BTC/USD

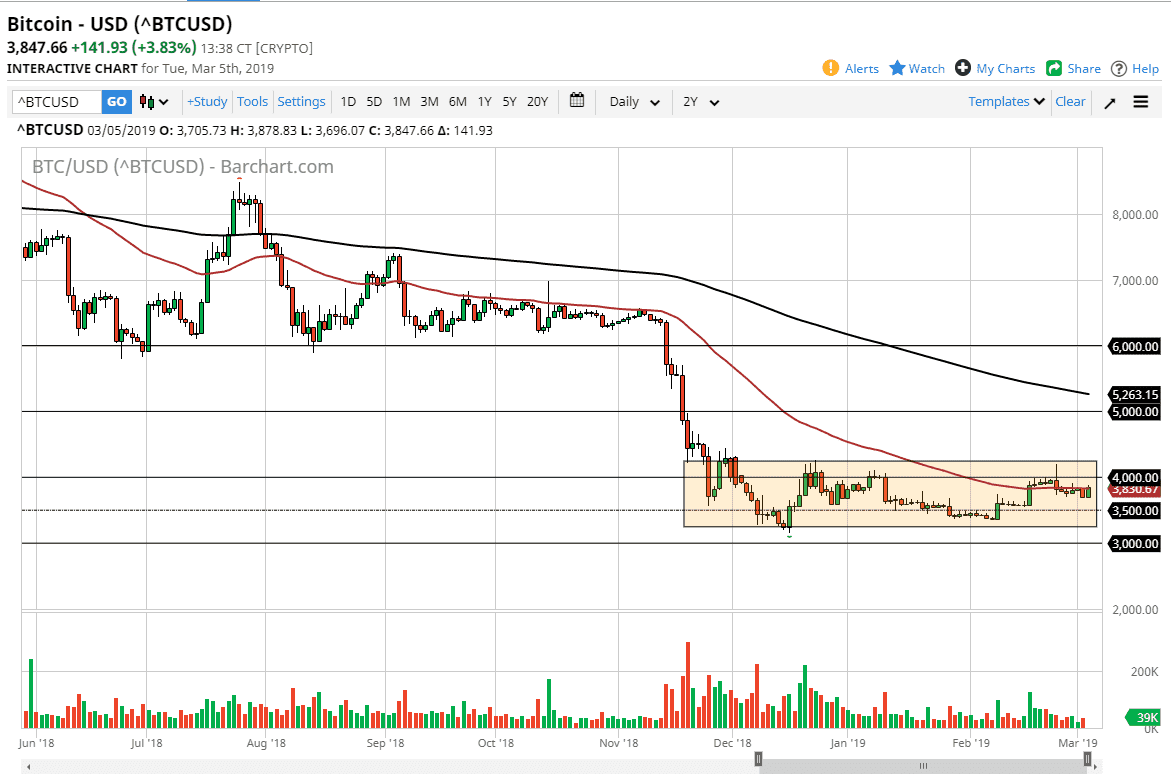

Bitcoin rallied during the trading session on Tuesday, heading back towards the 50 day EMA, which is exactly where we fell from on Monday. This is indicative of how this market has been behaving: simply chopping around back and forth. With that in mind, and the extraordinarily high spreads that we see in this market, it’s important to get the entries consolidation area is no place to try to enter.

From what I see, there is a significant amount of resistance above the $4000 level heading towards the $4250 level, possibly even the $4500 level. So as above $4000 and on signs of exhaustion that I am willing to start selling. However, there are buyers underneath and they will be very aggressive near the $3250 level, starting at the $3500 level.

When I look at bitcoin, I see a market that is completely broken. However, it has lost a lot of its appeal, and for longer-term traders that might be exactly what is needed. They may need a couple years of nothing in order to get enough of the retail traders out. However, I think at this point it’s obvious that bitcoin is in the future, and therefore it’s very hard to imagine a scenario where bitcoin holds on to major value over the longer-term.

People who bought bitcoin by the idea of digital money. However, they didn’t buy anything tangible. Unlike a stock, or currency, in theory you have something backing it up. With bitcoin you only have an algorithm. I’m not sure exactly what kind of valuation that supposed to have, but clearly $4000 probably isn’t going to be had in the end. Bitcoin has been one of the biggest suckers markets over the last couple of decades, and I think that this is one of those things that when we look back 10 years from now, it will be the butt end of jokes.