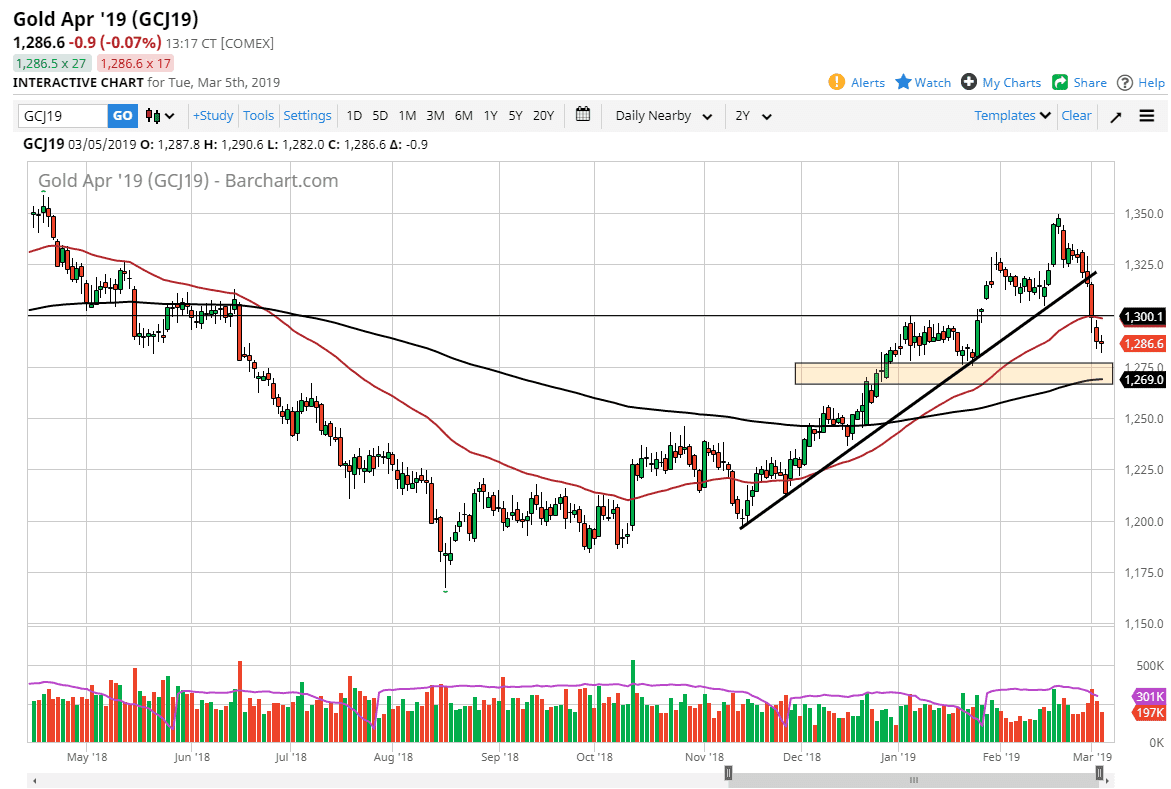

Gold markets pulled back a bit during the trading session on Tuesday but did find a bit of stability by the end of the day. By doing so, it looks as if the market is trying to find its footing, and I do recognize that the area underneath at the $1275 level should offer plenty of support as well. Just below that level, we have the 200 day EMA which of course always attracts a lot of attention. With that being the case, I think that the downside is somewhat limited, at least in the short term, because we are oversold regardless, and at the very least we need to see some type of bounce to get more movement to the downside. I think the $1300 level above, and of course the 50 day EMA will both offer a bit of resistance higher.

If we break down below the 200 day EMA, then the market will initially target the $1250 level, and then eventually the $1200 level which is the bottom of the overall consolidation that we have been in for some time. For what it’s worth, pay attention to the US Dollar Index, because if it starts to fall that should send this market higher. If you don’t have access to that live data, then look at the AUD/USD pair and the EUR/USD pair. If they both start to rally from here, it’s a good sign that Gold will continue to grind higher. Obviously, it works in both directions, so if the US dollar strengthens, that works against the value of gold.

I suspect that short-term bounce is coming, but a longer-term trade is going to be much more difficult as we have broken through a couple of major support levels. This is all about central banks, and the liquidity issues that they are taking in.