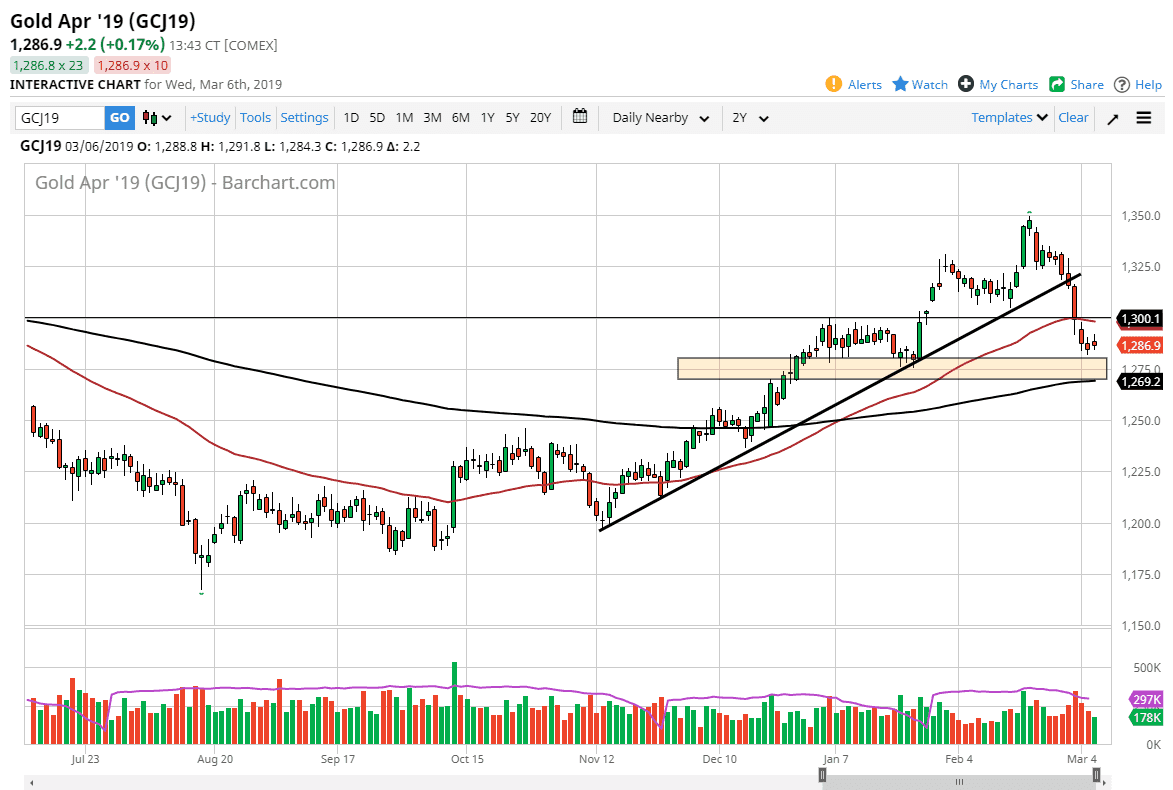

Gold markets pulled back a bit during the trading session on Wednesday but continues to find support in the region that I have highlighted on the chart. This is ostensibly the $1275 level, extending all the way to the $1285 level, an area that had major consolidation forming around it at the beginning of the year. The question is whether or not we can hang onto these levels, because if we don’t it’s very likely things could get ugly rather quickly.

Currently, the 50 day EMA is just above but seems to be wanting to turn lower, while the $1270 level has the 200 day EMA parked at it. Because of this, I think the market is essentially “squeezed” in this area. The next couple of days should be crucial, with a direct emphasis on Friday’s jobs report. The reaction of the greenback to that event is probably going to be quite telling as to what happens with gold.

If the US dollar pulls back and falls due to a poor jobs number, that’s probably going to send Gold towards the $1300 level. If the greenback strengthen significantly, we could see gold break down below the 200 day EMA, sending it down towards the $1250 level, the $1225 level, and then eventually the $1200 level which was the bottom of the larger and more crucial consolidation range that we had been in for so long.

As for Thursday, things are going to be choppy and difficult would be my guess. Unless there is some type of major catalyst, perhaps headlines coming out about US/China relations, it’s hard to imagine a scenario where gold gets a huge move. All things being equal it should be a relatively quiet 24 hours.