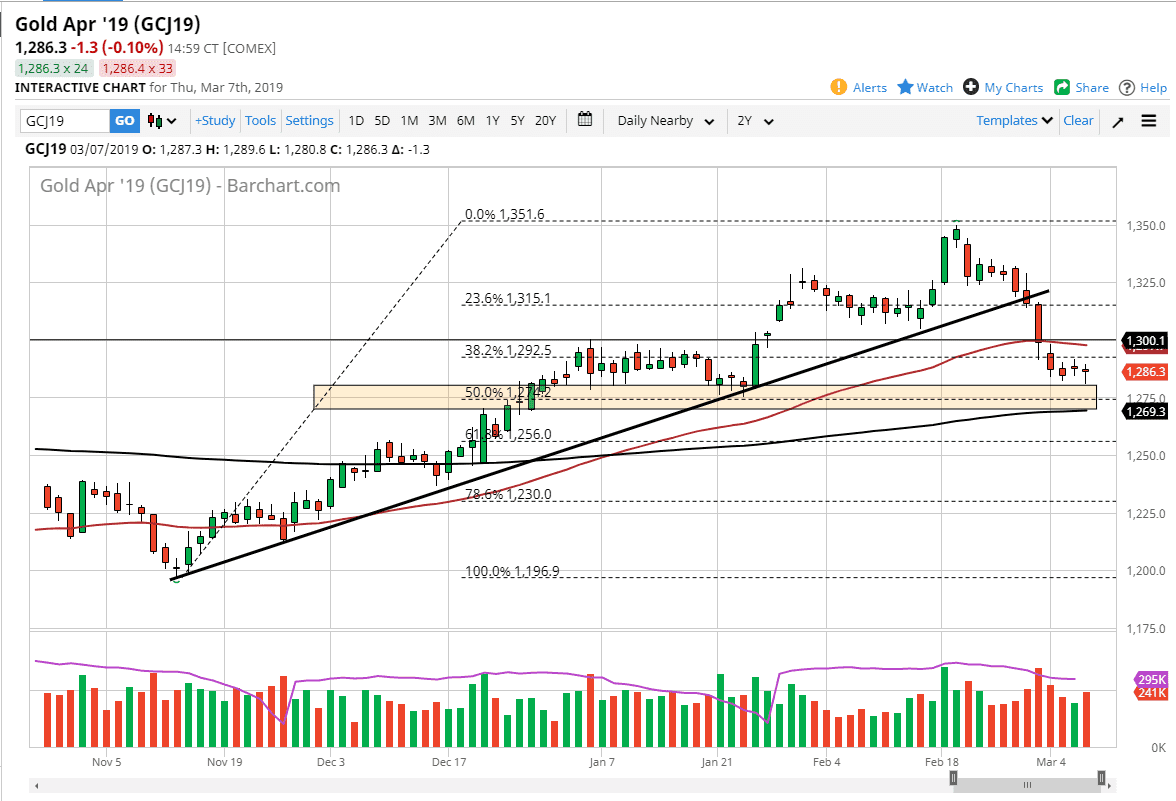

Gold markets fell a bit during the trading session on Thursday, reaching down towards the $1280 level before turning around to form a bit of a hammer. This is interesting, because the support level has held and of course this was against all odds considering that the ECB President suggested that the European Union was going to hold off on raising interest rates for some time and have introduced more quantitative easing. Overall, this shot the value of the US dollar higher, and that of course work against gold initially.

By the time we reached the beginning of the support area I have marked on the chart, we bounced rather hard. By doing so, it looks likely that the market is ready to continue to show resiliency. The Gold markets may have been rocked as of late, but it now looks as if all central banks around the world should continue to be very dovish, so that should put a bid underneath precious metals longer-term.

We do have the jobs number to deal with on Friday, but the fact that we have started to show signs of resiliency here tells me that there is still hope for this market. In fact, it’s not until we break down below the $1270 level that I would start to think about being a seller. The 200 day EMA is just below, so it gives this area even more meaning. Overall, I do like Gold longer-term and I think that this pullback has been rather healthy. If we do break down though, it probably opens the door to a return to the $1200 level which is the bottom of the longer-term consolidation. On the upside, the initial target would be $1300.