EUR/USD

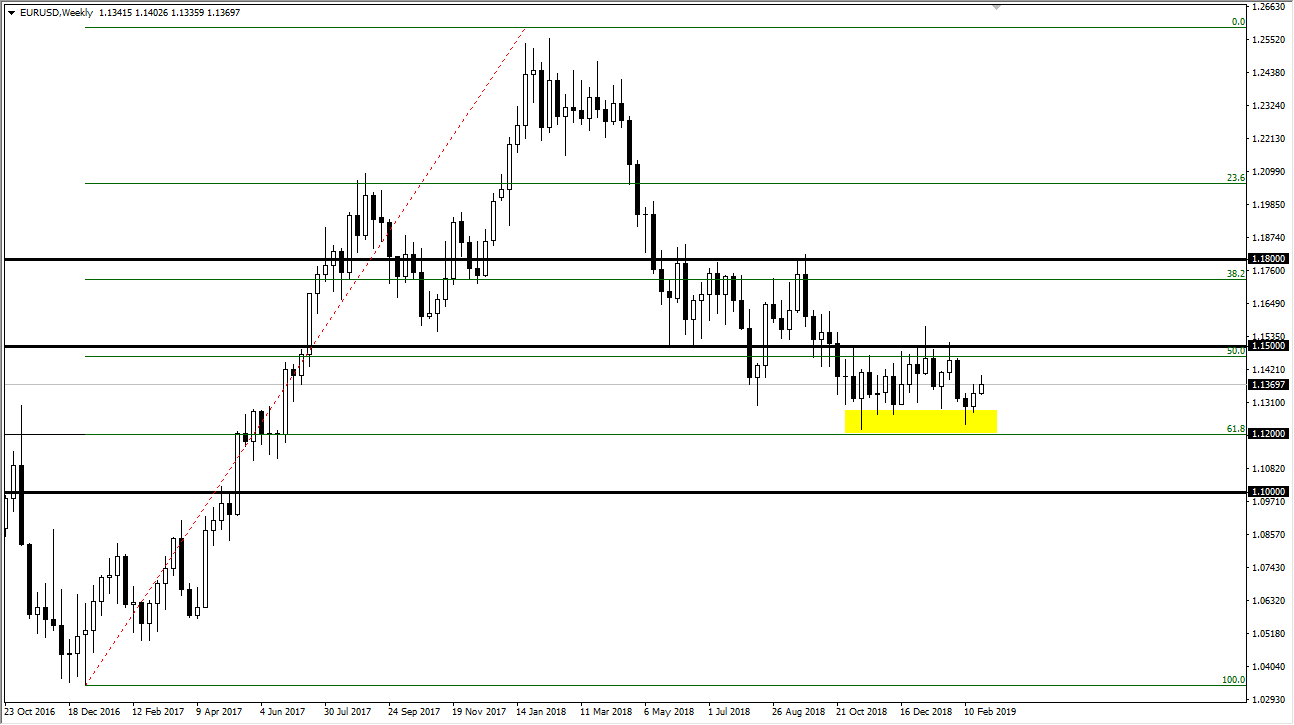

The Euro rallied a bit during the last couple of weeks in February, bouncing from a major support level. When I look at this chart I see consolidation. I don’t necessarily think that we are going to go anywhere over the next couple of weeks of note and believe that we will continue to go back and forth between 1.12 on the bottom, and 1.15 above. Obviously, a move outside of that range on a daily close would be a significant turn of events, but there’s so much institutional demand below at the 1.12 level that it’s difficult to imagine that we will break down significantly. I suspect it’s easier to simply be a range bound traders yet again for the month of March.

However, if we get the break out that the market would love to see above 1.15, that opens the door to the 1.18 level. I would put the odds of this at about 30% for the month. I suggest that there is much more likelihood of back-and-forth trading, so focus on shorter-term charts and look for nice set ups on the hourly chart, perhaps even the four hour chart as we bounce around in a well-defined range. Eventually we will change things obviously, but until that happens you assume that the consolidation will run until it ends, and that could be forever.

The Federal Reserve has started to loosen its language, and it looks as if it’s going to keep a lot of assets on the balance sheet. If that’s going to be the case, very likely that we could continue to see the greenback weakness creep into the market.