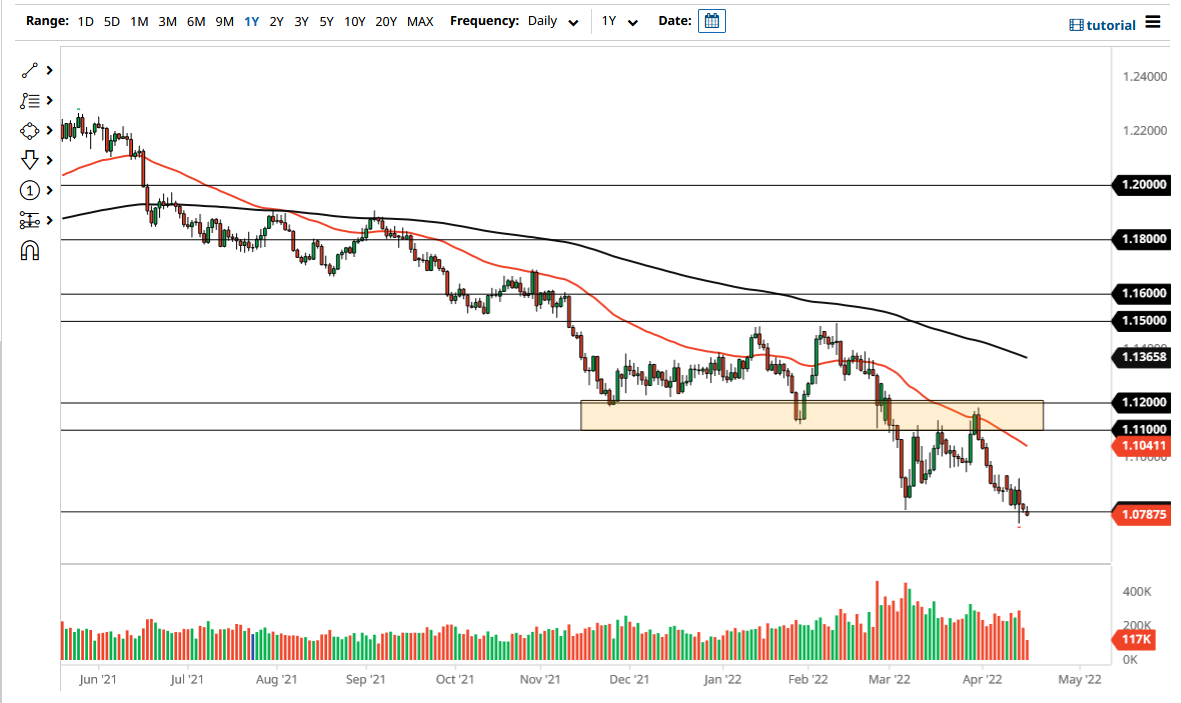

EUR/USD

The Euro initially fell during trading on Friday, continuing the negativity that we had seen the previous session as we smashed through the 1.12 level. However, later in the day we started to rally and certainly picked up a little bit after the jobs number came out in such disappointing fashion to clear the 1.12 level quite significantly. Because of this, it looks like we may make an attempt to head back into the larger consolidation area, as the recovery has been somewhat impressive. When you look at the longer-term charts, there is a massive amount of support just below, so it makes sense that perhaps the worst is over and value hunters are coming in to pick up the Euro at these extraordinarily low levels. This will be especially true if the economic figures in the United States continue to drag.

GBP/USD

The British pound fell hard during the trading session, reaching towards the 1.30 level, an area that I have talked about previously. There should be some interest here, because it is the 61.8% Fibonacci retracement level from the most recent bounce, and of course an area that has a large come around, psychologically significant figure. We are still technically in and uptrend, because we have made a “higher high”, and would need to drop down below 1.2775 to change the potential of the trend as it would make a “lower low.”

Granted, the situation with the British pound is fluid and a bit volatile, but it is historically cheap and I think a lot of people are starting to look at through that prism. As long as there is something beyond a “no deal Brexit”, it’s very likely that the British pound will continue to find buyers underneath.