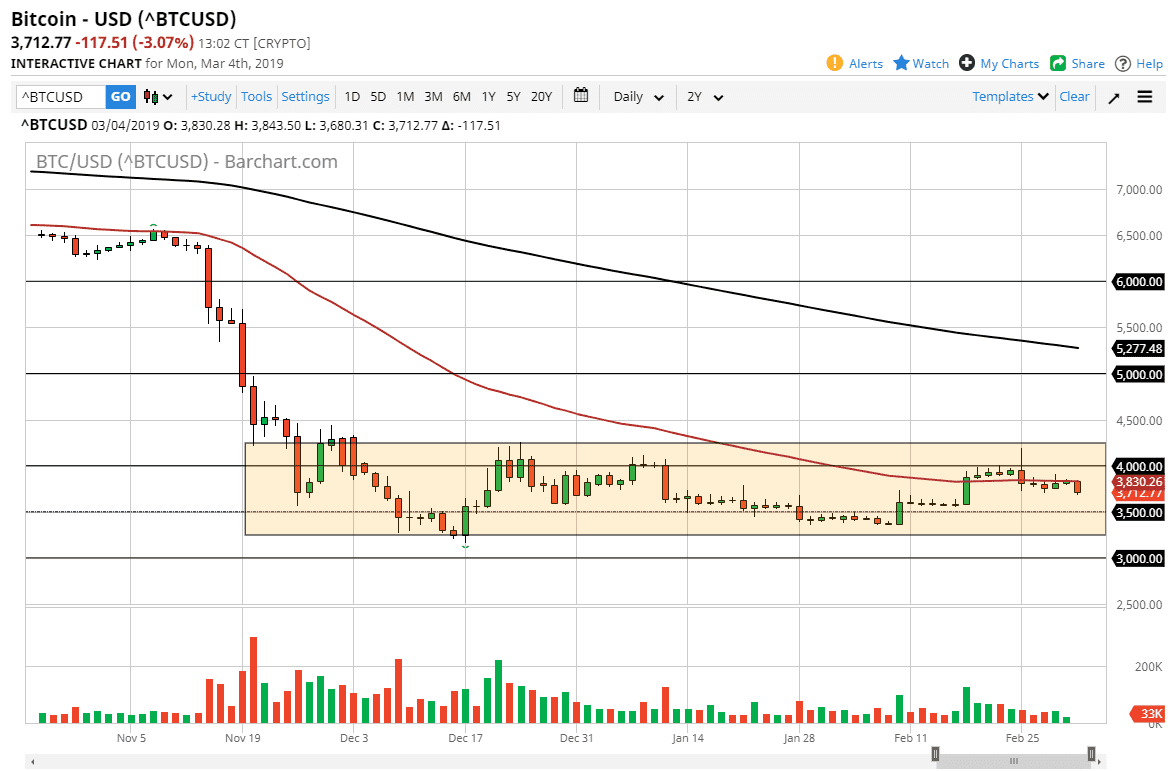

Bitcoin markets fell hard during the day on Monday to kick off the week, as we continue to see an overall negative bias. We had a couple of sessions of almost no movement, and then a sudden and impulsive move to the downside. That’s basically how this market moves, going sideways for several days, and then making a big up or down move.

I think at this point we are still stuck in consolidation, and therefore I think that short-term trading is about as good as it gets in Bitcoin. After all, we have very little in the way of volume, as the lure of making easy millions has suddenly disappeared from the market over the last year. Longer-term, we are still higher than we were a few years ago, but most traders don’t want to hear that. After all, the real money was made by closing out your trades in December of last year. Once it became something that everybody in the world was talking about, it was time to get rid of bitcoin.

Ironically, that might be the bull case here. Obviously, that’s more of an investment than some type of trade, but I know some of you are diehard’s that will be looking to pick up bitcoin on the cheap. In the short term, it looks like we will continue to bounce around between $3250 level on the bottom, and $4250 on the top of the range. Until something changes, I think that’s all you have to look at this market.

Since we are in a downtrend over the last 15 months, it’s obviously easier to sell this market but there has been money to be made to the upside as of late. With that being the case, I think we are going to enter a nice range bound market that can be traded from the short term, flipping directions every couple of weeks.